The World Steel Association reported last week that “World crude steel production for the 64 countries reporting to worldsteel was 148.8 million tonnes (Mt) in May 2020, an 8.7% decrease compared to May 2019.

Ferrous

- By country, worldsteel reports:

- “China produced 92.3 Mt of crude steel in May 2020, an increase of 4.2% compared to May 2019.

- Japan produced 5.9 Mt of crude steel in May 2020, down 31.8% on May 2019.

- India produced 5.8 Mt of crude steel in May 2020, down 39.1% on May 2019.

- South Korea’s steel production for May 2020 was 5.4 Mt, down by 14.1% on May 2019.

- In the United States, AISI reports that domestic steel production for the week ending June 20th “ …was 1,224,000 net tons while the capability utilization rate was 54.6 percent. Production was 1,863,000 net tons in the week ending June 20, 2019 while the capability utilization then was 80.1 percent. The current week production represents a 34.3 percent decrease from the same period in the previous year. Production for the week ending June 20, 2020 is up 1.2 percent from the previous week ending June 13, 2020 when production was 1,210,000 net tons and the rate of capability utilization was 54.0 percent.”

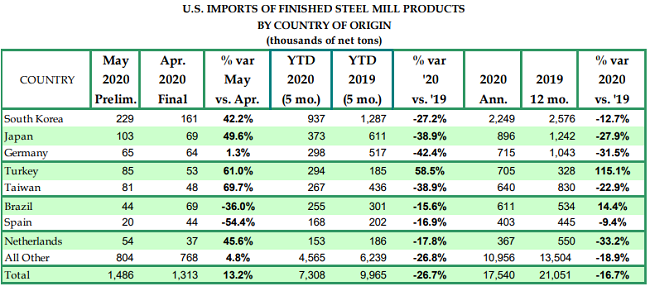

- As for U.S. steel imports, AISI reports “Through the first five months of 2020, total and finished steel imports are 10,981,000 and 7,308,000 net tons (NT), down 19.2% and 26.7%, respectively, vs. the same period in 2019. Annualized total and finished steel imports in 2020 would be 26.4 and 17.5 million NT, down 5.7% and 16.7%, respectively, vs. 2019.”

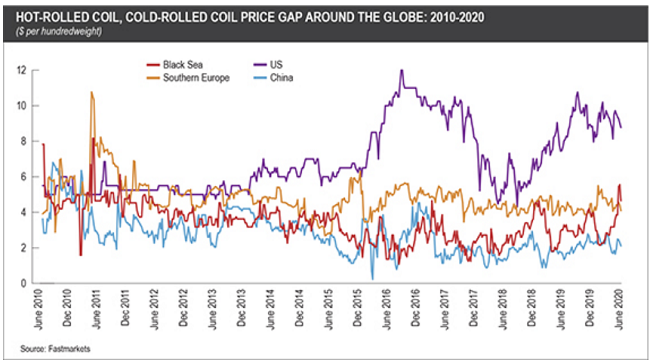

- Of note, Fastmarkets AMM reports on the record ($10/cwt) spread in the United States between HRC and CRC. One explanation presented: “US mills’ sales representatives have been given more pricing power on their value-added products, and the market went along and accepted the more expensive cold-rolled price as normal somewhere along the way.” Here’s their chart comparing spreads globally:

- Last but not least, here’s an excerpt from Friday’s market update provided by our friends at Argus:

- “The Turkish market has cooled as mills filled July requirements and domestic rebar prices fell, putting additional pressure on prices. That has added to some of the negative sentiment for July in the US…

- US steel prices also slid this week, with HRC lead times heard at 3-4 weeks compared to 3-5 weeks the prior week, also adding to scrap headwinds for July…

- Some moves being made on the east coast as Chuck and Eddies/Chase Waste bought a 2,000-horsepower shredder from Rubino Brothers, who is exiting the shredding business. Chuck and Eddies will install the shredder as a replacement of its existing smaller one in New Haven, Connecticut. And in New York, Upstate Shredding is building a new scrap yard and steel service center in Ithaca as it relocates two older facilities.”

