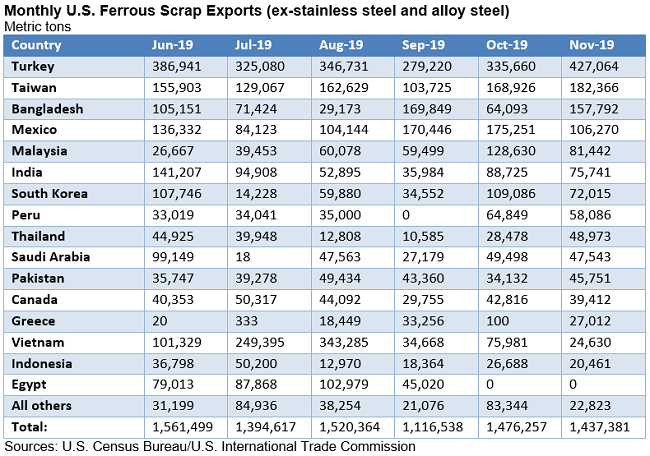

Ferrous Sticking with the trade, the latest figures from the Census Bureau shows U.S. ferrous scrap exports (excluding stainless steel and alloy steel scrap) slipped from 1.48 million tons in October to just under 1.44 million tons

in November as improved business with Turkey, Bangladesh, Greece, and Thailand was more than offset diminished demand from Mexico, Vietnam, Kuwait, Malaysia, and South Korea.

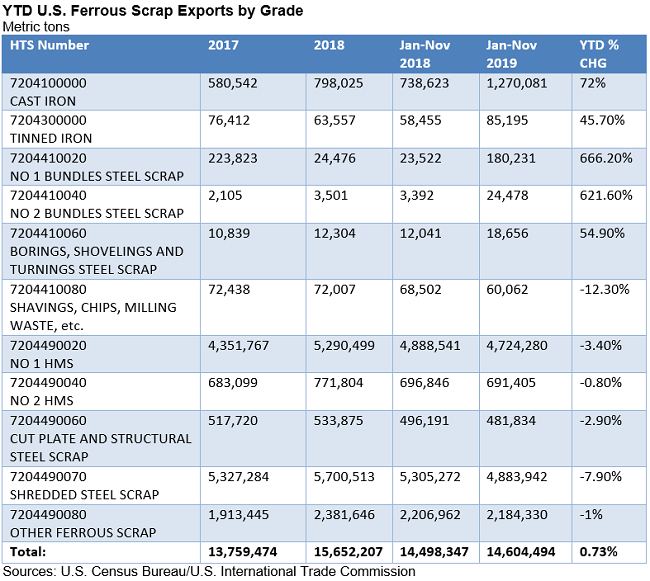

For the first 11 months of 2019, the Census Bureau trade data show total ferrous scrap exports from the United States were up 0.7% to 14.6 million metric tons on sharply higher exports of No. 1 bundles, cast iron scrap, and other grades more than offset lighter loadings of shredded, heavy melt, and cut P&S.

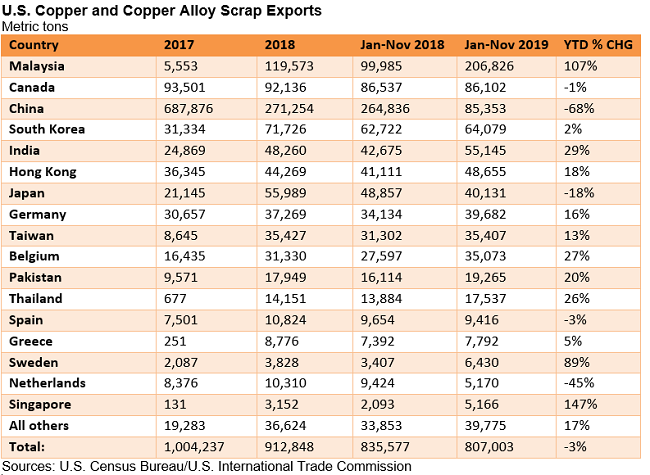

Nonferrous Unlike with the ferrous scrap exports, U.S. exports of copper and copper alloy scrap were reportedly down 3% year-on-year during Jan-Nov 2019 as copper scrap exports to mainland China plunged from nearly 265,000 tons in Jan-Nov 2018 to just over 85,000 tons during Jan-Nov 2019. But improved trade with Malaysia (now the largest destination for U.S. copper scrap exports), India, Germany, Belgium, and other markets has helped to offset the decline to China. Through the first 11 months of 2019, U.S. copper scrap shipments to Malaysia more than doubled to 206,828 metric tons, while exports to India rose 29 percent to more than 55,000 tons.

As announced by the BIR last week, the second batch of Chinese import quotas have been released:

“Following the publication of the 1st batch of waste import quotas for 2020* on 24 December 2019, the Solid Waste & Chemicals Management Centre of the Ministry of Ecology and Environment of the People's Republic of China published the 2nd batch of waste import quotas for 2020* yesterday, 8 January 2020.

According to the Solid Waste and Chemical Management Centre, this second batch allows 26,566 tonnes of copper scrap, 7,544 tonnes of aluminium scrap and 3,180 tonnes of steel scrap to enter China.”

*Original lists in Chinese, please use your web browser to translate into your preferred language.

Paper and Plastic According to Fastmarkets RISI, last week China’s Ministry of Ecology and Environment released 3.19 million tons of recovered paper import permits, considerably down from the expected 6 to 7 million tons.

This is significantly down from a year ago, when 5.47 million tons were issued in the initial two batches.

For the entire year for 2020, nearly 35 percent fewer import tons are expected to be approved (7 million tons), compared to the previous year’s 10.7 tons. This is down dramatically from 2018’s 18.2 million tons.

In the U.S., the American Forest and Paper Association reported U.S. containerboard production was down 4 percent in November 2019 compared to the same month a year ago. Exports of containerboard were down 9 percent for the month and 15 percent year-to-date through November 2019.

As for plastics, the National Association for PET Container Resources (NAPCOR) shows over 1.8 billion pounds of PET bottles were collected in the U.S. for recycling in 2018, up 5% over the previous year.

NAPCOR’s report indicates a “2018 U.S. recycling rate of 28.9 percent for polyethylene terephthalate (PET) plastic bottles, essentially unchanged from the 2017 rate of 29.2 percent. Despite the flat recycle rate, purchases of US bottles by U.S. reclaimers increased 16 percent to 1,673 million pounds compared to 1,442 million pounds in 2017 which more than offset declines by exports. The recycling rate is derived by using the total volume of recycled PET material purchased by U.S. processors (reclaimers) and export markets in 2018 — 1,813 million pounds — taken as a percentage of the total volume of PET resin used in U.S. bottles and potentially available for recycling, 6,270 million pounds. Of that 1,813 million pounds collected, 1,673 million pounds was purchased and processed by domestic PET reclaimers, with the balance of collected material, 140 million pounds, sold to export markets, including Canada. Export volumes continued to see a decline, with 2018 being the lowest export fraction recorded since the year 2000, at just under eight percent of total collection. Even with PET exports declining by 50 percent, the domestic market was able to absorb more bottles and more than compensate for the loss.”