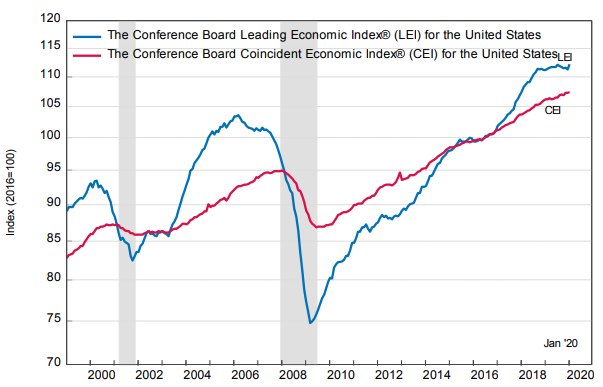

Last week’s U.S. economic reports mostly came in better than expected, including the Conference Board’s index of leading economic indicators, which rebounded 0.8% higher in January following a 0.3% decline in December.

According to Ataman Ozyildirim, Senior Director of Economic Research at the Conference Board, “The strong pickup in the January US LEI was driven by a sharp drop in initial unemployment insurance claims, increasing housing permits, consumers’ outlook on the economy and financial indicators… The LEI’s six-month growth rate has returned to positive territory, suggesting that the current economic expansion – at about 2 percent – will continue through early 2020. While weakness in manufacturing appears to show signs of softening, the COVID-19 outbreak may impact manufacturing supply chains in the U.S. in the coming months.”

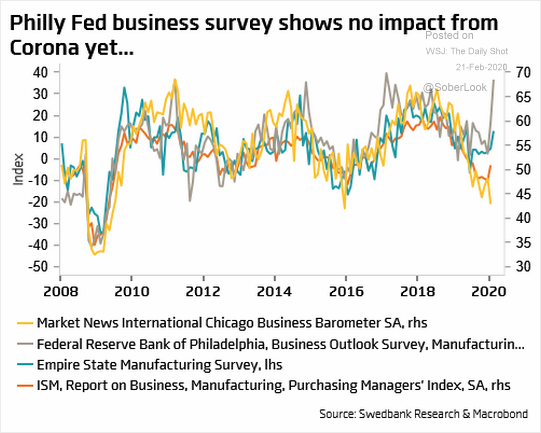

In other positive news, the Philly Fed’s Manufacturing Index jumped to 36.7 in February, easily beating the 11.0 consensus forecast and, along with a positive New York regional manufacturing report, is pointing to a rebound in the ISM’s manufacturing Purchasing Managers Index.

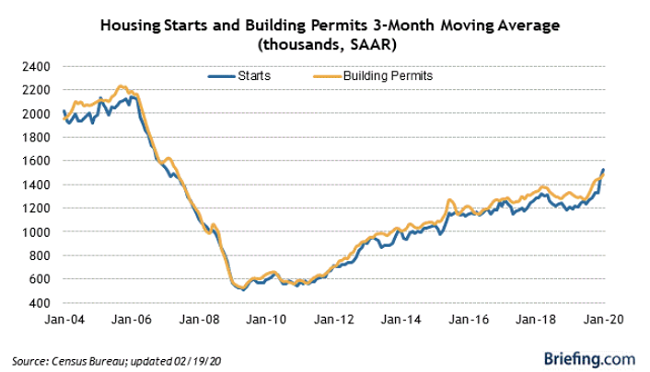

Strong housing market numbers have also bolstered the outlook for the first half of 2020, with the Census Bureau and HUD reporting last week that housing permits were up 17.9% year-on-year in January to 1.55 million units SAAR while housing starts surged 21.4% higher Y-o-Y to nearly 1.63 million units SAAR last month. According to Briefing.com, “The key takeaway from the report is the recognition that the three-month moving average for starts (1.525 mln) is the highest since January 2007.”

Of course, the lag in some of the U.S. economic data means that the coronavirus worries haven’t been baked in yet. An early indicator from China – Chinese car sales in the first half of February – points to the potential scale of the impact not just for China but for the global manufacturing supply chain: