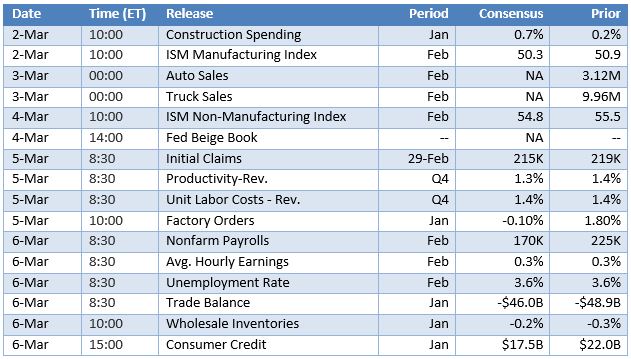

Prior to the Fed’s unexpected half-point rate cut on Tuesday, the week’s major scheduled economic announcement was going to be the U.S. jobs report due out on Friday. The consensus forecast is that U.S. nonfarm payrolls grew by around 170,000 in February while the unemployment rate held steady at 3.6%.

Other U.S. economic reports out this week cover factory orders, the trade balance, light vehicle sales, and consumer credit. On Monday, the Institute for Supply Management reported their manufacturing PMI reading dipped from 50.9 in January to 50.1 in February, slightly below the consensus 50.3 forecast. (We’ll have more on the mfg. PMI numbers in next week’s Market Report.) Overseas, we’ll get the latest figures on German retail sales and manufacturing orders, euro zone retail sales and composite PMI, China’s trade balance, and Japanese household spending, along with a monetary policy statement from the Bank of Canada. Markets will of course continue to pay close attention to political and coronavirus developments. As for the global oil market, the Financial Times reports “OPEC and its allies begin a two-day meeting on Thursday as global energy producers scramble to respond to the coronavirus outbreak that has crippled demand. Saudi Arabia is asking producers including Russia to sign up to a collective production cut of an additional 1m barrels a day, a significantly higher amount than provisionally discussed when the so-called OPEC+ group agreed to convene. The plan is designed to show oil producers are able to respond to the sharp reduction in demand created by a virus that has paralyzed global supply chains and stifled international travel.” Have a good week and keep washing your hands!