Monday

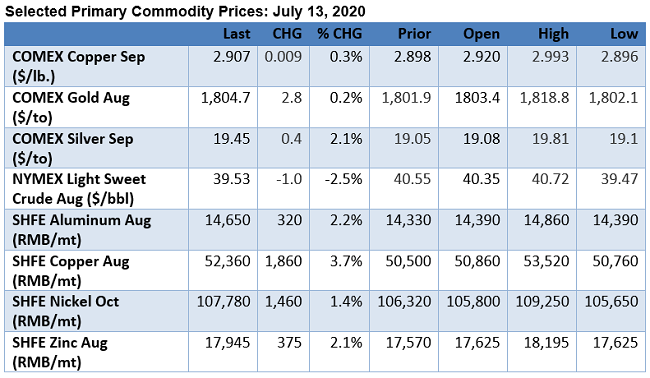

Copper prices have been surging higher over the last week on gains attributed to Chilean labor disputes and other global supply disruptions. In New York, COMEX copper traded as high as $2.993 per pound on Monday, up from around $2.73/lb. just one week ago.

- In London, Fastmarkets reports that “turnover in LME copper was at its highest since July 2018 at more than 33,000 lots at the close. Despite a continued backwardation in LME copper’s cash/three-month spread - recently trading in a $9-per-tonne backwardation. ‘The copper strength of late has to do, of course, with intermittent virus-related supply issues coming out of Latin America,’ ED&F Mann commodity analyst Edward Meir said in an afternoon report.”

- Stock markets in Asia started the week in positive territory as the Shanghai stock index rose more than 1.7% on Monday.

- But renewed coronavirus concerns and newly announced restrictions in California weighed on U.S. stock prices late in the day, with the S&P 500 closing down 0.94% on Monday as the Nasdaq fell 2.1% while the Dow Industrial eked out a 10-point gain.

- In foreign exchange trading the euro traded as high as $1.1375 on Monday while the greenback was buying 107.3 Japanese yen.

You are not allowed to post comments.