U.S. economic reports released last week included updates on first quarter GDP, personal income & spending, durable goods orders, new home sales, initial unemployment claims, and consumer sentiment.

Here’s a recap of the week’s key reports:

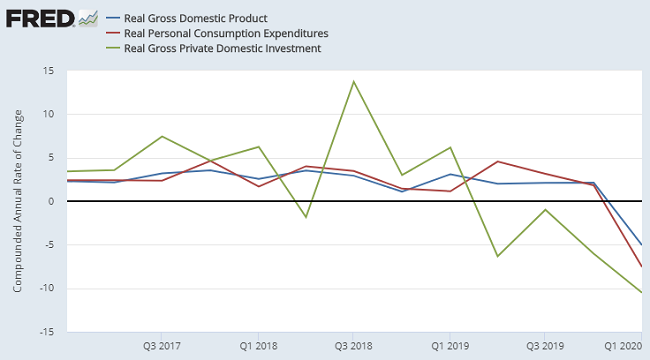

Gross Domestic Product

- The Bureau of Economic Analysis downwardly revised its initial estimate of first quarter real GDP from a 4.8% contraction to a 5.0% contraction.

- Personal Consumption Expenditures decreased -6.8% in the first quarter.

- Gross Private Domestic Investment fell -10.5% in Q1, the fourth consecutive quarter of falling business investment.

- The BEA reports, “With the second estimate, a downward revision to private inventory investment was partly offset by upward revisions to personal consumption expenditures (PCE) and nonresidential fixed investment.”

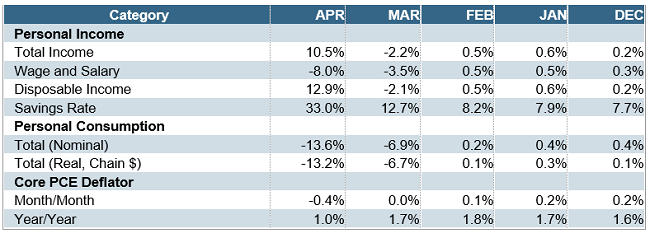

Personal Income and Spending

- Personal income and spending diverged sharply in April as stimulus payments were credited for the increase in incomes, while personal consumption expenditures plunged sharply.

- According to the BEA, personal income increased $1.97 trillion (10.5 percent) in April even as wages and salaries fell 8%, while disposable income increased 12.9%.

- Nominal personal spending decreased $1.89 trillion (13.6 percent) in April and was down 13.2% adjusted for inflation.

- Briefing.com reports, “The key takeaway we think is that the personal savings rate, as a percentage of disposable income, skyrocketed to 33.0%! That's a lot of pent-up spending potential. Then again, it might also reflect an increased propensity to save money in preparation for a long recovery and extended period of high unemployment. What is done with those savings will be key to the recovery trajectory.”

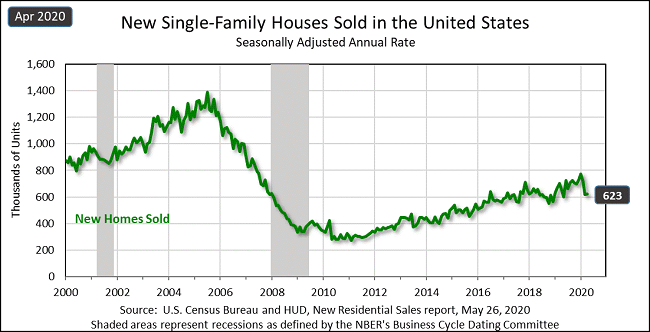

New Home Sales

- Sales of new single-family houses in April 2020 rose slightly by 0.6 percent to 623,000 on a seasonally adjusted annual basis, according to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development.

- The West was the only region with fewer sales, down 6.3 percent. The other regions were up between 2.4 percent and 8.7 percent for the month.

- But compared to a year ago (April 2019), new home sales were down 6.2 percent. Regionally, the Northeast was down 26.5 percent and sales in the West were down 33.5 percent year-on-year. Sales in the Midwest were up 26.5 percent and the South saw a 4.7 percent increase.

- Taking out the seasonal adjustment, through the first four months of 2020, new home sales were 241,000, up 1.4 percent from the comparable period of 2019.

- The new house median sales price in April 2020 was $309,000, the second lowest price of the last thirteen months. Similarly, the average price was $364,500.

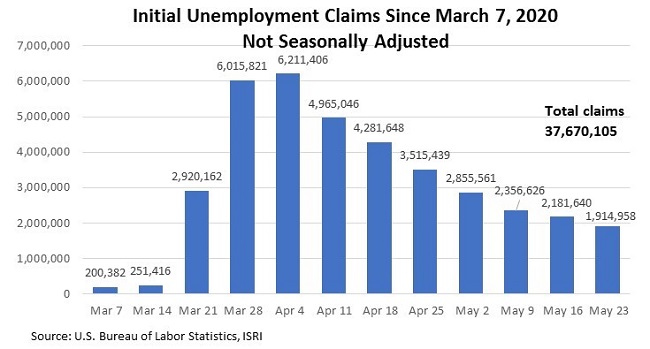

Unemployment Claims

- For the week ending May 23, initial unemployment claims, on a seasonally adjusted basis, were 2,123,000, a decrease of 13 percent from the previous week, according to the Department of Labor.

- The somewhat good news is that the last two weeks were below the four-week average of 2,608,000. Still, no one expected that by the end of May, over two million people would be filing for unemployment, an indication of the uphill economic challenges that lie ahead.

- Taking out the seasonal adjustment, which was fairly predictable until COVID-19 hit, the actual number of claims filed in the week ending May 23 was 1,192,616, a decrease of more than 12 percent from the previous week. In comparison, initial claims (also not seasonally adjusted) in the corresponding period last year were one-tenth of the current amount, or 198,194.

- Since the pandemic began, nearly 37.7 million initial unemployment claims were filed (without the seasonal adjustment).

University of Michigan Surveys of Consumers, Final Results

- The U of M Consumer Sentiment Index for May 2020, increased by a one-half of an index point to 72.3.

- April’s index of 71.8 was the lowest index number since December 2011. The effect of the coronavirus pandemic and the states’ responses plummeted this index nearly 29 percent between February (101.0) and April (71.8).

- The Current Economic Conditions Index rebounded 82.3 in May, up from 74.3 in April. And the Index of Consumer Expectations declined to 65.9 in May, from 70.1 in April.

- Richard Curtin, chief economist for the Surveys of Consumers, stated, “It should not be surprising that a growing number of consumers expected the economy to improve from its recent standstill, or that the majority still thought conditions in the economy would remain unfavorable in the year ahead. This has been a common occurrence in past cycles. Expectations for economic growth have always dominated at the ends of recessions, and favorable assessments about the current state of the economy are more frequent near the ends of expansions.”