Ferrous According to the American Iron and Steel Institute, “In the week ending on February 29, 2020, domestic raw steel production was 1,923,000 net tons while the capability utilization rate was 82.5 percent.

Production was 1,917,000 net tons in the week ending February 29, 2019 while the capability utilization then was 82.4 percent. The current week production represents a 0.3 percent increase from the same period in the previous year. Production for the week ending February 29, 2020 is up 1.2 percent from the previous week ending February 22, 2020 when production was 1,901,000 net tons and the rate of capability utilization was 81.5 percent.”

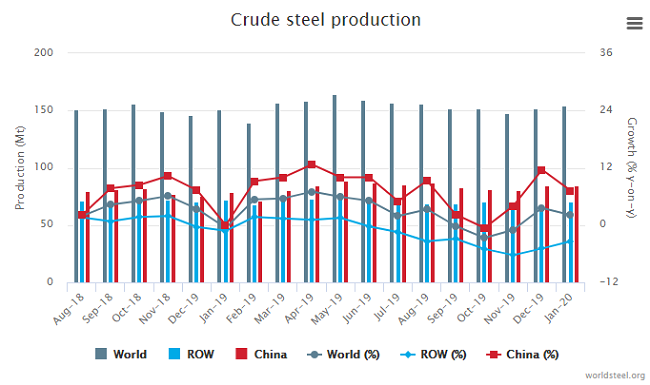

Global steel production in January “…was 154.4 million tonnes (Mt) in January 2020, a 2.1% increase compared to January 2019. China’s crude steel production for January 2020 was 84.3 Mt, an increase of 7.2% compared to January 2019. India produced 9.3 Mt of crude steel in January 2020, down 3.2% on January 2019. Japan produced 8.2 Mt of crude steel in January 2020, down 1.3% on January 2019. South Korea’s crude steel production was 5.8 Mt in January 2020, a decrease of 8.0% on January 2019,” according to the latest figures from the World Steel Association.

In other news, our friends at Argus media reported last week that:

- $40/st price hike announcements for sheet products by major producers including Nucor and U.S. Steel were announced last week;

- “The US International Trade Commission decided against placing dumping duties on fabricated steel imports from Canada, China and Mexico in a rare trade case win for importers.”

- “In project news, Liberty Steel confirmed it has put its new EAF install on hold at its Georgetown, South Carolina, wire rod mill while it revaluates. The existing melt shop was idled in September 2019. Liberty has been supplying the mill with billet from its Illinois mill (ex-Keystone). Also for the record, it closed on its acquisition of bankrupt bar mill Bayou Steel on January 31.”

- “North Star Bluescope also flagged the potential for the coronavirus to cause delays to its expansion at the Delta, Ohio, mill because some parts are being sourced in China.”

Nonferrous

As reported by Andy Homes at Reuters, “The scale of the coronavirus hit to China’s giant manufacturing sector was laid bare by the slump in the country’s purchasing managers indexes (PMI) for February. The official PMI imploded from 50.0 to 35.7, while the Caixin index, which captures activity among smaller companies, tumbled from 51.1 to a record low of 40.3. The collapse in manufacturing activity last month was worse than that seen during the global financial crisis.

Base metal prices have fallen but by nowhere near as much as they did in late 2008, suggesting traders are still expecting a fast rebound in activity and metals demand once the virus is contained in China. However, there are ominous signs that a physical demand shock is playing out in China which may generate a second-wave hit to prices. Shanghai Futures Exchange (ShFE) holdings of copper, aluminium and zinc are trending sharply higher. More may be accumulating in the off-exchange shadows.

A call by China’s Nonferrous Metals Industry Association (CNIA) for a government stockpiling plan is a clear distress signal from China’s producers.”

Recovered Paper and Fiber

At ISRI’s Winter Meeting in Nashville, TN, two presentations from Fast Markets/RISI informed attendees of the PSI Chapter (Paper Stock Industries) on current paper conditions in the US and worldwide.

Hannah Zhao, Senior Economist, Recovered Paper, presented information on the worldwide recovered paper markets (RCP) and the uncertainty within Asia. The prices of OCC dropped in 2018 and have stayed depressed, however, they have seen an early rebound this year because of temporary easing of Indonesia import restrictions and the coronavirus situation. She compared the SARS and coronavirus, and showed data on how China’s local supply and demand are being effected.

China RCP import licenses have decreased over 40 percent to 3.2 million tonnes for the first three 2020 issuances versus a year ago. Ms. Zhao questioned whether the import restriction will ease, and when.

Chinese imports have decreased from all areas, North America, Western Europe, Japan, and others. By grade, they have also decreased. China paper imports, of all grades, have seen significant reductions since 2017.

With import restrictions in place in 2018, a 7.5 million tonne gap in recycled fiber was created. China has increased imports of recycled and virgin pulp, and increased domestic collection. Paper and board output declined because of lower demand from slower economic growth, low fiber supply, and increasing restrictions. This scenario continued in 2019, but with a lower gap of 5.6 million tonnes.

In 2019, other Asian countries, for the first time, imported more RCP than China. In the other Asian countries, RCP imports nearly doubled from 2016 to 2018, to 13.2 million tonnes. Chinese restrictions, growing demand and a higher supply of low cost RCP fueled this increase. However, many of these countries are implementing import restrictions of their own, generally because of environmental concerns and low quality. Market effects in the US show significant reductions in RCP exports, a push toward higher quality, and in some instances, landfilling of RCP caused by lower demand and lower prices.

Containerboard production is on a growth path worldwide. Significant growth in production is seen in the Asian markets (except China where negative growth is seen), the United States, Italy, Germany, Russia, Turkey, Slovakia, Poland, Mexico, Brazil and Australia. Greg Rudder, Managing Editor for PPI Pulp & Paper Week, focused on box demand, corrugated growth and new board capacity. There are many current and verified near future US containerboard expansions. Between 2019 and 2022, Mr. Rudder reported that 3,522,000 tons capacity expansion plans for RCB, Kraft Paper, OCC, and other types. He showed new projects starting in all areas of the country, including the South, West, Pacific Northwest, Mid-West, and the Northeast. In addition, another nearly 3 million tons of potential expansions are under study. Nine of these expansions are 100 percent recycled content. Some of the pressures creating this demand are sustainability, e-commerce (growth expected 15-18%), colored graphics including digital printing, trade agreements, lightweight recycled demand, and the US presidential election.

Generally, growth of US box shipments and US containerboard follow each other within a percentage point. However, in 2019, while both growth rates curved downward, US containerboard went negative, declining 3.7 percent, while box shipments experienced no growth. Forecasts for US box shipments show an expected 1.1 percent growth for 2020, to 396.8 billion square feet – based on existing factors as of February 5. The average growth rate for the period from 2013 to 2019 was 1.2 percent. Expect more changes to e-commerce packaging. Amazon initiated their frustration free packaging certification in 2019. Fisher-Price also has frustration free packaging. The differences between Fisher-Price frustration free packaging and the traditional e-commerce packaging are: easy to open (less than 42 seconds versus up to 11 minutes traditionally; 100% recyclable and less packaging waste versus not fully recyclable and more packaging waste; and lab specific tested and design protective packaging versus standard packaging not designed specifically for e-commerce.