As the Financial Times reports, “Coronavirus death tolls and infection rates continue to rise around the world, leaving governments poised to introduce more measures to stop the spread of the pandemic.” In the United States, the Wall Street Journal reports “Legislators are already roughing out the contours of yet another emergency-spending package to try to keep the crisis from turning into a 21st-century Great Depression.”

This week is critical as we enter into April and as rent, mortgage, auto loan, credit card, student loan, and other payments come due, which will test financial market conditions as individual, company, and municipal loan default risks continue to rise.

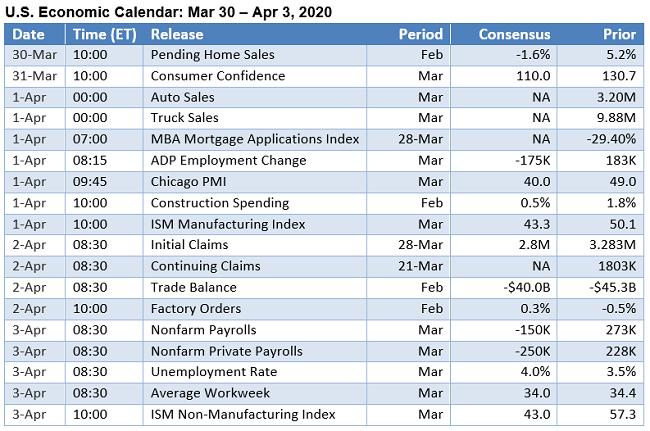

On the U.S. economic calendar, the consensus forecast is that ISM’s reading on manufacturing PMI dropped from 50.1 in February to 43.3 in March. But the big releases this week will cover the U.S. labor market as Briefing.com forecasts initial unemployment claims will rise to 3.5 million for the week ending March 28th and the Labor Department’s jobs report is expected to show a contraction in nonfarm payrolls of around 150,000 as the unemployment rate is expected to increase sharply. Overseas, investors will be paying close attention to the latest official PMI numbers from China as well as from the European Union, Great Britain, and India. Japan also releases a batch of data this week covering unemployment, industrial production, and retail sales. Good luck and be safe.