Last week, Fed Chair Jay Powell and Treasury Secretary Steve Mnuchin testified before the Senate Banking Committee and, as the Wall Street Journal reported, “The nation’s top two economic policy leaders offered contrasting visions about the economic outlook, with Treasury Secretary Steven Mnuchin favoring a wait-and-see approach to more federal aid and Federal Reserve Chairman Jerome Powell suggesting more would be needed.

Their positions expressed Tuesday reflected differing views on the prospects for a swift economic rebound from the coronavirus pandemic. Mr. Mnuchin, appearing alongside Mr. Powell at an online congressional hearing, reflected the Trump administration’s belief that the biggest danger to the economy is waiting too long to restart activity after two months in which millions of Americans have sheltered in their homes to slow the spread of infections.”

The deteriorating economic conditions were reflected in a number of new releases put out last week, including the latest housing market data and the Conference Board’s leading economic index.

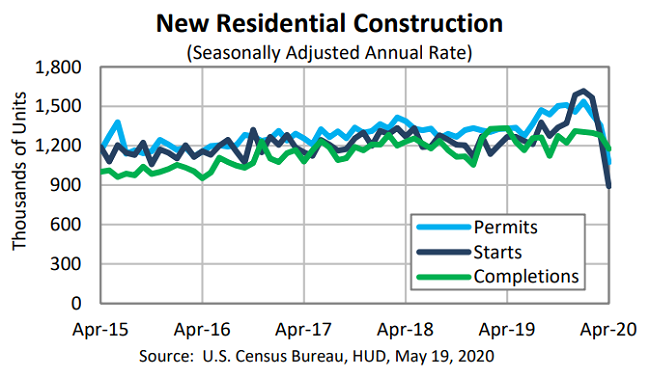

Housing Starts and Permits

According to the Census Bureau and U.S. Department of Housing and Urban Development, new building permits in April 2020 were down 20.8% from the preceding month and were down 19.2% year-on year to a seasonally adjusted annual rate of 1,074,000. Housing starts were down 30.2% as compared to March 2020 and were down 29.7% as compared to April 2019 according to last week’s press release. Briefing.com reports “The key takeaway from the report is that… permits for single-family dwellings decreased 24.3% m/m to 669,000, which points to a slowing market.”

Existing Home Sales

At the same time, the National Association of Realtors reports that “Existing-home sales dropped in April, continuing what is now a two-month skid in sales brought on by the coronavirus pandemic… Each of the four major regions experienced a decline in month-over-month and year-over-year sales, with the West seeing the greatest dip in both categories. Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, dropped 17.8% from March to a seasonally-adjusted annual rate of 4.33 million in April. Overall, sales decreased year-over-year, down 17.2% from a year ago (5.23 million in April 2019).

‘The economic lockdowns – occurring from mid-March through April in most states – have temporarily disrupted home sales,’ said Lawrence Yun, NAR’s chief economist. ‘But the listings that are on the market are still attracting buyers and boosting home prices.’ April’s decline in existing-home sales is the largest month-over-month drop since July 2010 (-22.5%).”

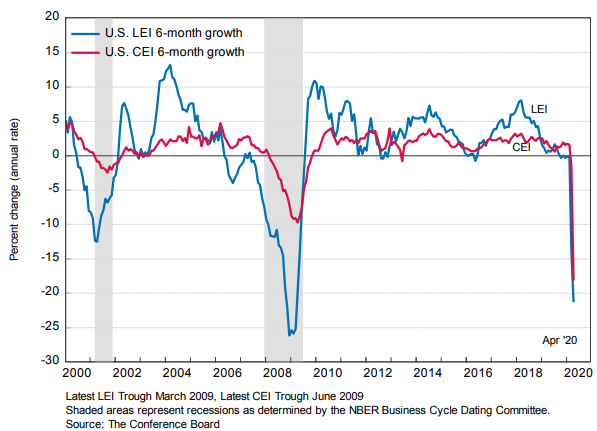

Leading Economic Indicators

Looking forward, the Conference Board reported last week that their U.S leading economic index “…declined 4.4 percent in April to 98.8 (2016 = 100), following a 7.4 percent decline in March, and a 0.2 percent decline in February.

“In April, the US LEI continued on a downward trajectory, after posting the largest decline in its 60-year history in March,” said Ataman Ozyildirim, Senior Director of Economic Research at The Conference Board. “The erosion has been very widespread, except for stock prices and the interest rate spread which partially reflect the rapid and large response of the Federal Reserve to offset the pandemic’s impact and support financial conditions. The sharp declines in the LEI and CEI suggest that the US economy is now in recession territory.”

“Business conditions may recover for some sectors and industries over the next few months,” added Bartvan Ark, Chief Economist at The Conference Board, “But, the breadth and depth of the decline in the LEIsuggests that an imminent re-opening of some sectors does not imply a fast rebound for the economy at large.”

Last but not least, the WSJ’s Daily shot reports that 31 percent of U.S. small business owners have tapped into personal savings in order to keep their businesses afloat, while 41 percent are worried they will have to temporarily shut down and nearly 19% are worried about permanently shutting down.