Last week’s jobs report came in remarkably better than expected. Against a consensus forecast for a loss of more than 8 million jobs, the Bureau of Labor Statistics reported nonfarm payrolls increased by 2.5 million in May while the unemployment rate declined from 14.7% in April to 13.3% last month.

May 2020 Employment Situation Report

- The latest report emphasizes the massive shifts in the monthly (and weekly) numbers. For example, BLS reports “…the number of unemployed persons who were jobless less than 5 weeks decreased by 10.4 million to 3.9 million” while “…the number of unemployed persons who were jobless 5 to 14 weeks rose by 7.8 million to 14.8 million, accounting for about 70.8 percent of the unemployed.”

- Those figures reflect the fact those who only recently lost their jobs due to the pandemic are coming back into the workforce quickly as the economic restrictions are relaxed, while those who have been out of work for a longer period of time are going to have a harder time rejoining the workforce.

- There’s significant variation by worker group as well: BLS reports unemployment rates for adult men at 11.6%, adult women at 13.9%, and Whites at 12.4%, while the unemployment rates were 15.0% for Asians, 16.8% for Blacks, 17.6% for Hispanics, and 29.9% for teenagers.

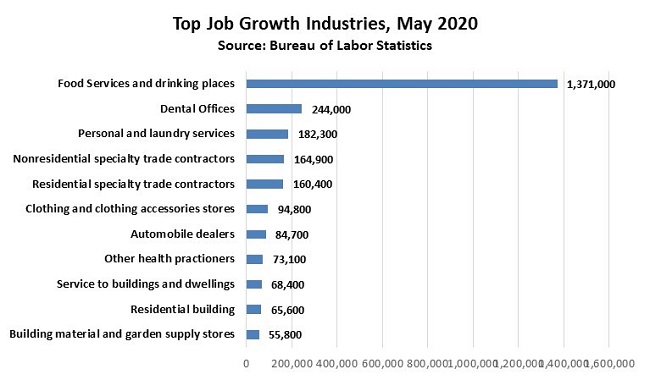

- Job growth was led by some of the same service- sector industries that were most effected by the coronavirus pandemic: leisure and hospitality (+1.239 million), education and health services (+424 thousand), and retail trade (+367.8 thousand). Manufacturing added 225,000 jobs and the construction industry added 464,000 jobs in May.

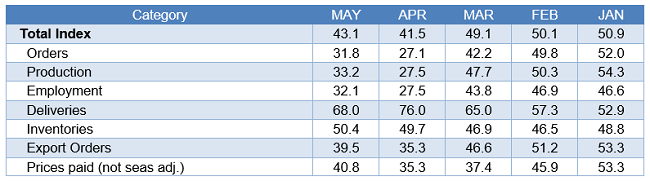

Manufacturing PMI

Last week’s manufacturing PMI report also showed signs of improving (or at least less bad) manufacturing sector conditions. The Institute for Supply Management reports their Purchasing Managers Index increased by 1.6 points to 43.1 in May. Timothy R. Fiore, Chair of the ISM’s Manufacturing Business Survey Committee, reports ““The coronavirus pandemic impacted all manufacturing sectors for the third straight month. May appears to be a transition month, as many panelists and their suppliers returned to work late in the month. However, demand remains uncertain, likely impacting inventories, customer inventories, employment, imports and backlog of orders.

Here’s what some of the ISM survey respondents had to say:

- “Despite the COVID-19 issues, we are seeing an increase of quoting activity. This has not turned into orders yet, but it is a positive sign.” (Computer & Electronic Products)

- “Current conditions in the automotive, construction, oil and gas, agriculture equipment, and tube/pipe markets are all adversely impacting our business results.” (Chemical Products)

- “We see an issue with suppliers that are affecting production. At the same time, social distancing measures in [the] manufacturing plant and customer demand are impacting the rate of production.” (Transportation Equipment)

- “Fuel sales demand are beginning to rebound in May as stay-at-home orders are lifted across the country.” (Petroleum & Coal Products)

- “Returning to full production for automotive, ramp-up will still depend on speed of automotive start-ups. We have built up inventory to stock. Ready to ship.” (Fabricated Metal Products)

- “Business activity remains strong for consumable applications and very weak in durable segments.” (Plastics & Rubber Products)

- “We have been fortunate that most of our customer base is considered to be a part of the critical workforce, so we have been running at around 80 percent of our normal production volume.” (Primary Metals)

- “Getting out from under several suppliers being closed worldwide. Also, looking at what really needs to be in China.” (Machinery)

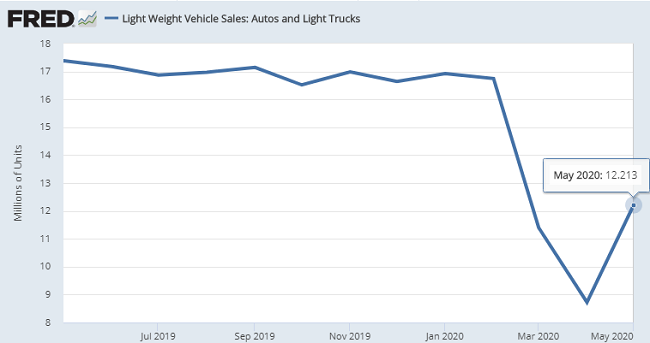

Light Vehicle Sales

- Following dismal sales in April and a nearly two-month shutdown in vehicle manufacturing, light-vehicle sales in May 2020 rose nearly 42 percent to 12.21 million units on a seasonally adjusted (SA) basis. However, they remain down nearly 30 percent from May 2019.

- This is a substantial rebound from April’s coronavirus-related plunge of nearly 50 percent.

- The light-truck segment accounted for over 78 percent of sales or 9.56 million units.

- Year-to-date, both car and light truck sales are down from a year ago:

- Car sales are at a SA rate through May 2020 of 3.15 million units.

- Light truck sales are at a SA rate through May 2020 of 9.85 million units.

Light Vehicle Sales, May 2015 to May 2020

U.S. Trade Balance

- U.S exports decreased in April to $151.3 billion, down $38.9 billion from March.

- U.S. imports decreased in April to $200.7 billion, down $31.8 billion from March.

- The U.S. trade deficit increased in April to $49.4 billion, up nearly 17 percent from March.

- Exports of goods decreased $32.2 billion in April to $95.5 billion.

- Automotive vehicles, parts, and engines exports decreased $7.4 billion in April.

- Civilian aircraft and aircraft engines exports decreased $4.3 billion in April.

- Exports of services decreased $6.7 billion in April to $55.8 billion. Travel decreased $3.4 billion and transport decreased $2.3 billion.