MARCH/APRIL 2020

By Katie Pyzyk

As the pace of tire design innovation accelerates, tire recyclers are encountering new and hard-to-detect contaminants in end-of-life tires that have the potential to put some recycled rubber markets at risk.

Max Daughtrey has seen tire design evolve significantly during his nearly 30 years recycling these products. “It’s changed from night to day, from bias to steel radials to run-flats,” says the vice president of operations at Four D Corp. (Duncan, Okla.). Indeed, modern automobiles and their components are vastly different now than when they first were mass-produced more than 100 years ago. Passenger vehicle tires initially were solid rubber. They transitioned to pneumatic, or air-filled, models that today consist largely of natural rubber, synthetic rubber, fabric, and steel. Innovations that lower costs or improve performance continue, with some tires now having embedded sensors that provide data to owners or manufacturers.

Max Daughtrey has seen tire design evolve significantly during his nearly 30 years recycling these products. “It’s changed from night to day, from bias to steel radials to run-flats,” says the vice president of operations at Four D Corp. (Duncan, Okla.). Indeed, modern automobiles and their components are vastly different now than when they first were mass-produced more than 100 years ago. Passenger vehicle tires initially were solid rubber. They transitioned to pneumatic, or air-filled, models that today consist largely of natural rubber, synthetic rubber, fabric, and steel. Innovations that lower costs or improve performance continue, with some tires now having embedded sensors that provide data to owners or manufacturers.

What has not evolved, recyclers say, is manufacturers’ approach to recyclability. For decades, recyclers and manufacturers of tire recycling equipment have asked tire manufacturers for information on new tire designs and materials to better prepare for those tires’ end of life. “They claim they want to work with you and help you, but … when we’re asking what [new product] is coming out? No comment,” Daughtrey says.

The lack of dialogue leads recyclers to question whether and to what extent manufacturers consider design for recyclability when creating new products. “When you’re designing a product, you’re trying to make it the best it can be for the market … recycling is not really on their radar,” says Charlie Astafan, general manager at CM Shredders (Sarasota, Fla.).

A Goodyear spokesperson confirms that safety and performance are the company’s top priorities when designing a tire, but sustainability also is a consideration, the spokesperson says. The U.S. Tire Manufacturers Association (Washington, D.C.) points to its inaugural sustainability report, released last year, which notes the industry’s commitment to increasing the use of sustainable materials and its goal to have all scrap tires enter sustainable end-use markets. The report describes research projects that are advancing those efforts but does not set specific industry benchmarks. “We’re committed to design for sustainability and think end-of-life recycling is very important, but there are other, much more significant considerations that go into producing the high-tech product we call the pneumatic tire,” says John Sheerin, USTMA’s director of end-of-life tire programs.

Sources affiliated with European recycling associations report similar challenges despite more stringent European Union requirements for product sustainability and recycled content, and extended producer responsibility schemes in about two dozen European countries. Tire manufacturers do not communicate with recyclers as part of their design process, “even [with] their legal obligation for their end-of-life tire responsibility,” says Kees van Oostenrijk, director of the Dutch end-of-life tire management group RecyBEM (The Hague, Netherlands).

These recyclers acknowledge that manufacturers keep certain product details under wraps because of intellectual property concerns, but they wonder if the manufacturers realize the end-of-life consequences of their design decisions. Beneficial end uses of tires—recycling and consumption of tires for fuel—are on the decline: In 2017, 81% of U.S. scrap tires made their way to beneficial end-use markets, down from nearly 88% in 2015 and a peak of 95.9% in 2013, according to USTMA’s most recent figures. As the scrap tire supply continues to grow—the United States generated about 256 million scrap tires in 2017, up 3.7% from 2015—the need for viable end markets increases, Sheerin says.

What’s New

When a new tire design hits the market, it typically takes three to five years before significant numbers of those tires make their way into the recycling stream. Some recyclers consider that ample time to discover how a new tire design differs from previous models. Others point out that when manufacturers don’t announce design changes, the changes’ impact only becomes apparent after those tires enter a processing operation—especially when they damage the equipment. “This is a topic … that the industry should really be concerned about,” Astafan says. “For years, we’ve been focused on the rubber, nylon fiber, and steel that’s in a tire. When you get outside of those three components, it’s going to be a large paradigm shift.”

