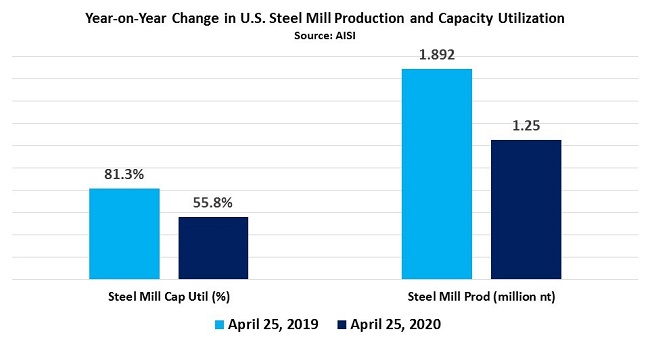

Ferrous: The American Iron and Steel Institute reports that for the week ending April 25th, “domestic raw steel production was 1,250,000 net tons while the capability utilization rate was 55.8 percent. Production was 1,892,000 net tons in the week ending April 25, 2019 while the capability utilization then was 81.3 percent.

The current week production represents a 33.9 percent decrease from the same period in the previous year. Production for the week ending April 25, 2020 is down 2.1 percent from the previous week ending April 18, 2020 when production was 1,277,000 net tons and the rate of capability utilization was 57.0 percent.”

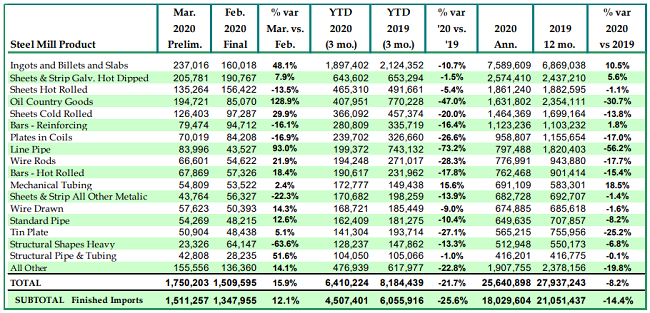

On the U.S. steel import front, AISI previously reported that “through the first three months of 2020, total and finished steel imports are 6,410,000 and 4,507,000 net tons (NT), down 21.7% and 25.6%, respectively, vs. the same period in 2019.”

Looking into May scrap trading, Argus Media reports “A severe shortage of industrial prime grade ferrous scrap and tighter supplies of obsolete grades are widely expected to drive US prices higher in May, despite weaker demand fundamentals. But dealers and consumers surveyed by Argus expect US ferrous scrap prices will see little uniformity between regions. Mill buyers will likely rely more heavily on remote scrap supplies due to local shortages, particularly for prime grades like #1 busheling. Prime scrap flows have been practically halted over the last 40 days amid stoppages of US auto manufacturing. Finished steel demand and prices have also been severely depressed over the last month from delays in restarting US auto manufacturing, as well as a collapse in oil prices hitting energy sector demand.”

ISRI Members: Don’t miss our Ferrous Spotlight Webinar to be held on May 14, 2020 at 1 pm Eastern when Brandi Harleaux from South Post Oak Recycling Center, Blake Hurtik from Argus Metal Pricing, and ISRI’s Joe Pickard discuss how recyclers are responding to the COVID-19 crisis and the outlook going forward for the domestic & global steel and ferrous scrap markets.

Nonferrous

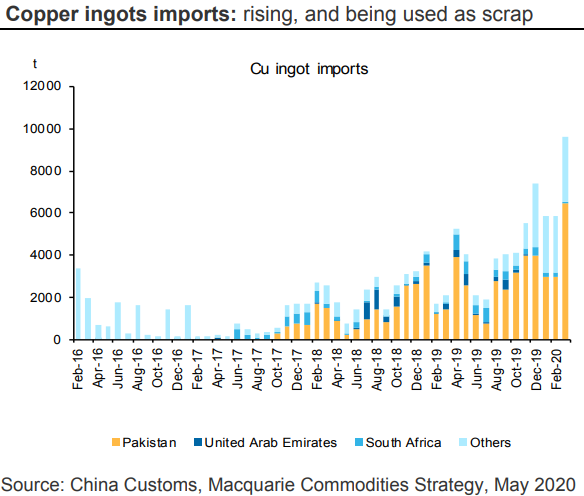

Our friends at Macquarie reviewed China’s Q1 2020 metal imports last week, reporting that China’s copper scrap imports during Jan-Mar 2020 fell to 210,000 metric tons, down 16% from the previous quarter and off 38% year-on-year as copper ingots are increasingly being used as scrap substitutes:

- Copper concentrate imports dropped 9% MoM to 1.8Mt (+1% YoY); 1Q total imports -1% YoY. Refined imports of 282kt (-6% MoM; -1% YoY), 1Q total imports lifted 5% YoY to 883kt. 1Q scrap copper imports were just 210kt (-16% QoQ), despite the adequate quota available for 1H2020.

