Major economic developments continue to unfold rapidly as governments and central banks are pulling out all the stops to confront the economic fallout from the coronavirus. U.S. markets were driven last week by the latest massive fiscal and monetary stimulus measures, along with an unprecedented spike in initial unemployment claims.

Stimulus Measures

For a great review of the latest U.S. fiscal stimulus package and the potential impacts on recyclers, you should listen to second episode of ISRI's podcast/video series dedicated to how COVID-19 is impacting the recycling industry. ReMA Chief Lobbyist Billy Johnson discusses the implications of the CARES Act, the outlook for future Congressional action, and how recyclers can advocate.

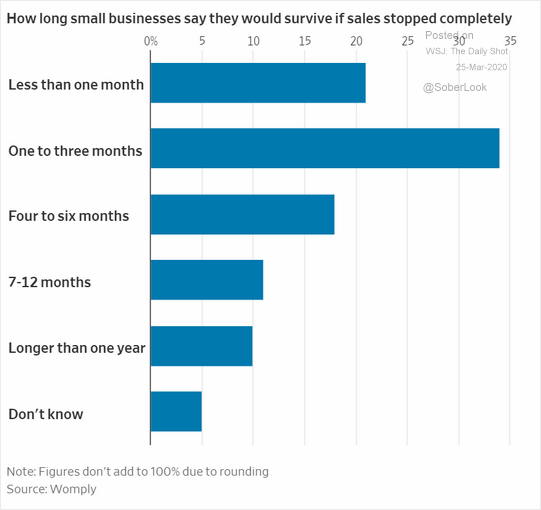

The signing of the CARES Act comes at a time when most small businesses are reporting they would only be able to operate for three months or less if sales stopped completely:

As for monetary policy, the WSJ outlines the new and expanded set of tools the Fed is implementing to compliment the fiscal stimulus measures, which far exceed the measures taken in 2008:

“• Unlimited QE: Purchases of "Treasury securities and agency mortgage-backed securities in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions and the economy."

• Support for commercial real estate: Including commercial mortgage-backed securities (CMBS) in QE.

• Support for consumers and businesses: Credit facility to provide financing to "employers, consumers, and businesses" ($300 billion).

• Support for corporate bonds: Two facilities to stabilize primary and secondary corporate bond markets. To support the secondary market, the facility will purchase "corporate bonds issued by investment grade U.S. companies and U.S.-listed exchange-traded funds.”

• Support for consumer credit: Issuance of debt "backed by student loans, auto loans, credit card loans, loans guaranteed by the Small Business Administration" (TALF 2.0).

• Support for municipal finance:

- Expansion of the Money Market Mutual Fund Liquidity Facility to "include a wider range of securities, including municipal variable rate demand notes and bank certificates of deposit."

- Including "tax-exempt commercial paper as eligible securities" in the Fed's commercial paper facility.

• Support for small and medium-sized businesses: "Main Street Business Lending Program to support lending to eligible small and medium-sized businesses, complementing efforts by the SBA."

Economic Data

Many of the official economic, industrial, and manufacturing sector reports have a considerable lag with respect to current market conditions given the extreme day-to-day market fluctuations and on-going investor uncertainty. Here are some of the key releases from last week:

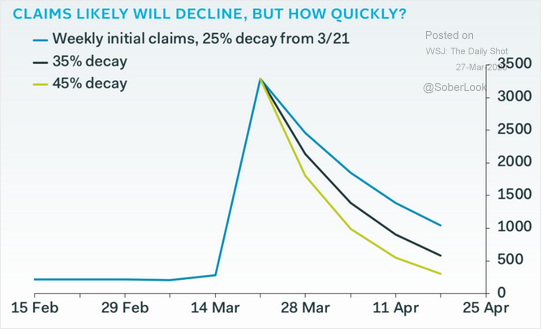

Initial Unemployment Claims

During the recent economic recovery, the weekly initial unemployment claims numbers were hovering around 210,000-230,000 on any given week. Two weeks ago that figure shot up to more than 280,000 and forecasters were predicting that figure could rise to a million or even more than 2 million. Last week’s report showed that the figure was more than 3.2 million, the highest number of weekly U.S. initial unemployment claims on record by far. Some forecasters are expected a quick decline in initial unemployment claims, but this week’s numbers are likely to be discouraging.

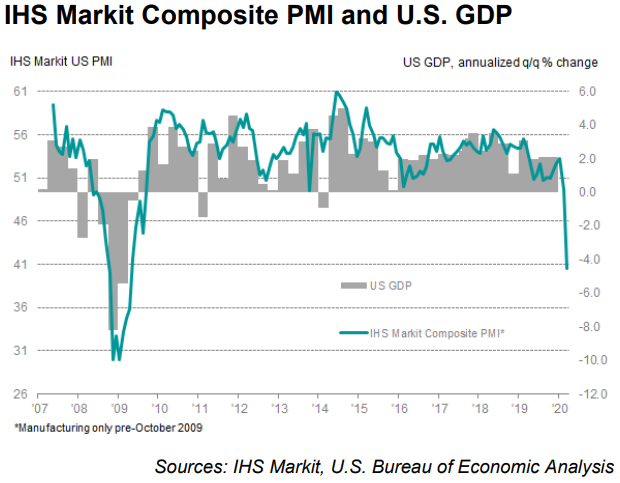

Flash Composite PMI Readings

According to IHS Markit, “U.S. private sector firms indicated a marked contraction in overall business activity in March following the escalation of the coronavirus disease 2019 (COVID-19) outbreak. The overall decline was the steepest recorded since comparable survey data were available in October 2009, and reflected widespread falls in activity across the manufacturing and service sectors.”

Readings from other key economic regions are even less encouraging. In Europe, the latest figures show “The eurozone economy suffered an unprecedented collapse in business activity in March as the coronavirus outbreak intensified, according to provisional PMI survey data. At 31.4 in March, the ‘flash’ IHS Markit Eurozone Composite PMI collapsed from 51.6 in February to register the largest monthly fall in business activity since comparable data were first collected in July 1998,” IHS Markit reports.

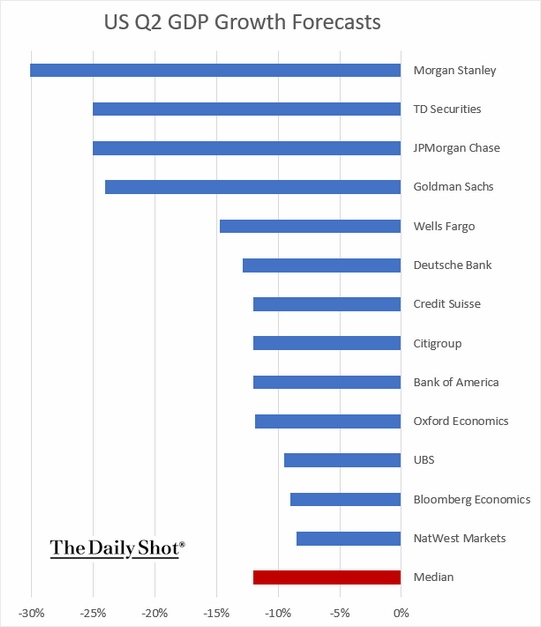

Second Quarter U.S. GDP Forecasts

Looking ahead, expectations for contraction in the U.S. economy vary widely, with Morgan Stanley projecting a massive 30% contraction, while other forecasters are calling for a less pronounced but still dramatic pullback of less than 10 percent, which would still rival the worst quarterly contractions in history: