For the week ending June 27th, the American Iron and Steel Institute reports that “…domestic raw steel production was 1,240,000 net tons while the capability utilization rate was 55.4 percent. Production was 1,863,000 net tons in the week ending June 27, 2019 while the capability utilization then was 80.1 percent.

Ferrous

- The current week production represents a 33.4 percent decrease from the same period in the previous year. Production for the week ending June 27, 2020 is up 1.3 percent from the previous week ending June 20, 2020 when production was 1,224,000 net tons and the rate of capability utilization was 54.6 percent.”

- As for finished steel prices, BMO Capital Markets reports that “The decline in US HRC prices resumed on Thursday on short lead times and uneven demand, with Fastmarkets’ US HRC index declining 0.6% d/d to $477/st (-0.2% w/w), while Platts TSI US HRC index declined 0.1% d/d to $475/st (-1.7% w/w, -5.0% m/m).”

- Following recent Turkish buys from European suppliers, Fastmarkets AMM reports their “daily index for steel scrap, HMS 1&2 (80:20 mix), North Europe origin, cfr Turkey was calculated at $250.73 per tonne on Monday, down by $3.76 per tonne compared with Friday’s index. The daily index for steel scrap, HMS 1&2 (80:20 mix), US origin, cfr Turkey was $256.31 per tonne, down by $4.81 per tonne day on day. This put the premium for US material over European scrap at $5.58 per tonne on July 6, compared with $6.63 per tonne on July 3.”

Nonferrous

Macquarie reports that copper prices are becoming increasingly sensitive to developments in Chile: “Recent copper price action seems very attentive to events in Chile, the world’s largest mining country with 28% of annual supply. The country has experienced one of the most challenging outbreaks of COVID-19, catching up fast to second-placed Peru in the South American region. On top of this, many miners have contracted the virus and some have died, which has led to growing calls to restrict production activity to safeguard workers. On the other hand, as Codelco’s CEO pointed out last week, the country will need the revenues generated by its overseas copper sales to help pay for its massive welfare and recovery stimulus, and set Chile back on the road to economic stability.”

Fastmarkets reports today that “Copper prices are poised to move above the $7,000-per-tonne level next year as the supply impacts of the Covid-19 pandemic last well beyond this year and the market enters a prolonged period of structural undersupply, the chief executive officer of Eurasian Resources Group (ERG) said. According to Benedikt Sobotka, around 700,000 tonnes of mined copper output has been lost to date due to disruptions related to the pandemic, with further disruptions looming in South America - especially in Chile. Capital expenditure cuts have also been made by copper miners while the project pipeline is shrinking due to Covid-19 lockdown-related delays, he noted. Visible copper inventories are down by a third year on year, copper concentrate treatment and refining charges (TC/RCs) have narrowed to the lowest level since 2012 and cif Shanghai cathode premiums firmed to multi-year highs in May, Sobotka said.”

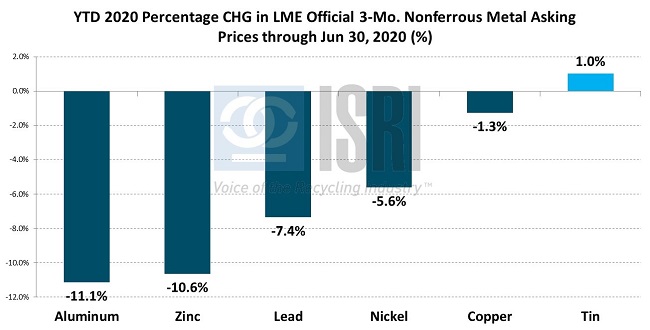

Copper prices in London traded as high as $6,143/mt on Monday but the LME official 3-mo. copper asking price was still off 1.3% for the year-to-date as of this morning:

And in case you missed it from the top of today’s report, “China approved a large import block of copper/aluminum/steel scrap, the largest since 1Q20, probably a response to a scrap shortfall that emerged during lockdown. The China Solid Waste and Chemicals Management Center (CSWCMC) approved additional imports of 176.7kt of high-grade copper scrap; 209.7kt of aluminum scrap and 5kt of steel scrap. Approvals so far in 2020 (9 separate directives) total 718.5kt copper (7% of China’s 2020e total supply); 693.7kt aluminum (2%), 16.5kt steel scrap (tiny contribution; most scrap generated locally). Scrap flows have been scrutinized since 2017 by both the CSWCMC and China’s Ministry of Ecology and Environment, to limit imports of polluting materials,” Macquarie reports.

Plastics: Malaysian “export accreditation” and U.S Plastic Exports

As per ISRI’s e-mail last week, “As a result of several member inquiries about obtaining a letter of accreditation from ReMA to export to Malaysia, we have come to learn the purpose of this requirement. The Malaysian Government is now requiring that importers of plastic scrap must have an ‘export accreditation’ from their foreign suppliers. In other words, companies exporting plastics to Malaysia must be ‘accredited’ by their government before they can export the material. Most governments can do this, but as you may know, the U.S. Government does not do this – and the Malaysian Government understands that and is willing to accept an ‘accreditation certificate’ from ISRI. To that end, ReMA has gained approval by the Malaysian Government that our letter serves that purpose.

Important things to note:

- These letters will be done for ReMA members – upon request – only. It is a unique value proposition for members.

- The letters MUST be signed by ReMA VP of Membership Brianna Gianti to be official.

- This is for plastic scrap exports only.

- This is for U.S. exporters only – companies, affiliates and partners in other countries must get the letter from their home government.

Also for special mention – the Malaysian Government is already enforcing the Basel Convention’s new trade restrictions. This means that they are keeping a strict eye on the quality and content of plastics that arrive at ports. The accreditation requirement is for all plastics exports, but it does not provide a guarantee of clearance by customs. Material that is clean and mostly homogenous will have the greater chance of being cleared by Malaysian customs.”

Please contact Adina Renee Adler, VP Advocacy for further assistance.

Also of note:

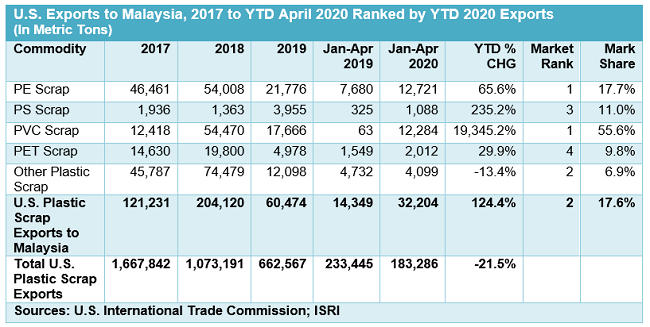

- U.S. plastic scrap exports to Malaysia through April 2020 more than doubled to 32,204 metric tons, or 17.6 percent of all U.S. plastic scrap exports.

- Among U.S. plastic scrap export markets, Malaysia ranks second, behind Canada.

- By plastic scrap commodity, Malaysia ranks between 1 and 4. Nearly 56 percent of U.S. PVC scrap was exported to Malaysia through April 2020, making it the number one country for this commodity.

- See table below for all five commodities exported to Malaysia along with the market rank and share.