Ferrous: The American Iron and Steel Institute reports that for “the week ending on June 13, 2020, domestic raw steel production was 1,210,000 net tons while the capability utilization rate was 54.0 percent.” As compared to one year ago, when the capacity utilization rate was 80.1%, U.S. steel production was down 35.1 percent but was up 1.3% as compared to the preceding week.

- Fastmarkets AMM reports “Hot-rolled coil prices in the United States fell sharply on Friday June 19, with certain mills willing to sell at deeply discounted prices potentially due to weak demand, sources said. Fastmarkets’ daily steel hot-rolled coil index, fob mill US was calculated at $23.94 per hundredweight ($478.80 per short ton) on June 19, down by 3.9% from $24.92 per cwt on Thursday and a drop of 7.8% from $25.97 per cwt on June 12.

- In its guidance for 2nd quarter 2020 earnings, Nucor announced last week that “Second quarter operating performance has been better than expected and we have estimated our guidance range accordingly. Though overall market conditions are still challenged by the pandemic, demand in nonresidential construction has been resilient during this time. Nucor's downstream steel products segment is having another strong quarter. In our steel mills segment, the impacts of the COVID-19 pandemic have most negatively impacted our sheet and plate mills due to weak oil and gas market activity and customer production disruptions. Although domestic automotive production was halted due to COVID-19 concerns, we are seeing a strong rebound in automotive related steel demand. The automotive industry experienced better than expected sales during their outage period resulting in low inventory levels as we enter the third quarter of 2020. Our raw materials segment has been challenged by decreased pricing for raw materials and the impact of an outage at our DRI facility in Trinidad to comply with that country's stay at home orders.”

- On the scrap export front, despite reports of deteriorating global sentiment, AMM reports that “US ferrous export market participants reported higher prices on recent sales from the West and East coasts to Turkey and South Korea.”

- In China, Macquarie reports that “China’s latest inventory data flags some seasonal weakness for the ferrous trade. The surprisingly strong May-Jun steel destock by local traders/mills is ending. What’s the seasonality here? CISA mills’ daily output continues to climb, on track for a record-high in June, but they’re super-stretched – typical for this time of year. Elsewhere, flooding rains in China’s south have slowed construction activity.”

Nonferrous

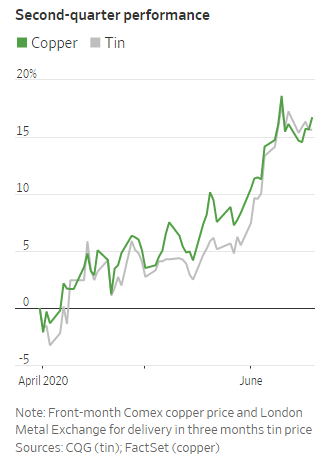

- The Wall Street Journal reports today that “Prices for raw materials including oil and copper are surging as the world economy reopens for business, a signal to many investors that global growth is returning more quickly than anticipated… Industrial metals have also been on a tear, with copper and tin up more than 15% so far this quarter.”

- In corporate news, Macquarie reports that “Freeport McMoran this week announced the closure of its 340ktpa Norwich copper rod mill in Connecticut and its 8ktpa Bayway specialty copper products facility in New Jersey, to “gain efficiencies with our two other rod mill operations” and due to “continued economic uncertainty resulting from the COVID-19 pandemic” (Fastmarkets). FCX retains its 340ktpa rod mill in El Paso, Texas and a 135ktpa rod mill in Miami, Arizona.”

- On the aluminum scrap front, Fastmarkets AMM reports that

“Aluminium scrap prices edged up in the United States on Thursday June 18 while smelter capacity continued to improve, albeit slowly, and demand for finished aluminium products seemed on the road to recovery. Industrial scrap supply also appeared to be improving, but peddler-sourced scrap remained tight. ‘I think the big secondaries might get busier in July,’ one trading source said. ‘It’s everybody’s goal to [increase production] by 10% per month.’”

- Our friend Edward Meir at ED&F Man Capital cites a Reuters report indicating “China's primary aluminum production edged higher in May from the previous month, as the launch of new smelting capacity lifted supply. The country produced nearly 3 mln tons of metal last month, up .4% from April and just about flat year-over-year. January-May aluminum output was up 2.1% year-on-year (at 14.81 million tons).

Plastics

Earlier this month, ReMA hosted a Spotlight on Plastics. Presenters for the plastics section were Dr. Kevin Swift, Chief Economist and Managing Director at the American Chemistry Council and Scott Saunders, General Manager of KW Plastics Recycling Division and Vice President of the ReMA Plastics Division. Sunil Bagaria, President of GDB International Inc. and President of the ReMA Plastics Division moderated the panel. Below are some highlights from the plastics portion of the webinar.

Kevin Swift, American Chemistry Council

- Dr. Swift reminded attendees of the importance of plastics, from their use in vehicles, making them lighter and increasing fuel economy. He pointed out that plastic packaging uses 80 percent less energy than alternatives.

- The largest endues markets for plastics, and subsequently are drivers in their use, are:

- Retail; Housing and construction; Light vehicles; Appliances; Furniture and furnishings; Machinery and industrial; and exports.

- Thirty percent of resins are exported.

- He provided all with a rule of thumb about the oil-to-natural gas price ratio: When this ratio is above 7, this gives the petrochemicals markets an advantage. When below 7, they are less advantaged and supply constricted.

- Since 2010, there have been 344 projects related to shale gas valued at $204.4 billion

- Plastic resin projects number 89, valued at $57.7 billion nearly two-thirds of this amount has been completed or is under construction.

- Producer inventories of basic chemical and synthetic materials are in pretty good shape going into this recession, with about an 18-day supply.

- Production levels in the basic chemical and synthetic materials sector are forecasted to sharply drop about 10-11% this year, and are estimated to take about a year to recover to pre-COVID levels. Capacity is expected to continue to expand.

- Plastic resins production, following the approximate decline of 20 percent, are expected to reach 68.1 million metric tons by 2022. U.S plastic resin production accounts for about 17 percent of worldwide production and this will likely increase in the future as U.S. has a good competitive outlook.

Scott Saunders, KW Plastics

- Scott built on some of the macro area that Dr. Swift presented.

- KW Plastics are recyclers, processing about 250 million pounds of HDPE and 250 million pounds of PP annually. KW container consumes 100 million pounds of PP post-consumer plastics annually in paint pail production.

- In September 2018, China began instituting counter tariffs on plastics from the U.S. and this started to weaken the demand for PP worldwide.

- In late 2019, as tariffs were added and counterbalance by US, scrap plastics market was affected.

- Automotive production uses lots of PP and HDPE and these markets were hurt considerably with automobile production ceasing for six to seven weeks.

- Another factor negatively effecting these markets is the low oil prices, which fell to $20 per barrel and have since rebounded, but the plastics market continues to be impacted.

- In August and September of 2019, consumer product companies announced that they were going to use a minimal amount of post-consumer resins, this led to an unprecedented run up in value of natural high density, meaning that the unprepared scrap was the same value as the virgin alternative.

- The mixed color bales were not affected by the consumer product company demand, but by market conditions.

- Tub and lid bales from MRFs, used by automotive sector, took a big hit during the cease of automotive production and expect this market to return to somewhat normal in July, but time will tell.