The Week Ahead

The easing of COVID-19 lockdown restrictions, continued social unrest, and concerns about U.S.-China trade relations are again expected to feature prominently this week.

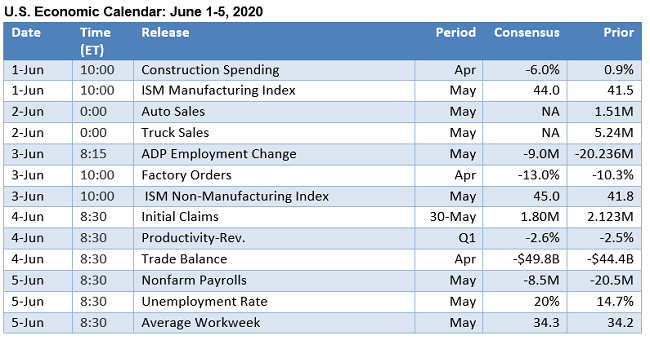

- On the U.S. economic calendar, the monthly jobs report for May looms large, with the U.S. unemployment rate forecast to increase to 20% while nonfarm payroll losses are projected at around 8.5 million.

- Investors will also be paying close attention to releases on initial unemployment claims (consensus: 1.8 million), construction spending, manufacturing PMI, light vehicle sales, factory orders, and the trade balance.

- In Europe, we’ll get updated PMI reports along with data on euro zone producer price inflation, unemployment, and retail sales.

- The European Central Bank meets on Thursday and, as the Financial Times reports, “No changes to the key interest rates are expected but investors will watch for any decision the ECB takes on its €750bn asset-purchasing program, which many believe will still be needed even if European leaders finalize a €500bn EU recovery fund proposed by Germany and France.”

- Please be safe and have a great week!

You are not allowed to post comments.