Innovative tire models “have added materials, which do not support the recycling process or its efficiency,” van Oostenrijk says. These materials can make a previously desirable recycled-material feedstock less desirable, or even unusable in certain markets. With the amounts and types of these atypical materials on the rise, recyclers are forced to pursue new processing models and new end markets.

CM Shredders recently performed a shred test on a variety of newer tires to determine their compositions and shredability. Equipment manufacturers “have to be cognizant of changes as well so we can adapt our equipment to do the best job of processing tires,” Astafan explains. He presented the findings in December at the Scrap Tire Recycling Conference, hosted by USTMA and the Scrap Tire Research and Education Foundation, a USTMA-managed nonprofit. “We’re seeing some very challenging things happening with tire designs that are going to have very disruptive effects on the recycling market. We’ve already seen it,” Astafan says. He and tire recyclers identify at least five materials of concern—and one potentially game-changing tire design on the horizon.

Kevlar. This lightweight, heat-resistant synthetic fiber is said to be stronger than steel and frequently replaces metal in products; it is well-known for its use in bulletproof vests, military helmets, and other body armor. Kevlar makes

tires lighter—and therefore more fuel efficient—stronger, and more resistant to punctures. “We were a little surprised. … There’s a high percentage of Kevlar in the newer tires we saw,” Astafan says. Kevlar initially was developed in the 1970s as an alternative to steel in radial tires, but it did not become a prominent tire material until the past 10 to 15 years, with several years’ lag until it reached the recycling stream. “It doesn’t cut or tear or disintegrate like nylon or other reinforcing materials. It’s a problem at all levels of processing,” says Terry Gray, president of TAG Resource Recovery (Houston).

Tire rubber that contains Kevlar does not meet the ASTM standard for shredded recycled rubber used as playground surfacing, says Gary Champlin, general manager of Champlin Tire Recycling (Concordia, Kan.). Kevlar-containing tires don’t have any special markings, he says. Thus, recyclers that need to keep Kevlar out of their shred must get lists of Kevlar-containing tire models from manufacturers, check each tire that arrives against that list, and segregate the problematic tires for other uses.

The same is true for the other materials, Astafan says. There’s no information on a tire that indicates it contains Kevlar or any of the other materials that can cause problems with its recycling. The only way to get that information is to research the tire brands and models on the internet. “When you are handling 5,000 to 15,000 tires per day on a production line, that is problematic,” he says.

Silica. Silica is often a filler in low-rolling-resistance tires for commercial trucks, replacing carbon black filler. The compound does not necessarily damage processing equipment, but it can be considered a contaminant in processed scrap rubber, depending on the end-use application. It is difficult to segregate from other materials, which creates a potential problem both for processors and consumers, says Tom Rosenmayer, chief technical officer at Lehigh Technologies (Tucker, Ga.). Lehigh has noticed an uptrend in the amount of silica in the granulated scrap rubber it purchases to create micronized rubber powder, he says. As silica content increases, carbon black content decreases. Thus, end users of scrap tire rubber who want a specific proportion of carbon black may find greater silica content problematic if this trend continues. Gray notes that silica also could be a problem in tire-derived fuel applications where ash content is a concern.

Polyurethane foam. Like silica, PU foam is a tire additive that contaminates end-of-life scrap rubber. Manufacturers have been using it in passenger tires since 2010 because it effectively absorbs noise when the tire rolls. Tires containing foam last longer than pneumatic air-filled tires but are two to three times heavier. Although a relatively small number of tires on the market today contain foam, recyclers and scrap rubber end users worry that its popularity will spread as manufacturers and consumers increasingly desire noise abatement. CM Shredders discovered foam during its shred test. It had “never seen foam rubber in a tire before, so we have no good way to separate that product,” Astafan says.

Rosenmayer recounts meeting with tire industry representatives to discuss their possible use of Lehigh’s micronized rubber powder in their products. When he asked the manufacturers if they would accept micronized rubber that contains the foam, “they said, ‘Absolutely not. That would be a contaminant, and we couldn’t accept that.’ Then the room got very silent, as if nobody at this tire company had ever given consideration to the downstream implications of putting PU foam into tires,” he says.

