Most of the economic indicators released by the Federal Government last week reflect economic conditions prior to mid- March 2020. Two releases last week show February and March data. While the economic world has changed from around mid-March onward, the importance of looking at the data prior to this is an indication of the potential snap or climb back that may occur.

CPI

BLS released the consumer price index last week showing the all-urban CPI was down 0.4 percent in March 2020, on a seasonally adjusted basis, the largest decrease since January 2015. This main driver was a 5.8 decline in the energy index, specifically gasoline (all types) which was down 10.5 percent. Other contributing sectors include apparel (down 2.0 percent), lodging away from home (down 7.7 percent), public transport (down 8.5 percent). The all items index, less food and energy, only decreased 0.1 percent in March 2020. As compared to March 2019, the all items index increased 1.5 percent, significantly less than the 2.3 percent the month before. Less food and energy, the all items index increased 2.1 percent from March 2019. The energy index decreased 5.7 percent year-on-year.

Unemployment Claims

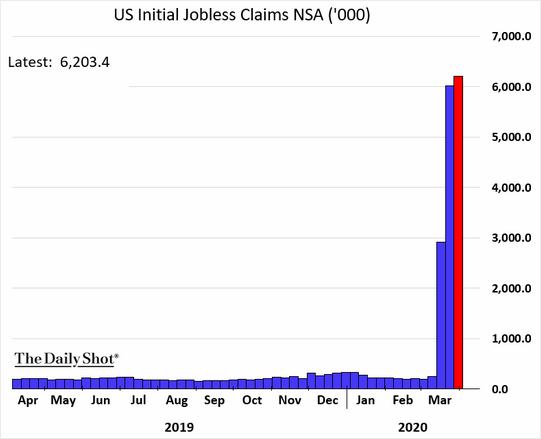

Initial unemployment claims decreased 261,000 (0.6%) for the week ending April 4, 2020 to 6,606,000, on a seasonally adjusted basis, according to the Department of Labor. The prior week, ending March 28, initial claims filed was revised upward by 219,000 to 6,867,000.

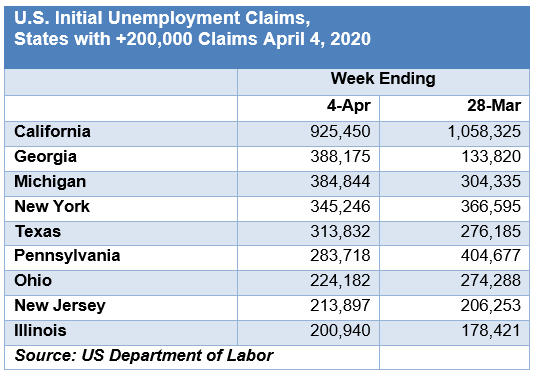

Taking out the seasonal adjustment, which was fairly predictable until COVID-19 hit, the actual number of claims filed in the week ending April 4, 2020 was 6,203,359, an increase of 3.1 percent from the week ending March 28, 2020. In just the past month, nearly 15.4 million initial unemployment claims were filed (without the seasonal adjustment). The states with over 200,000 claims for the week of April 4, 2020 along with their prior week’s claims, are shown in the table below.

JOLTS

Last week the Bureau of Labor Statistics released February 2020 numbers from its monthly Job Openings and Labor Turnover Survey (JOLTS) showing employment stability. Job openings remained about the same at 6.9 million, as of the last day of February. Hires remained at 5.9 million, flat from January and separations were down 2.5 percent to 5.6 million. With minor fluctuations over the past year, the levels of these three employment measurements remained about the same as their previous levels. Manufacturing durable goods showed the largest increase in hires, rising by 29,000 and the retail trade industry increased 18,000. Regional data remain virtually constant. Professional and business services showed a 122,000 decline in separations, and real estate and rental and leasing declined 20,000. Government showed an increase of 28,000 separations.

Monetary Policy

On the monetary policy front, the Federal Reserve announced on Thursday a massive new $2.3 trillion program. The New York Times reports, “The Federal Reserve said it could pump $2.3 trillion into the economy through new and expanded programs it announced on Thursday, ramping up its efforts to help companies and state and local governments suffering financial damage from the coronavirus… The Fed announced that it would use Treasury Department funds recently authorized by Congress to buy municipal bonds and expand corporate bond-buying programs to include some riskier debt. The Fed also rolled out a highly-anticipated lending program that targets midsize companies, including those not eligible under a Small Business Administration loan program.” As outlined by the WSJ, the new Fed program includes:

- “Small and mid-size business loans (Main Street Lending Program, up to $600 billion).

- Municipal debt (Municipal Liquidity Facility, up to $500 billion).

- Corporate debt, including high-yield bonds that were recently downgraded from investment-grade ("fallen angels").

- The program will even include corporate bond ETFs that are ‘mostly’ investment-grade, collateralized loan obligations (CLOs), and commercial mortgage-backed securities (CMBS).”