Ferrous: Last week the American Iron and Steel Institute reported that for the week ending on March 28, 2020, “domestic raw steel production was 1,670,000 net tons while the capability utilization rate was 71.6 percent. Production was 1,913,000 net tons in the week ending March 28, 2019 while the capability utilization then was 82.2 percent.

The current week production represents a 12.7 percent decrease from the same period in the previous year. Production for the week ending March 28, 2020 is down 9.8 percent from the previous week ending March 21, 2020 when production was 1,852,000 net tons and the rate of capability utilization was 79.4 percent.”

As steel production volumes decline and market conditions continue to deteriorate, Fastmarkets AMM reports hot-rolled coil prices are falling fast: “Prices for hot-rolled coil in the United States have come down sharply, to a more-than-four-month low, while suppliers have been fighting each other for any orders on the market amid anticipated deteriorated demand. Fastmarkets’ daily steel hot-rolled coil index, fob mill US was calculated at $25.92 per hundredweight ($518.40 per short ton) on Friday April 3, down by 2.7% from $26.65 per cwt on Thursday April 2 and down by 16.1% from a year-to-date high of $30.91 per cwt reached on January 15. Hot band prices are now at their lowest since mid-November of last year and are likely to drop further in the near term, sources said. Sellers - including both mills and service centers - have been trying to secure any orders on the spot market because it is widely anticipated that the steel demand will only get worse due to the spread of the novel coronavirus.”

On the April scrap outlook, Argus Media reports “Scrap flows and generation of prime and obsolete grades have been decimated over the last two weeks due to the slew of closures from automakers and parts manufacturers, as well as shelter-in-place orders that have severely muted scrap collection rates. Temporary closures of stamping and machining plants have had an immediate impact on scrap flow with suppliers surveyed by Argus this week reporting prime scrap flows down between 60-75pc over the last two weeks, with turnings and borings witnessing similar sudden and steep drops… The slowdowns have shrunk prime inventories at dealer yards with fears that containment measures will only get stricter through April, suggesting that prime grades will become increasingly scarcer. Drops in cut grade and shredded scrap prices last month considerably slowed inflows to dealer yards, a trend that has intensified as many states and local governments encourage people to stay home, while some recyclers halt public purchases.”

Nonferrous

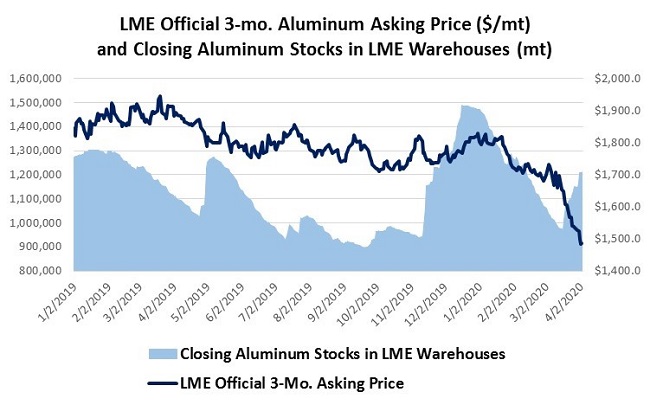

LME official 3-mo. aluminum prices are down nearly 19% for the year-to-date, having dropped from around $1,800 per metric ton (=82 cents/lb.) at the end of 2019 to $1,486/mt (=67 cents/lb.) on Friday. Meanwhile, aluminum stocks in LME warehouses have increased by more than 245,000 mt over the last several weeks.

Amid falling primary aluminum prices, reduced mill product demand, smelter shutdowns, and severe retail business downturns, domestic aluminum scrap market participants are facing unprecedented challenges. Fastmarkets AMM reports “Aluminum scrap prices in the United States continued to trend flat to soft this past week as the novel coronavirus prompted industrial slowdowns through capacity reduction at smelters and manufacturing plants across the country. Prices for smelter-grade scrap mostly moved lower week on week due to sustained pressure resulting from automotive plant closures and reduced flows of peddler scrap as companies limit interactions with the public. Fastmarkets’ assessment of the aluminum scrap non-ferrous auto shred (90% Al) buying price realized the biggest decline, falling by 14.1% on Thursday April 2 to 35-38 cents per lb from 41-44 cents per lb previously… Fastmarkets’ assessment of the aluminium-copper radiators buying price fell to 103-108 cents per lb from 108-110 cents per lb at the last session.”

On the mill side, new orders for aluminum mill products had already gotten off to a difficult start to the year. The Aluminum Association reports “The Association’s ‘Index of Net New Orders of Aluminum Mill Products’ for February 2020 decreased 8.3 percent from January 2020. Orders for flat roll products (sheet, plate, can stock and foil) were off 7.6 percent from the previous month, while orders for extruded products were down 9.1 percent and orders for redraw rod dropped 21.4 percent. Compared to February 2019, total orders were down 6.7 percent. On average, orders recorded by domestic producers through February 2020 were off 6.7 percent from year-to-date 2019.”

Paper

RISI Seeking Input on Pricing Methodology:

“SAN FRANCISCO, March 27, 2020 (PPI Pulp & Paper Week) - Fastmarkets RISI is inviting feedback from the industry on the pricing methodologies for North American Packaging Paper and Board and North American Recovered Paper, as part of its announced annual methodology review process.

This consultation, which is open until Apr. 24, 2020, seeks to ensure that our methodologies continue to reflect the physical market under indexation, in compliance with the International Organization of Securities Commissions (IOSCO) principles for Price Reporting Agencies (PRAs). This includes all elements of our pricing process, our price specifications and publication frequency.

Please send responses in writing, preferably in electronic format, to the following address: pricing.risi@fastmarkets.com. Please add the respective subject heading "NA PPB annual methodology review" or "NA RCP annual methodology review." Please specify whether your response is confidential. Opinions offered in confidential responses may be referenced but will not be attributed in any way.

Fastmarkets will publish the outcome of this methodology review by Apr. 30, 2020, including a summary of the feedback with the exception of those marked as confidential. Any proposals to make material changes, discontinue or launch prices will involve a separate market consultation, the length of which will depend on how substantial the change is.”