Lehigh only purchases granulated rubber made from commercial truck tires, which don’t contain PU foam—yet. But the meeting raised red flags about what might happen if manufacturers add foam to more types and quantities of tires in the future. “Somebody is going to have to take the foam out” before processing the tires if they want to produce viable feedstock for new products, Rosenmayer says. “As of today, I don’t think there’s a solution for how to deal with the polyurethane foam.”

Self-sealing coatings. Run-flat tires first hit the market in the mid-1980s. Although it took a while for them to gain market share, they’re quite popular now, says Brent Gruber, senior director of global automotive at market research firm J.D. Power. The self-sealing coating along the tire’s inner structure contains a gummy substance that creates a mess for end-of-life tire processors. In addition to being tough on shears and knives, the sticky, pliable material can clog size-reduction machinery’s fine screens. “I cannot run those tires; I have a big pile of them,” Daughtrey says. “If a material is too soft and melts, it could blow out screens. If it’s bad enough, it can twist a shaft.”

Advanced sensors. There’s been a lot of buzz in the past three years about “smart” tires. Most often, these are commercial vehicle tires that contain radio-frequency identification tags to track location and performance metrics including temperature, air pressure, and tread wear. The data help fleet owners manage maintenance, costs, and performance. In 2017, Michelin announced that all its truck tires and those of its subsidiaries—BFGoodrich and Uniroyal—would contain RFID tags. Bridgestone announced the same thing in 2018.

These products are too new to have hit the scrap stream in significant numbers, and empirical evidence on their end-of-life impact is scarce. RFID chips are about the size of a grain of rice, although they sometimes lie within a larger sticker or patch that is affixed to the tire interior. Recyclers consulted for this story believe they will be able to separate RFID sensor components, which are mostly metal and plastic, from other elements relatively easily with existing equipment.

Other sensor technologies under development could pose greater difficulty for recyclers, Sheerin says. “Larger sensors—along the size of a wheel weight—are more significant and may need to be removed before the tire is properly recycled,” he says. He expects those to emerge soon in the commercial tire sector and eventually make their way to the passenger-tire side. Gruber agrees that next-generation sensors in tires are likely. On the positive side, sensors could help scrap processors and retreaders segregate tires when they arrive at a facility. “They could work to recyclers’ advantage if we have chip readers on our belt … and we can pull them,” Champlin says. The RFID tag could provide information on tire components that recyclers need to know about, such as Kevlar, silica, and PU foam, he suggests.

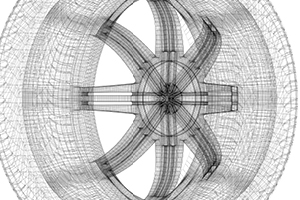

Airless tires. Tier 1 tire manufacturers created a stir when they introduced plans for airless, or nonpneumatic, tires. The tires consist of a thin rubber tread connected to an aluminum or resin open sidewall with polyresin or rubber spokes. The light, flexible tires cannot be punctured or blow out, and they have the potential to be retreaded. About seven years ago, Michelin started selling its nonpneumatic Tweel in the United States for limited industrial applications such as construction, agricultural, and landscaping equipment. Last year, it unveiled plans for Uptis, a passenger vehicle airless tire that could hit the market in 2024. Bridgestone entered the game in January when it revealed a concept for nonpneumatic commercial vehicle tires.

Nonpneumatic tires could be a game-changer for tire recyclers if they become prevalent in the passenger and commercial marketplace. “They use significantly less rubber. … That would be a real change in the scrap tire marketplace,” USTMA’s Sheerin says. In addition, the rims of these tires are bonded to the inside of the tire. “There’s no good way to separate those parts or recycle those tires without an enormous amount of manual labor,” Astafan says.

For now, airless tires remain contained to industrial applications, and no one expects them to get a foothold on the market in the immediate future. But tire recyclers should learn about nonpneumatic tires and take them seriously as a potential business disruption, industry participants say. “They may seem novel and unusual, but they could be a very viable product down the road,” Gruber says.

Tire manufacturers are testing even more innovative designs that replace petroleum-based materials with plant-based materials such as rice husks, Russian dandelion, and oils from citrus, evergreen, and soybean plants. “Sustainability is more than just end-of-life, you also have to look at the materials extracted or produced to manufacture a tire,” Sheerin says. Goodyear is developing more tire lines with a soybean-oil base and aims to increase its soybean oil consumption 25% by 2020; it strives to fully replace petroleum-based oils in its products by 2040, the spokesperson says. In 2018, it introduced its Oxygene concept tire, which contains living moss that grows within the sidewall. The moss absorbs water from the road and carbon dioxide from the air through its tread and releases oxygen.