Nonferrous

Macquarie just released its updated Commodities Compendium, and here are some excerpts related to copper and aluminum.

Copper

- “Copper’s price has rebounded strongly and steadily from decade-lows briefly seen in March, back up at pre-COVID-19 levels near to $6,000/t. On fundamentals, it has been aided by China’s recovery and probably the reserve bureaus’ stocking, in addition to around half a million tonnes ofmine disruptions and, on the flows side, by broader market buoyancy inspired by vast stimulus measures and rebound expectations. Indeed, we note that copper’s strongest price correlation looking across asset classes is with the S&P500 this year. Demand concerns past and future seem to have been swept aside, at the same time as supply woes have apparently been factored in…

- However, returning demand will be accompanied by returning mine and scrap supply over the next half, and stocking dynamics will begin to work against copper cathode this time as downstream semis destock and, in our view, the SRB and other Chinese stocking bureaus hold back on higher prices. Mines are already returning (Fig 59), with feed pushing back down the pipe and the spot TC/RCs’ slide stabilising. For cathode consumption, returning demand is anticipated but shaky: Freeport McMoran recently decided to close one of its two large rod mills and a specialty copper products plant in the US on concerns about the outlook. Putting it all together, we think copper’s rebound looks to have overshot, and a price pullback is more likely in the next quarter towards the mid-$5,000s/t.”

Aluminum

- “Despite reporting only a modest supply-side response to the virus lockdown (1% of global market), and evidence that normalised demand growth is the weakest in over a decade, aluminium’s price has recovered sharply from its Apr-lows, >10% in just 6 weeks to over US$1,550/t-$0.70/lb – a SHFE-led short-covering rally, helped by a recovery of key input costs of alumina and power…

- It’s basically part of a macro-backed re-rate across industrial metals, on the expectation of a shortterm normalisation in activity levels across aluminium’s fundamentals. For aluminium too, it’s mostly China that’s driving the recovery story here (~60% of global S/D): market signals that we track indicate subdued trade persists ex-China, particularly in Europe…

- For 2020, our unchanged aluminium cash price forecast is for an 11%YoY decline to an annual average of US$1,595/t-$0.72/lb, recovering post-virus to trade at $1,700-1,725/t in 2021-22.”

Source: Macquarie Commodities Compendium, June 2020

Paper and Fiber

Last week Fastmarkets RISI & Norexeco hosted a webinar on Global Pulp Markets & Managing Risk. The presenters were David Fortin, Vice President, Economic Analysis of Fastmarkets RISI; Matt Graves, Senior Vice President of Fastmarkets RISI; and Anita Skjong, Director Market of NOREXECO - The Pulp and Paper Exchange. Below are some highlights:

- The proportion of market pulp consumption has increased 50 percent since 2000, going from about 26 percent to about 39 percent in 2018.

- “Supply shocks are getting bigger because assets are getting bigger.” Looking at new greenfield pulp mills since the 1990’s: 560,000 tonnes capacity added by Peace River in the 90’s; 1,300,000 tonnes added by Tres Lagoas in the 2000s; and 2,600,000 tonnes added by OKI in the 2010s.

- Tissue and packaging markets have since big increases and while graphic paper markets have collapsed

- The supply disruptions have been offset by weakened demand, thus keeping inventories from rising.

- The market for pulp that is dried and sold as a commodity is 68 million tons per year.

End uses for pulp:

- Tissue 40%

- Graphic papers 30%

- Cartonboard & specialties 25%

- All other markets 5%

- RISI forecasts a 5 percent decline in world paper and board production for 2020. This translates in 20 million tons of board not being, a massive decrease in specialty paper production – around 9-10 million tons. It is important to note that the forecast does not include a second wave of outbreak.

- The pulp markets are forecasted to decrease 2.5 million tons in 2020 followed by an increase of about the same amount in 2021.

- Worldwide demand for board production is decreasing across all packaging grades from outsized exposure to industrial segment that is being hammered during the COVID-19 crisis.

- The swing capacity of the wood pulp markets is very weak. The advantage for pulp is in the paper grade pulp and chemical pulp markets.