For most U.S. businesses last week the key economic event of the week wasn’t the dismal jobs numbers but the opening of the new SBA loans under the Paycheck Promotion Program on Friday. ABC News reports, “Across the U.S. banking industry, officials scrambled overnight to stand up a massive new government-backed lending program to help small businesses ravaged by the coronavirus pandemic and many were unable to make it happen by the Friday deadline given that the Treasury Department released its guidelines for the loans late Thursday night.

The $350 billion federal program… was a key part of the recently-passed $2 trillion COVID-19 stimulus package. The Paycheck Protection Program is a relief plan designed to extend loans, backed by the federal government, that become grants if the money is used for payroll and other overhead operating expenses… But across the U.S., at banks big and small, the program is simply not yet operational. And experts said it would be a week before the program was fully up and running.” Frustrations mounted as small businesses became concerned that the program’s funds would be exhausted before they could submit their applications. Guidance on the Paycheck Promotion Program, along with a wealth of additional information, was presented at ISRI’s Virtual Town Hall last week.

Unemployment Claims

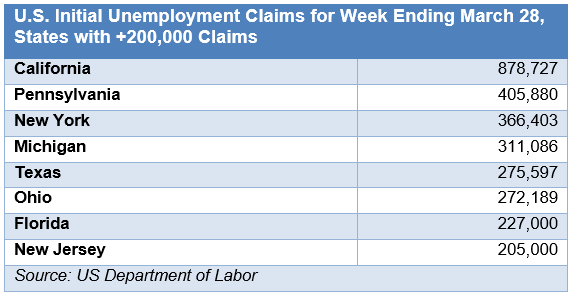

As you may have seen, initial unemployment claims nearly doubled for the week ending March 28, 2020 to 6,648,000, on a seasonally adjusted basis, according to the Department of Labor. The prior week, ending March 21, 3,341,000 initial claims were filed. By comparison, typically weekly claims since March 2019 have hovered between 201,000-237,000. Taking out the seasonal adjustment, which was fairly predictable until COVID-19 hit, the actual number of claims filed in the week ending March 28, 2020 was 5,823,917, nearly double the previous week’s 2.9 million claims. In a matter of two weeks, an astounding 8.7 million initial unemployment claims were filed (without the seasonal adjustment). Here are the states with over 200,000 claims for the week of March 28, 2020.

Employment Situation

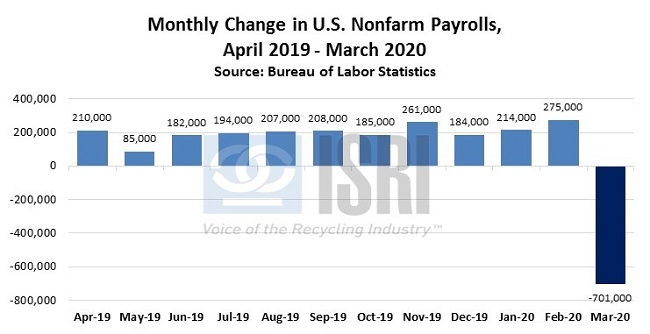

Also last week, the Bureau of Labor Statistics released the Employment Situation for March 2020. Non-farm employment decreased 701,000 in March 2020, a complete reversal of the nearly 500,000 boost in employment seen in January and February. Last month’s numbers marked the biggest drop since the period between November 2008 and April 2009. The unemployment rate reflected the reversal in the job market, increasing 0.9% to 4.4%, the largest monthly increase since January 1975.

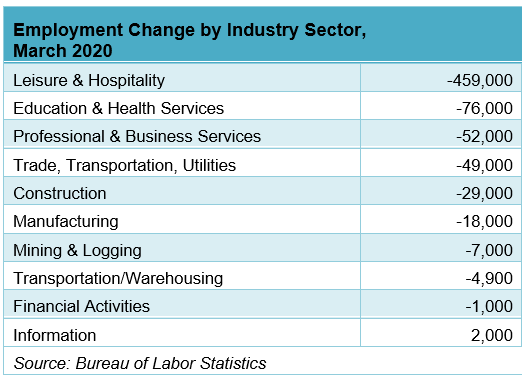

According to the BLS, the national and local responses to containing COVID-19 drove these changes, with the leisure and hospitality sectors enduring the brunt of the effect. The employment changes for several broad US economic sectors are shown below. Only the Information sector showed a net increase in employment.

Note: The coronavirus introduced several abnormalities in the BLS collection process, from lower response rates to changing the method of collection (away from in-person interviews) and self-reporting inconsistency. In addition, the collection period was between March 8 and 14, before the increased response from states initiating their stay-at-home suggestions and directives.

Light Vehicle Sales

Last week Edmunds reported estimated sales for March 2020 to be 1,044,805, down over 23% from February 2020 and down over 35% from a year ago. On a seasonally adjusted annual rate, 11.9 million cars and trucks are estimated to have been sold. For the first quarter of 2020, 3,546,415 new cars and trucks were sold, down nearly 12% from the first quarter 2019. Edmunds sites COVID-19 crisis for causing these market disruptions: "The first two months of the year started off at a healthy sales pace, but the market took a dramatic turn in mid-March as more cities and states began to implement stay-at-home policies due to the coronavirus crisis, and consumers understandably shifted their focus to other things," said Jessica Caldwell, Edmunds' executive director of insights. "The whole world is turned upside down right now, and the auto industry is unfortunately not immune to the wide-ranging economic impacts of this unprecedented pandemic."

ISM Manufacturing PMI

The Institute for Supply Management released their latest set of manufacturing indicators last week and the manufacturing PMI dropped to 49.1% in March from 50.1% in February, indicating a contractionary phase for manufacturers. The new orders index, production index, and employment index all decreased in March and confirm that manufacturing is contracting.

Here’s what some of the respondents said:

- “COVID-19 is impacting China’s raw material supply chain. We are now seeing revenue impact in that region. Our operations team is reviewing plans for spread of the virus.” (Computer & Electronic Products)

- “The two main issues affecting our business [are] COVID-19 and the oil-price war. We are in daily discussions and meeting constantly, updating tracking logs to document high risk concerns.” (Chemical Products)

- “All North American manufacturing plants have ceased operations or drastically scaled back as a result of customer plant closings and other responses to COVID-19.” (Plastics & Rubber Products)

- “COVID-19 impact has extended to Europe and North America. The virus escalation is affecting our purchasing and logistics operations. We have incurred air-shipment and production interruptions due to shortages of raw materials and components.” (Transportation Equipment)

- “COVID-19’s spread in the U.S. may start impacting our domestic business. As for Asian suppliers, they are starting to get back up to speed.” (Fabricated Metal Products)

February 2020 U.S. Trade

The U.S. trade deficit for goods and services declined 12.2 percent in February 2020 to $39.9 billion, the lowest since September 2016 ($39 billion) according to the U.S. Census Bureau. Exports were down slightly (0.4%) to $207.5 billion. Imports declined 2.5 percent to $247.5 billion. Compared to the same period a year ago, the deficit for YTD 2020 declined $19.7 billion or 18.7 percent. In February, U.S trade of all goods and services with China had a deficit of $16.0 billion, the lowest since March 2009 ($15.6 billion). Of note, the February petroleum trade surplus ($0.9 billion) was the highest on record, based on the current definition of the petroleum series which was established in 1978. In next week’s Market Report, we’ll delve into the February 2020 scrap exports by major commodity and destination.