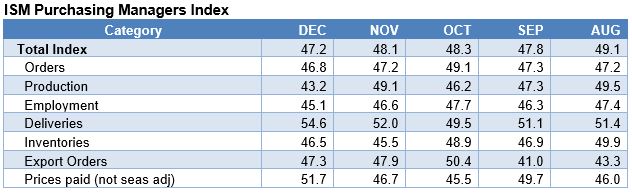

Last week, the Institute for Supply Management reported their manufacturing Purchasing Managers Index (PMI) fell from 48.1 in November to 47.2 in December, the fifth consecutive month of sub-50 readings signaling contraction in the manufacturing sector.

The indexes for orders (46.8), employment (45.1), and production (43.2) were particularly weak, contributing to the lowest overall reading since June 2009.

Here’s what some of the ISM survey respondents had to say about business conditions in December:

- "Backlog of orders is shrinking due to new order pace continuing to fall." (Computer & Electronic Products)

- "Due to sluggish sales, we have introduced promotions to generate increased sales." (Chemical Products)

- "Cautiously optimistic is the rule these days. Sales are decent, but we're wondering what 2020 will bring. Still hedging that it will be successful — but maybe not as much as this year." (Transportation Equipment)

- "Starting to see suppliers try to pass on costs associated with tariffs. Uncertainty on the trade front continues to keep agricultural markets on the defensive." (Food, Beverage & Tobacco Products)

- "Down month-to-month, but up over last year." (Miscellaneous Manufacturing)

- "Anticipated large export orders did not materialize. As a result, expected U.S. production has decreased." (Fabricated Metal Products)

- "Dealer inventories have rebounded, and overall customer market has softened, resulting in corrections to near-term production schedules and a tentative forecast outlook." (Machinery)

- "Export markets continue to weaken for plastic resins — Mexican producers are actually trying to sell product back into the U.S. due to weak in-country demand." (Plastics & Rubber Products)

- "Our outlook for the first quarter of 2020 is positive. We have secured contracts from a number of former customers and expect sales growth of about 5 percent over Q4 of 2019." (Textile Mills)

- "The construction market seems to have slowed for end of year. Overall, it’s marginally up." (Nonmetallic Mineral Products)

(On a related note, the Census Bureau reported last week that U.S. construction spending improved 0.6% month-on-month in November but during the first 11 months of 2019 construction spending was down 0.8% as compared to the corresponding period in 2018.) According to Timothy R. Fiore, Chair of the ISM’s Manufacturing Business Survey Committee, "Global trade remains the most significant cross-industry issue, but there are signs that several industry sectors will improve as a result of the phase-one trade agreement between the U.S. and China.” As reported by CNBC and other news outlets, the Trump Administration announced it expects to sign a “phase one” trade deal with China on January 15th, “…in which China agreed to make ‘substantial purchases’ of U.S. manufacturing, agricultural and energy products, along with services,” although China has yet to confirm the scale of those purchases.

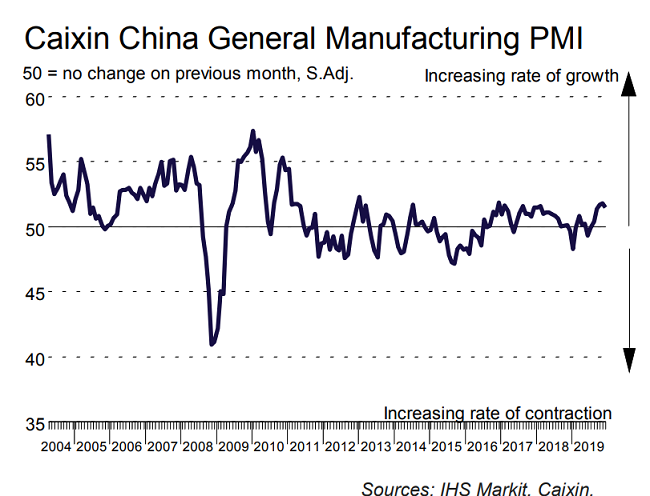

The Caixin manufacturing PMI reading for China softened from 51.8 in November to 51.5 in December while remaining in expansionary territory as a rise in output was offset by a slower rate of new order growth.

Looking forward, additional Chinese monetary stimulus is expected to give a boost to Chinese growth. According to the Wall Street Journal’s reporting last week, “Chinese officials kicked off the new year—one that is expected to present new challenges for the world’s second-largest economy—by signaling a tilt toward easier money. The People’s Bank of China said Wednesday it would reduce the portion of deposits that commercial banks are required to set aside as reserves by half a percentage point, a move that essentially releases 800 billion yuan ($115 billion) into the financial system. The widely-expected decision, which takes effect on Monday, comes as liquidity conditions are expected to be tight ahead of the Lunar New Year celebrations, which fall in late January this year, said Liu Xuezhi, a Shanghai-based economist at Bank of Communications. By freeing up bank liquidity on the first day of 2020, China’s central bank is ‘sending a clear message that policy stance won’t be tight this year,’ Mr. Liu said.”