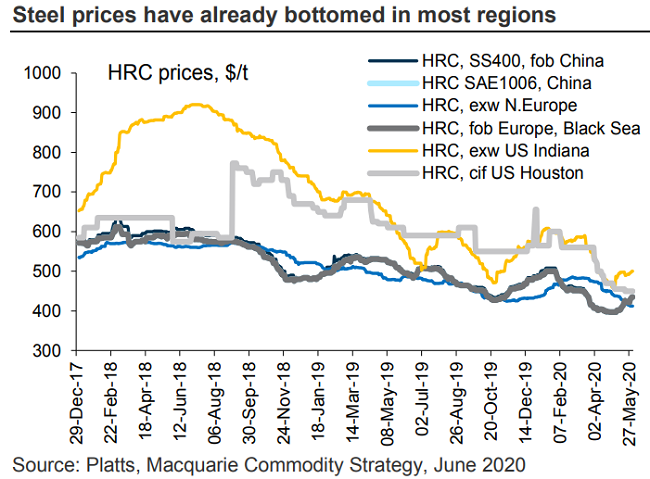

Ferrous: Macquarie reports that steel prices around the world ex-China appear to have bottomed out: “As the “Great Unlocking” of major economies gains pace, we can see a slow recovery in steel demand too, from the very low base reported in Feb-Apr.

- A wave of capacity closures in Mar-Apr ushered in a short, quiet period for steel makers worldwide. The pause appears to be ending.”

- In the United States, AISI reports that for the week ending May 30, 2020, domestic raw steel production edged up 1.3% from the previous week (but was still down 35.9% year-on-year) to 1.206 million net tons while the capability utilization rate was 53.8% – up slightly from 53.2% the prior week but still down sharply from the 80.8% utilization rate one year ago.

- Fastmarkets AMM reported last week that trading in most regions of the U.S. saw prime scrap price increases of around $10 per ton while shredded scrap prices were mostly $10 per ton lower, reflecting the disparity between prime and obsolete scrap availability.

- Fastmarkets AMM also reports Turkey booked at least five deep-sea cargoes from all origins last week totaling 150,000 tons as U.S. export prices advanced on improving demand from Taiwan, India, and Vietnam as well.

Nonferrous

- Last week, our friend Edward Meir at ED&F Man Capital reported “We are seeing more impressive upside action in a number of complexes right now. In the LME space, copper is leading the group higher, now edging past $5600 basis 3-months and at a fresh high. Lead also looks like it has staged a tentative breakout on the charts after languishing in a sideways range for weeks. Aluminum is grinding higher, ignoring a steady stock build on the LME and taking comfort instead that Shanghai stocks are falling (down another 25,000 tons this week). Nickel is looking perkier as well, but it has yet to break out on the charts although it is close.”

- Macquarie reports “The LME announced that it is planning to facilitate the trading of low carbon or so-called ‘green’ aluminum brands. The FT quoted CEO Matt Chamberlain today as saying that the platform will go live next year, allowing consumers to distinguish aluminum that has been produced with a lower carbon footprint.”

- Reuters’ Andy Home warns that a metals glut looms in the shadows and while those “shadow stocks” haven’t shown up in the LME data, that’s going to change next month: “Surplus stocks are accumulating in the statistical shadows and more is on its way. Unfortunately, there is no way of seeing this metal since the LME only counts what is on warrant. That is about to change. The exchange has for several months been collating statistics on what it calls its shadow warehousing network with the aim of boosting transparency.”

- In New York, COMEX Jul copper ended the week at $2.555 per pound on Friday, up from $2.43/lb. at the open on Monday, according to CME Group data.

- Fastmarkets AMM reports that rising COMEX pricing has helped to improve the flow of copper scrap, recently listing brass ingot maker prices at 247-249 for Bare Bright, 240-242 for No. 1 copper, 226-228 for No. 2 copper, and 221-223 cents for light copper.

Recovered Paper and Fiber

- Last week, ReMA continued to provide commodity-specific webinars though its Spotlight on Paper. Two professionals Jose Gonzalez and Sanna Sosa, from AFRY presented their research on the effects of COVID-19 on the paper industry. Their research predicates itself on the U.S. GDP decreasing 4.8 percent for the year, based upon more than a dozen forecasts they reviewed.

- Consumer habits have changed as working from home and business travel has nearly gone to zero. The continuing of these trends creates opportunities.

Tissue

- The at-home (AH) bleach kraft paper pulp market will be an opportunity for both big brands – bringing in more recycled paper content to tissue, and for private labels to make inroads into the market.

- The away-from-home market (AFH), which uses the most recycled paper, was severely effect by the pandemic as the restaurants closed or only offered take out, universities went to online learning, and hospitals’ regular activity dramatically decreased.

- AFRY expects total tissue demand to grow over the long term.

- They found that mid-sized companies are leading the growth, especially in the private label sector.

Packaging – Container board

- The largest companies still hold nearly three quarters of the containerboard industry and mainly use virgin fiber.

- The rest of industry players use a lot of recycled fiber and there is room for expanded RCP capacity.

- Currently, 60 percent of the 5.6 million short tons of expansion announced focuses on recycled.

- The main driver of containerboard is the manufacturing sector. Depending on the assumptions made, AFRY’s model forecast a wide range of change: ranging from a 1.5 percent growth to a negative growth of 13 percent.

- 53 percent of containerboard is used for food and beverage. Consumption has been down from a loss of disposable household income.

Fiber Market

- Negative growth products have been: envelopes, filter grades, and wall paper

- Positive growth products have been: labels and e-commerce.

Recovered Paper (RCP)

- Price volatility will continue for the remainder of the year and supply shortages will continue.

- Five million tons of RCP expansion in the US and 2.5 million tons of expansion – primarily in Southeast Asia. Projects like these are expected to continue this year.

Recycled Pulp

- AFRY stated that there are five OCC pulp expansion of capacity projects currently in the US.

Plastics

Don’t miss this week’s Spotlight on Plastics & Briefing on Basel Convention to be held on Thursday, June 11, at 1:00 p.m. ET. The global plastics and petrochemical markets continue to be negatively impacted by the productivity and economic downturn caused by COVID-19, especially in the oil and gas sector. The continued public attention on plastic consumption and concerns raised at international forums about EOL plastic trade has also become an issue. This two-panel virtual event will feature leading experts providing an outlook on the primary plastic and plastic scrap markets, as well as U.S. Government officials sharing details on compliance requirements for the Basel Convention’s new plastic scrap trade regime that will be implemented in 2021. This is a must attend event for any one processing, brokering, or consuming plastic scrap or considering getting into the business.