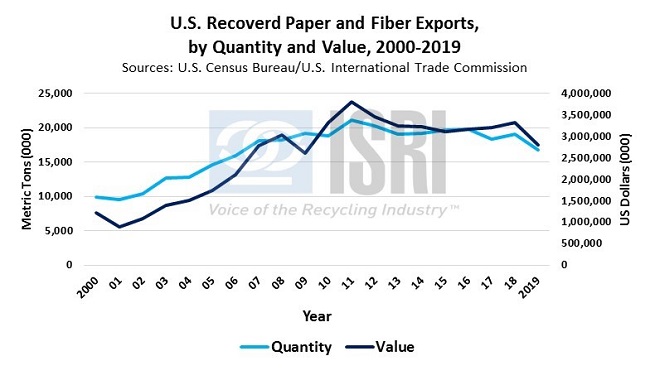

U.S. recovered paper and fiber exports declined in 2019 both in terms of quantity and value according to data released by the U.S. Census Bureau and the U.S. International Trade Commission. The quantity of RP exported from the United States in 2019 declined by 2,328,830 mt to 16,723,720 mt and the value dropped by $508.6 million to $2.8 billion.

Generally, quantity and value mirror each other in positive and negative year-to-year changes. One notable difference was 2009, when the quantity of RP exports increased but the value declined. U.S. recovered paper exports peaked both in terms of quantity and value in 2011 at 21.1 million mt and $3.8 billion, respectively.

Top 15 U.S. Paper Export Markets

Ninety-five percent of all U.S. recovered paper exports in 2019 went to 15 countries. China again topped the list of countries receiving U.S. recovered paper exports (5.5 million mt), even though the amount exported to China was half of the 2017 volume. More than half of the countries in the top fifteen have reached 20 year highs, helping to bridge the reduction in material sent to China. These countries are Vietnam, Taiwan, Thailand, Malaysia, Netherlands, Columbia, Saudi Arabia, and United Arab Emirates. Note that the United Arab Emirates received more than three times the amount in 2019 than in 2018. U.S. exporters are finding new markets as evidenced by the increase in exports outside of the top 15 markets, with shipments to the rest of the world up nearly 22 percent in 2019.

U. S. Exports by Grade and Market

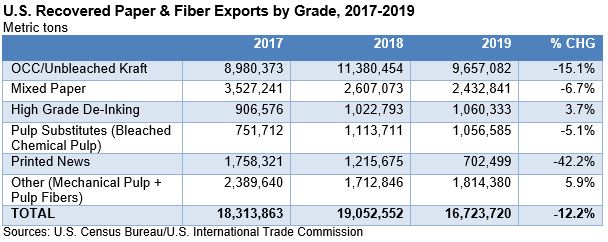

- OCC/unbleached kraft exports declined 15 percent in 2019. The top two countries, China and India, accounted for 53 percent of these exports. Top OCC growth markets last year were Vietnam, Taiwan, and Burma (Myanmar).

- High-grade deinking paper exports rose nearly 4 percent in 2019. Top countries Mexico and India accounted for nearly 60 percent of these exports. Top HG De-inking growth markets last year were Mexico, Colombia, and Chile.

- Pulp substitutes (bleached chemical pulp) exports went down by 5 percent in 2019. The top countries India and Mexico accounted for almost two-thirds of these exports. Top pulp substitute growth markets last year were India, the UAE, and Canada.

- Newsprint realized a significant drop in exports, plummeting over 42 percent in 2019. Exports to China were down over 62 percent and they were still the top country to receive this type of recovered paper exports. China, combined with Mexico, accounted for 47 percent of newsprint exports. Top newsprint growth markets last year were the UK, Germany, and Argentina, although the volumes were modest.

- Mechanical pulp exports decreased more than 7 percent in 2019, but were eclipsed by the 512% surge in shipments of pulp fiber derived from recovered paper. As compared to 2018 when the U.S. shipped less than 15,000 tons of recovered pulp fiber to China, in 2019 recovered pulp fiber exports to China rose to more than 216,000 metric tons, making it the top growth market.

- Mixed/unsorted exports decreased nearly 7 percent in 2019. India and Canada accounted for 52 percent of mixed paper exports. The top growth export markets for U.S. mixed paper in 2019 were Malaysia, South Korea, and Saudi Arabia.

Last but not least, we had two fantastic presentations from Fastmarkets RISI’s Greg Rudder and Hannah Zhao at last week’s ReMA Board of Directors meetings, which we’ll review for you in next week’s Market Report. In the meantime, please feel free to contact me at

jpickard@isri.org for more information.