Given the global shutdown in response to the COVID-19 pandemic, the U.S. economic figures have been particularly dismal lately and unfortunately will continue to deteriorate in many cases given the lag in economic reporting and on-going impacts of the crisis.

In case you missed it, here are some of the depressing economic reports that we’ve seen in the U.S. and around the world over the last two weeks:

United States

- New orders for U.S. durable goods declined 14.4% in March 2020;

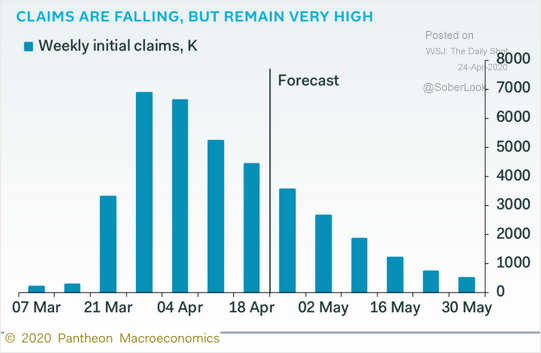

- U.S. initial unemployment claims came in at 4.4 million for the week ending April 18th, down from 5.2 million the week ending April 11th; the 4-week moving average came in at nearly 5.8 million new claims; the advance seasonally adjusted insured unemployment rate rose to 11.0% for the week ending April 11;

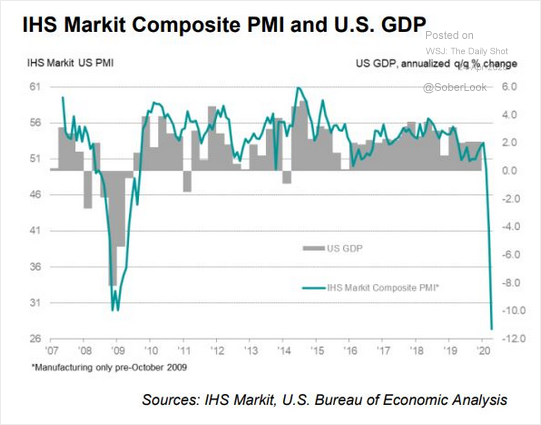

- IHS Markit’s U.S. flash manufacturing PMI fell from 48.5 in March to 36.9 in April, a 133-month low; their flash U.S. services index fell from 39.8 in March to 27.0 in April, the lowest level on record;

- The Federal Reserve reported U.S. industrial production contracted 5.4% in March, including a 6.3% drop in manufacturing output;

- U.S. retail sales contracted 8.7% month-on-month in March, according to the Census Bureau;

- Privately‐owned housing starts declined 22.3 percent in March as compared to the revised February estimate;

- The Conference Board’s Leading Economic Index was down 6.7% in March, the largest decline in the index’s 60-year history.

China

- Chinese GDP contracted 6.8% year-on-year in the first quarter of 2020, the first reported contraction on record;

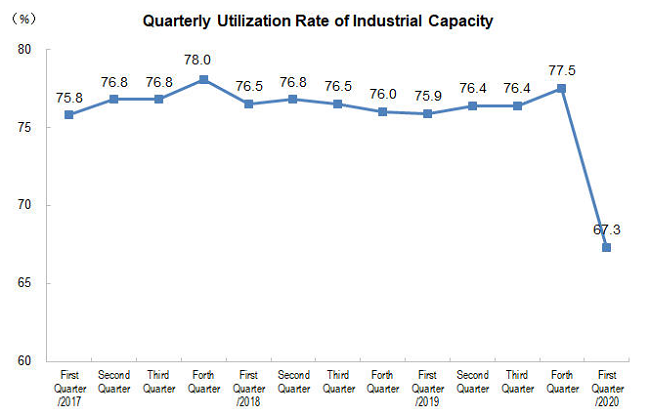

- In Q1 2020, China’s industrial capacity utilization rate fell by 8.6 percent points to 67.3 percent, according to NBS data;

- Chinese fixed asset investment fell 16.1% year-on-year in the first quarter of 2020;

- China’s retail sales declined 15.8% in March.

Europe

- IHS Markit reports “The eurozone economy suffered the steepest falls in business activity and employment ever recorded during April as a result of measures taken to contain the coronavirus outbreak”;

- The Flash Eurozone PMI Composite Output Index fell to 13.5 in April (from 29.7 in March), while the Flash Eurozone Services PMI Activity Index plummeted to 11.7 in April (from 26.4 in March);

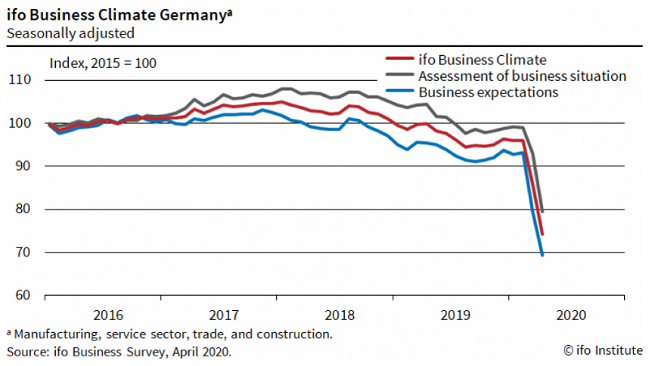

- The ifo Institute in Germany reports “Sentiment at German companies is catastrophic. The ifo Business Climate Index crashed from 85.9 points (seasonally adjusted) in March to 74.3 points in April. This is the lowest value ever recorded, and never before has the index fallen so drastically.”

ISRI Town Hall: COVID-19 Impact on Markets and the Economy

April 30, 2020 at 2 p.m. ET: The global COVID-19 pandemic is heavily impacting every segment of the U.S. economy, including the recycling and manufacturing sectors. Amid volatile commodity prices, contracting supply and demand for scrap, and slumping demand from end-use sectors, market conditions have never been more challenging for our industry. Join our conversation with ReMA experts to discuss the current market dynamics, economic outlook, global economic developments, and public policy initiatives that will shape our economy and industry in the coming months and years.

You must register to participate. Register online and select the ISRI Town Hall event. There is no charge for ISRI members for this event. Once you register, you will receive an email with login instructions. Make sure to save the information in your calendar.