Oil market developments took center stage on Monday, with Bloomberg reporting Brent crude oil futures “…rose less than 1% after earlier surging 8% following the OPEC+ alliance agreement to slash production by 9.7 million barrels a day starting in May. West Texas Intermediate fell 1.5%, and the May-June time spread moved deeper into contango, indicating that traders see the physical glut worsening even with the output cuts.

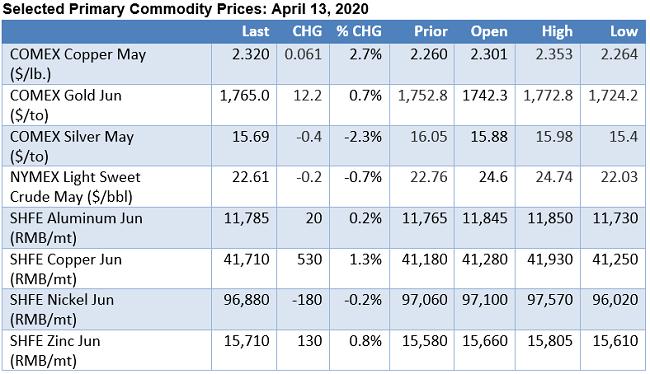

The group reached the deal following days of intense negotiations after Mexico declined to endorse the original agreement reached Thursday. While the OPEC+ deal amounts to the largest coordinated cut in history, it’s dwarfed by the estimated 20 million barrels a day or greater decline in oil consumption as a result of the coronavirus pandemic.” By the end of the trading day, front month NYMEX crude oil futures eased to around $22.60 per barrel while COMEX copper futures were up 2.7% to $2.32 per pound after having traded as high as $2.353/lb. earlier in the day. In London, the LME was closed today for Easter Monday but trading resume tomorrow. On Wall Street, the Dow Industrials fell by 1.4% (-328.6 points) on Monday while the Nasdaq gained 38.85 points to close 0.48% higher.