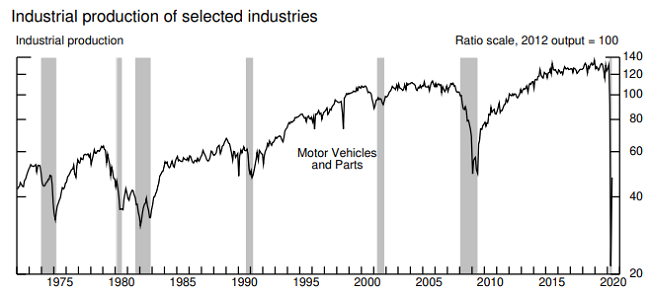

Last week, the Federal Reserve reported that U.S. industrial production rebounded 1.4% in May following a downwardly revised 12.5% contraction in April.

Industrial Production

- However, the Fed reports that “total industrial production in May was 15.4 percent below its pre-pandemic level in February…

- Manufacturing output—which fell sharply in March and April—rose 3.8 percent in May; most major industries posted increases, with the largest gain registered by motor vehicles and parts… At 92.6 percent of its 2012 average, the level of total industrial production was 15.3 percent lower in May than it was a year earlier.”

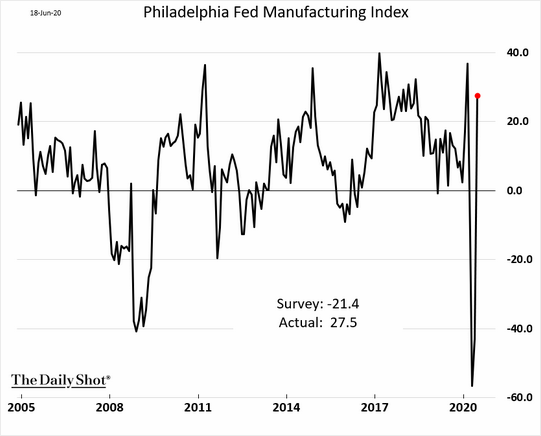

Regional Manufacturing

The Philadelphia Fed manufacturing index rebounded sharply in June (27.5), easily beating expectations:

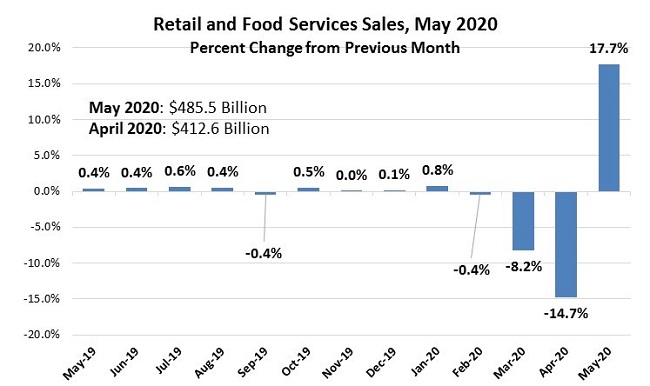

Retail Sales

The Census Bureau released its Advance Monthly Sales for Retail and Food Services, May 2020 last week. It shows an unforeseen and unprecedented bounce back from April, suggesting a “V” shape recovery, at least for retail. However, it is still too early to establish trends, no matter how welcome the bounce. In May 2020, clothing and clothing accessories stores led the way, followed by furniture & home furnishing stores; sporting goods, hobby, musical instrument, and book stores; and motor vehicle & parts dealers.

- Overall retail sales rose 17.7 percent in May 2020, from April to $485.5 billion, the largest percent change in the retail sales tracking.

- In April 2020, revised overall retail sales fell 14.7 percent from March. This is the largest percentage drop in the retail sales tracking.

- Industry sectors leading the May 2020 retail sales boom, as measured from percent change from April 2020 were:

- Clothing and clothing accessories stores rose 188.0 percent;

- Furniture & home furnishing stores increased 89.7 percent;

- Sporting goods, hobby, musical instrument, and book stores increased 88.2 percent; and

- Motor vehicle & parts dealers increased 44.1 percent

Sources: U.S. Census Bureau; ISRI

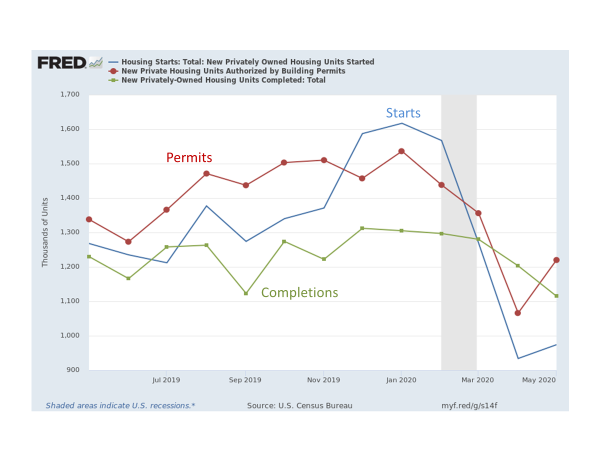

Housing Market Indicators

Contributing to optimism in near-term economic conditions, building permits and housing starts were up in May 2020. Building permits rebounded sharply, while the housing starts bounce back was mild. As an expected effect from the COVID-19 pandemic, housing completions are down, according to U.S. Census Bureau’s press release on Monthly New Residential Construction, May 2020.

Building Permits

- Building permits increased 14.4 percent in May 2020 from April to 1.22 million units on a seasonally adjusted basis (SA), but were 8.8 percent below a year ago (May 2019).

- Single-family permits were up 11.9 percent in May 2020 to 745,000 (SA).

- Multi-family permits, seasonally adjusted, were also up in May 2020:

- 2 to 4-unit structures were up 24.2% to 41,000; and

- 5 units or more structures were up 18.3 percent to 434,000.

- All regions of the country increased in May 2020, from between 5.6 percent to 18.4 percent.

Housing Starts

- Housing starts increased 4.3 percent in May 2020 to 974,000 (SA), but were still 23.2 percent below a year ago (May 2019).

- Single-family starts were virtually flat, rising 0.1 percent in May 2020 to 675,000 (SA).

- Multi-family structures with 5 + units increased 16.9 percent to 291,000 (SA). 2-4-unit structures did not meet publication standards so no numbers were published.

- The only region with growth in May 2020 was the West, up 0.6 percent (SA). All other regions were down, from between 0.6 percent to 4.1 percent (SA).

Housing Completions

- Housing completions fell 7.3 percent in May 2020 to 1.115 million (SA). They were 9.3 percent below a year ago (May 2019).

- Single-family housing completions were down, 9.8 percent in May 2020 to 791,000 (SA).

- Multi-family structures with 5 + units decreased 2.2 percent to 310,000 (SA). 2-4-unit structures did not meet publication standards so no numbers were published.

- The Northeast and Midwest saw housing completions increase nearly 12 percent, the South was down 16.5 percent and housing completions in the West were flat.