The Federal Reserve’s half point rate cut took center stage last week as the Fed announced “The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity. In light of these risks and in support of achieving its maximum employment and price stability goals, the Federal Open Market Committee decided today to lower the target range for the federal funds rate by 1/2 percentage point, to 1 to 1‑1/4 percent.

The Committee is closely monitoring developments and their implications for the economic outlook and will use its tools and act as appropriate to support the economy.” Prior to the Fed’s largely unexpected half-point rate cut on Tuesday, the week’s major scheduled economic announcement was going to be the U.S. jobs report, which actually came in better than expected. Here’s a recap of the week’s key U.S. economic reports from last week.

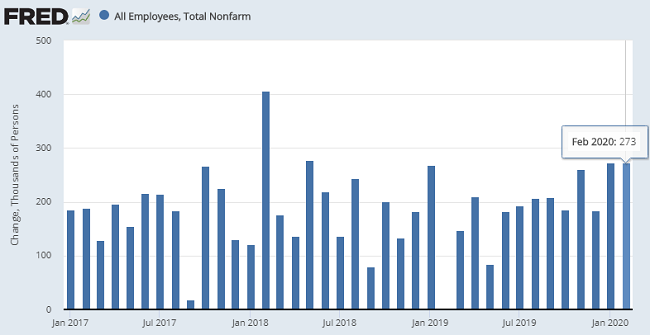

The Employment Situation

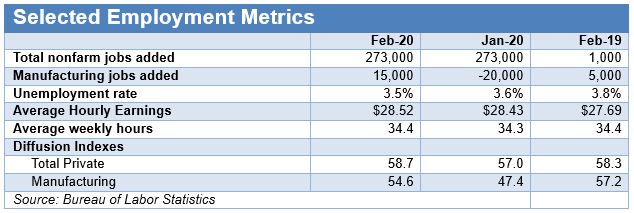

The Bureau of Labor Statistics released their month Employment Situation last Friday. Overall, most indicators stayed about the same as the prior month. For the second consecutive month, nonfarm payrolls rose by 273,000. This is the highest jobs added Since February 2018 (406,000).

The unemployment rate edged back down to 3.5 percent in February, down 0.1 percent from the previous month. A year ago, unemployment stood at 3.8 percent. In February, the private sector added 228,000 jobs and the government sector added the remaining 45,000 jobs. Manufacturers added 15,000 jobs, a positive sign after dropping by 22,000 combined in December and January.

The top five sectors with nonfarm employment gains in February 2020 were: education and health services, leisure and hospitality, construction, professionals and business services, and financial activities. Three main sectors that lost jobs in February 2020 were retail trade, transportation and warehousing, and wholesale trade.

Not only is employment up, but there are more companies adding jobs than reducing employment. The BLS measures this through their Diffusion Index. In February, the Total Private index number, looking at 258 industries, rose to 58.7, meaning more companies were adding jobs than cutting them (an index number of 50 would show an equal amount of companies were adding and reducing employment). The Diffusion index for 76 manufacturing industries in February was 54.6, up from 47.4 the previous month. Average employee earnings rose in February to $28.52 per hour, up 3 percent from a year ago. The average weekly hours worked edged back to 34.4 hours per week, the same number from a year ago.

Manufacturing PMI

The Institute for Supply Management reported last week that the manufacturing sector, for the 130th consecutive month, continues to grow. The PMI index for February 2020 was 50.1, down from 50.9 the month before. Index numbers above 50 show a growing sector. Their survey shows some slowing of new orders, as this index decreased to 49.8 in February from 52.0 the previous month. With this slowing, manufactures were able to address their backlogged orders. The backlog orders indexed rose to 50.3 in February from 45.7 the previous month. New export orders index shows a slowing of growth at 51.2 in February, down slightly from 53.3 the previous month. Here’s what some of the ISM survey respondents had to say:

- “There are always supply chain challenges with Lunar New Year shutdowns, and this year is no different. Coronavirus is wreaking havoc on the electronics industry. Companies are delayed in starting up production, which is resulting in longer lead times, constraints and increased pricing. It's a mad dash to dual source stateside in case China isn't back online soon.” (Computer & Electronic Products)

- “Layoffs are here.” (Transportation Equipment)

- “Energy markets seem to be responding to a potential drop in demand that may be related to responses [to] the coronavirus.” (Petroleum & Coal Products)

- “Coronavirus continues to be front and center as a major supply chain risk to our company. Access to information in China — from our supply base and customers — is slow to come by.” (Fabricated Metal Products)

- “Sales continue to be strong, with the supply base able to support as required. The major concern is the China virus and what that crisis could affect in getting parts. The company is putting plans in place to source out locations, especially in the U.S., for parts.” (Machinery)

- “Business continues to be strong. We had a little January slowdown, but February has been fantastic.” (Plastics & Rubber Products)

- “We have seen an increase of sales for our products.” (Furniture & Related Products)

- “Current favorable forecast to budget for first-quarter sales.” (Primary Metals)

Construction Spending

Total U.S. construction spending in January 2020 increased 1.8 percent from December to $1.369 billion at a seasonally adjusted annual rate. Year over year, total construction spending was up 6.8 percent.

Total private construction accounted for three quarters of total construction spending, or $1.023 billion SAAR, up 1.5 percent from the month before. Year over year, private construction was up 4.9 percent.

Total public construction, accounting for one quarter of total spending, increased 2.6 percent in January 2020, to $346 million. Year over year, public construction was up 12.6 percent.

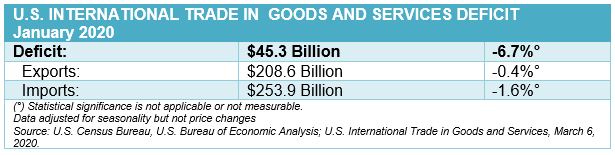

Trade Data

According to trade data released last week from the Census Bureau, the U.S. trade deficit decreased 6.7 percent in January 2020 to $45.3 billion. A year ago the deficit was $58.3 billion. Exports were $208.6 billion in January 2020, down $1.0 billion from December 2019. Imports also declined in January 2020 to $253.9 billion, down $4.2 billion from December 2019.