- Imports of Cu-contained materials including concentrate, blister and cathodes – all generally flat YoY, except ingots. Ingot imports have displaced scrap, since the scrap bans were imposed, and have now surged to an historic high in March, mainly from Pakistan.

- As NBS reported, China produced 771kt of copper cathodes (-3%YoY), taking 1Q production to 2.2Mt (flat YoY). Copper semis production rebounded 64% vs the average of Jan and Feb, while the total 1Q production was still ~6% lower YoY. In April, the market has seen continuous destocking. Even acid prices have recovered from their very low levels, implying a demand recovery.

In corporate news, Fastmarkets AMM reports that “Aurubis' attempts to get regulatory approval for its takeover of secondary copper-tin smelter Metallo continue, Europe’s largest copper smelter said, with the decision delayed due to Covid-19 uncertainty. The Germany-based company has been attempting to gain antitrust regulatory approval for a €380-million ($424-million) takeover of Belgian-Spanish recycler Metallo Chimique since May last year, seeking to solidify plans to diversify its product offering. The EU’s final decision had been expected by April this year but will now be given early this month, an Aurubis spokesperson confirmed to Fastmarkets on Thursday April 30…

Although a Reuters report earlier this week suggested that Aurubis is set to secure the EU's approval, the Aurubis spokesperson said that story is “is based on rumors by unknown sources.” "There is no official decision as of now... the merger control proceeding is ongoing and Aurubis is cooperating with the [European] Commission in a constructive manner,” the Aurubis spokesperson said. “In general, our view on the case has not changed. We still believe that the merger should be cleared unconditionally.”

In the U.S., COMEX July copper futures lost ground late last week, trading as low as $2.286 per pound on Friday after having traded as high as $2.395/lb. on Thursday. AMM was recently listing brass ingot maker prices for copper scrap at 219-221 for Bare Bright, 212-214 for No. 1 copper, 194-196 for No. 2 copper, and 143-144 cents for radiators.

Plastics

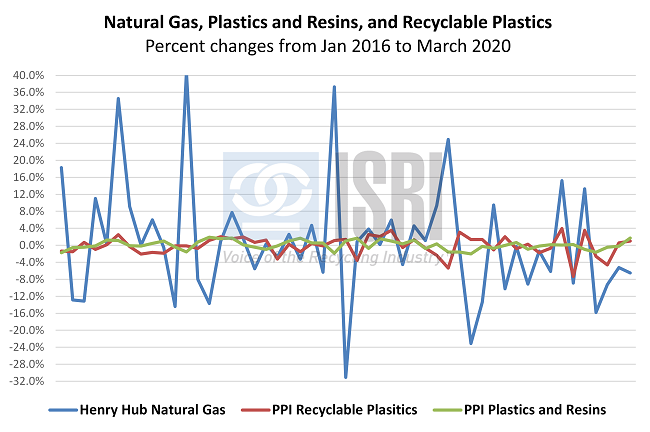

With the energy markets way out of equilibrium, we decided to look at percent changes in natural gas prices (as measured by the Henry Hub Natural Gas spot price), the PPI for recyclable plastics, and the PPI for plastics material and resins manufacturing. As you can see, the natural gas price is very volatile, while recycled plastic has some volatility and has followed natural gas price in the last year. Reported virgin plastic materials and resins have been relatively stable in comparison.

In other plastics news, Resource Recycling reports “The coronavirus has disrupted end markets for KW Plastics, moving demand away from industrial applications and toward packaging for essential products. Troy, Ala.-based KW Plastics, which describes itself as the world’s largest plastics recycling company, has 350 employees directly tied to plastics recycling. KW has not laid off any of those workers during the coronavirus pandemic, said Stephanie Baker, director of market development for KW Plastics.

Baker spoke on a recent webinar hosted by the Southeast Recycling Development Council (SERDC) and provided more details in an interview with Plastics Recycling Update. “We’re doing everything we can to keep business as usual so that we can keep PCR flowing to our customers that need it,” Baker said. But the company has seen fast changes in the numerous end markets it supplies.

The automotive sector has essentially shut down, and “we have seen that business come to all but an abrupt stop,” Baker said. Automotive manufacturers have floated plans to restart their plants in early May, but for the time being, that end market is closed. At the same time, however, KW has seen demand increase for its natural HDPE recycled pellets. This resin goes into packaging for personal care products, household cleaning agents, detergents, soaps and more.”