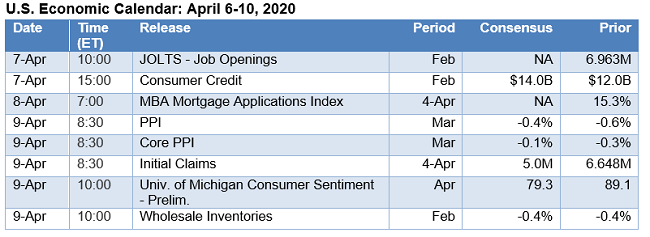

The U.S. economic calendar slows down in this holiday-shortened trading week, so the initial unemployment claims numbers will again be the focus. The consensus forecast is for 5 million new unemployment claims for the week ending April 4th, although Briefing.com expects something closer to 6.5 million. Either way it’s not expected to be pretty.

Other U.S. releases out this week will cover job openings and labor turnover in February, producer prices in March, and the preliminary reading on consumer sentiment in April, which is expected to drop significantly. On the monetary policy front, investors will be paying attention to the release of the minutes of the last FOMC and European Central Bank meetings. In overseas developments, the Financial Times reports “Eurozone finance ministers meet on Tuesday to try to sort out how they will fund the measures planned to protect and restart an economy battered by the shutdowns Covid-19 has brought. Then later in the week we should have an OPEC+ meeting where it is hoped a deal can be reached to cut the global supply of crude after disagreement between Russia and Saudi Arabia at the last meeting led to a drastic fall in oil prices.” Overseas economic releases will include German manufacturing orders, industrial production, and merchandise trade, along with Chinese PPI and CPI. Have a good week and a happy holiday season.