Rolling Forward

Brands, recyclers, and sustainability advocates point to consumer pressure as the primary driver of change in product and packaging design, whether to improve recyclability or increase recycled content. But tire manufacturers do not face the same pressure, these sources say; at least not yet. “Certainly, there’s a contingency of people looking for things that are ecologically friendly. But very seldom is that a purchase consideration when consumers are looking to replace tires,” J.D. Power’s Gruber says.

Tire manufacturers are making some strides in incorporating recycled content into their tires. Michelin acquired Lehigh Technologies in 2017 and uses some of that company’s MRP as a substitute for oil and other products in new tires. But recycled materials are still a tiny portion of new tires. “I haven’t really heard of anybody using over maybe 5% recycled material, and that may have been a specific case,” Champlin says. Companies including Bridgestone, Michelin, and Hankook have marketed various tire models as recyclable and/or partially made from recycled materials, which can include tire wire or nylon fibers as well as rubber. “Trials carried out by certain companies show that up to 20% of recycled materials could be incorporated in certain types of new tires,” says Emmanuel Katrakis, secretary general of the European Recycling Industries’ Confederation (Brussels). “Unfortunately, we are far from being there.”

Some manufacturers also promote their tires’ retreadability. “I don’t think [retreading] should be overlooked” as a component in sustainability, Rosenmayer says. Retreaders face design concerns as well, however. Low-cost foreign tires—mainly from China—lack the same quality or longevity as Tier 1 or domestic budget tires, they say. The imported tires, which are entering the U.S. market in increasing numbers, have lower-quality casings that are not designed to be retreaded more than once, if at all, Champlin says. He estimates that the imports have contributed to a 20%-25% decrease in U.S. retreading over the past four years. “The impact on the industry is significant. Retreaders are really struggling to get good [tire] carcasses,” Gray says.

Recyclers say they would like manufacturers to improve tire design for recycling or retreading. Tire-derived fuel is still the destination for the largest portion of U.S. scrap tires—43% of those recovered in 2017. Katrakis notes that using recycled rubber as a substitute for virgin materials can reduce a product’s carbon footprint by 95%, and granulating rubber produces 58.4% less carbon dioxide emissions than using tires as fuel. At the Scrap Tire Recycling Conference last year, USTMA issued a call to action to develop and expand new sustainable, circular scrap tire end-use markets. “We’ve heard [the recyclers], and we care about this stuff, and we’re very interested in keeping the tire stream as recyclable as possible,” Sheerin says. “We want to grow our partnerships,” says Sarah Amick, USTMA’s vice president of environment, health, safety, and sustainability and senior counsel. “Something we’re looking to increase this year is more collaboration with our entire value chain.”

Another effort is the Tire Industry Project, which brings together 11 tire manufacturers as part of the World Business Council for Sustainable Development. TIP’s goal is to identify and address possible health and environmental issues associated with tires’ development, use, and management throughout their entire life cycle. In December, it released a report sharing best practices for end-of-life tire management. “TIP members see growth of their work on ELT to include dialogue with stakeholders—including recyclers, processors, researchers, original equipment manufacturers (OEMs), and governments—toward an improved understanding of opportunities for more sustainable ELT management,” the Goodyear spokesperson says. Goodyear recognizes the “value in a multi-stakeholder approach to tire design and engagement … considering all stages of the life cycle of a tire.” Tire recyclers acknowledge that “manufacturers are doing better,” Champlin says. He cites recent improvement in their outreach to recyclers. He also sees potential for further collaboration with tire manufacturers in the Brand Leadership Council ReMA is developing this spring.

Tire design progressed through several big leaps in the past century, but the innovation “rate of change is going to accelerate,” Gruber says. Thus, greater communication and collaboration will be essential. Scrap tire recyclers will have to adapt to survive, and that’s easier when they’re included in design conversations. “Give us some help. That’s all we ask,” Daughtrey says.

Katie Pyzyk is a contributing writer for Scrap.