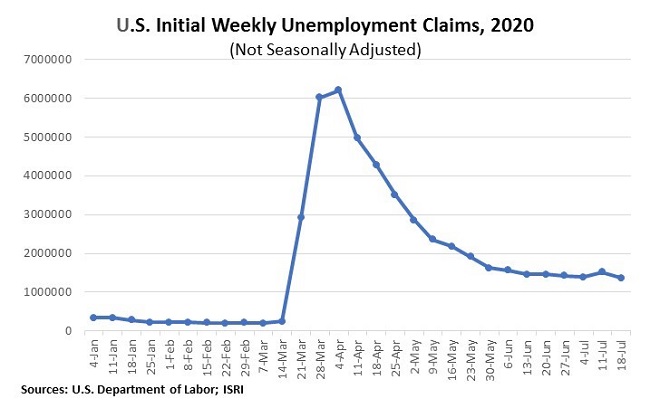

Initial unemployment claims decreased by 141,816 for the week ending July 18, 2020 to 1.371 million (not seasonally adjusted) but increased to 1.416 million seasonally adjusted (seasonal adjustments lose some of their validity in years like this where typical patterns are so out of whack).

Initial Unemployment Claims

The claims for the week ending July 18 were nearly seven times greater than the comparable week a year ago, when 196,382 initial claims were filed.

Insured unemployment claims, a measurement of total unemployment with a week lag from initial claims, was 16,390,919 (NSA) for the week ending July 11,2020. This is down 930,294 from the previous week.

The unemployment rate, based on insured unemployment claims, was 11.2 percent, down 0.7 percent from the prior week.

Thirty-six states, including DC, reported decreases in initial claims for the week ending July 18. The top four states with decreases were:

Florida down 27,421

Texas down 18,695

Georgia down 18,171

New Jersey down 13,219

Fifteen states reported increases in initial claims for the week ending July 18. The top four states with increases were:

Virginia up 7,896

California up 7,759

Louisiana up 4,804

Nevada up 4,109

Housing Market Indicators

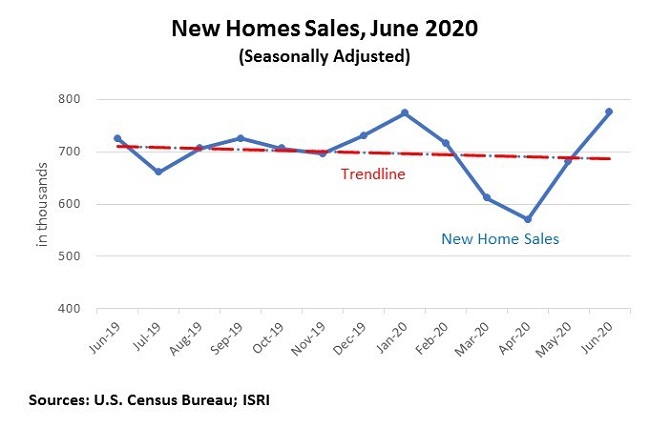

Residential Home Sales for June 2020

- Taking advantage of low interest rates, new home sales increased 13.8 percent in June 2020 to 776,000 (SA), a 12-month high according to numbers released last week by the U.S. Census Bureau.

- Year-to-date new home sales are up 3.2 percent as compared with Jan-Jun 2019.

- There were 307,000 new homes for sale at the end of June 2020 (SA).

- All regions saw increased sales in June 2020 from the previous month, with the Northeast nearly doubling, up 89.7 percent.

- The median price of home sold in June was $329,200 and the average price was $384,700.

- The COVID-19 effect on new home sales is clearly shown in the chart below, as March and April sales fell well below the 13-month trendline.

Building Permits

- Building permits increased 2.1 percent in June 2020, from May, to 1.241 million on a seasonally adjusted basis (SA). However, they are down 2.5 percent from a year ago (June 2019).

- Single-family permits are up 11.8 percent in June 2020 to 834,000 (SA).

- Multi-family permits, seasonally adjusted, are down in June 2020:

- 2 to 4-unit structures are down 7.1 percent to 39,000; and

- 5 units or more structures down 14.0 percent to 368,000.

Housing Starts

- Housing starts significantly increased by 17.3 percent in June 2020 to 1.186 million units (SA) but they are 4.0 percent below a year ago (June 2019).

- Single-family starts were up 17.2 percent in June 2020 to 831,000 units (SA).

- Multi-family structures with 5 + units increased 18.6 percent to 350,000 units (SA). 2-4-unit structures did not meet publication standards so no numbers were published.

- By region, the Northeast boomed in June 2020, up 114.3 percent to 105,000 units (SA); Midwest increased 29.3 percent to 181,000 units (SA); and the South was up 20.2 percent to 606,000 units (SA).

- The only region to decrease in June 2020 was the West, decreasing 7.5 percent 294,000 units (SA).

Housing Completions

- Housing completions increased 4.3 percent in June 2020 to 1.225 million units (SA). And they are 5.1 percent higher than a year ago (June 2019).

- Single-family housing completions are up 9.6 percent June 2020 to 910,000 units (SA).

- Multi-family structures with 5 + units decreased 5.5 percent to 311,000 units (SA). 2-4-unit structures did not meet publication standards so no numbers were published.

- Completions in the Northeast were down 22.9 percent to 74,000 units (SA).

- The other three regions are up: Midwest up 5.3 percent to 197,000 units (SA); south up 5.5 percent to 650,000 units (SA); and the West, up 10.5 percent to 304,000 units (SA).

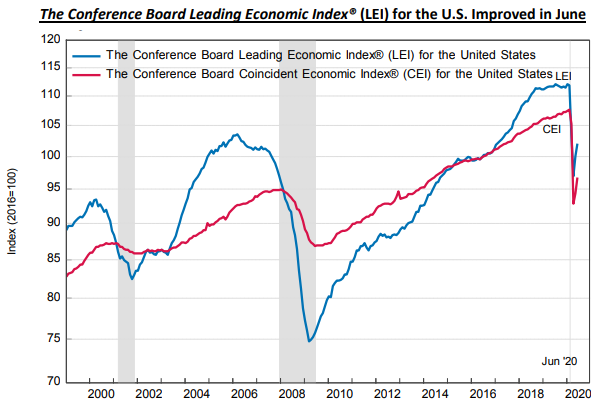

Leading Economic Indicators

Last week, the Conference Board reported that its Leading Economic Index increased 2.0 percent in June 2 to 102.0, the second consecutive monthly increase. According to the Conference Board’s press release, “The June increase in the LEI reflects improvements brought about by the incremental reopening of the economy, with labor market conditions and stock prices in particular contributing positively,” said Ataman Ozyildirim, Senior Director of Economic Research at The Conference Board. “However, broader financial conditions and the consumers’ outlook on business conditions still point to a weak economic outlook. Together with a resurgence of new COVID-19 cases across much of the nation, the LEI suggests that the US economy will remain in recession territory in the near term.”