Below is an edited excerpt from the 2020 Market Forecast article in Scrap magazine; please see the Jan-Feb edition of the magazine for the complete article.

Aluminum

As has been the case, scrap metal prices have had a hard time keeping up with primary metal prices, including for aluminum. Primary aluminum prices at the London Metal Exchange ended 2019 down less than one percent while average old aluminum cast and sheet scrap prices in the United States finished the year down more than 22 percent. Prices for several aluminum scrap grades fell to 30-year lows in 2019, including used beverage containers (UBCs). China’s scrap import restrictions have played a role in the divergence between primary and secondary prices. As compared to late 2017 when U.S. exports of all aluminum scrap (including UBCs and remelt scrap ingot) to China exceeded 75,000 metric tons per month, those shipments were down to just over 5,000 metric tons by November 2019.

The Chinese government’s intention to implement a new standards regime for imports of copper, brass, and aluminum derived from recycling beginning July 1 will be a key development in 2020. But aluminum recyclers continue to face a host of other challenges including the low valuation of automotive scrap, competition from scrap imports, weaker aluminum demand, and a potential rebound in global primary aluminum output in 2020 which could result in a supply glut. Absent a sharp rebound in global aluminum demand, forecasters are concerned that aluminum capacity expansion plans will have to be curtailed in order to rebalance the market. Analysts from Morgan Stanley reported in December that “supply cuts in excess of one million tons are needed to prevent a drop to our bear case of $1,657 per ton in early 2020.”

Copper

The global refined copper market is widely expected to see a supply surplus in 2020. According to the latest forecasts from the International Copper Study Group, world refined copper production is expected to exceed copper demand by more than 280,000 metric tons in 2020, reversing several years of supply deficits. A return to refined copper supply surpluses would only complicate the outlook for copper recyclers, who have been faced with excess domestic scrap supplies and declining export sales. U.S. exports of copper and copper alloy scrap were down nearly 5 percent year-on-year during in 2019 as copper scrap exports to mainland China plunged from more than 270,000 tons in 2018 to less than 88,000 tons during 2019. But improved trade with Malaysia (now the largest destination for U.S. copper scrap exports), India, Germany, Belgium, and other markets has helped to offset the decline to China.

As with aluminum, China’s reclassification of high-quality copper and copper alloy scrap imports could significantly reshape the scrap market in 2020. By late 2019, copper prices had already benefited from the signs of progress on the U.S.-China trade talks. As Reuters reports, “A renewed sense of optimism has been evident in the sharp turnaround in fund positioning on copper, as ever the metallic bellwether for the risk-on-risk-off trade. The money men held a net collective short on the CME copper contract for most of 2019 but turned net long in the last days of the year.” A December report from the Goldman Sachs Group pegs the price of copper at $7,000 per ton in 2020.

Lead and Zinc

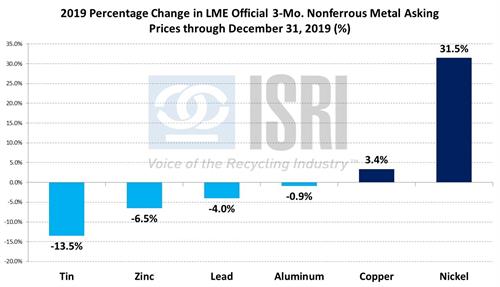

Over the course of 2019, zinc and lead prices were among the worst performers at the London Metal Exchange, falling 6.5 percent and 4.0 percent, respectively, last year. The decline in prices for the sister metals came despite a drawdown in LME warehouse stocks, which typically coincide with rising prices. Reuters explains that the disconnect stems from the difficulty in getting mined material transformed into refined metal: “Smelters’ collective capacity to convert raw material into metal was last year hampered by a string of outages, including the fire at the Mooresboro refinery in the United States, the temporary suspension of the Skorpion refinery in Namibia and lower output due to an electrical failure at the Trail plant in Canada. Chinese smelters’ ability to lift run-rates, meanwhile, was constrained by the rolling environmental inspections that have become a feature of the country’s metallic supply chains.”

Looking into 2020, the International Lead Zinc Study Group is forecasting global demand for lead metal will increase 0.8 percent to 11.9 million metric tons while world refined lead supply is expected to increase 1.7 percent in 2020 to 11.96 million tons, leaving a global lead market surplus of 55,000 tons. The Study Group also sees a 0.9 percent increase in world demand for zinc being outstripped by a 3.7 percent increase in global zinc production, resulting in a global zinc supply surplus of 192,000 metric tons. In light of the expected supply surpluses, the World Bank is projecting average prices for lead and zinc at $1,950/mt and $2,450/mt, respectively, in 2020.

Nickel and Stainless Steel

At the London Metal Exchange last year, LME 3-month nickel futures ranged from as low as $10,530 per ton in January to as high as $18,850 per ton in September. At the same time, closing nickel stocks in LME warehouses dwindled from more than 207,000 tons at the end of 2018 to less than 65,000 tons in November 2019. Despite the on-going volatility in nickel prices and warehouse stocks, nickel prices outperformed the other major base metals in 2019, ending the year nearly 32 percent higher in London as compared to the end of 2018. However, prices for stainless steel scrap came under pressure late last year amid reports of excess scrap supplies in the United States and Europe. As a result, the price of 304 stainless steel scrap in the United States declined nearly 2 percent over the course of 2019, despite rising primary nickel prices.

In the short term, despite continued uncertainty regarding nickel and stainless steel demand, Fastmarkets Metal Bulletin reports, “LME nickel's technical configuration has improved and could continue to support its prices to recover higher in the short term.” The International Nickel Study Group is forecasting another global nickel market supply deficit this year, which could also help to underpin prices. Looking further into the future, Macquarie is projecting a recovery in the stainless steel market starting in the second half of 2020 and healthy growth in nickel demand from the electric vehicle battery market. As a result, they project steadily rising global nickel prices that are expected to reach $19,500 per ton in 2024.