Ferrous: Steel production in the United States got off to a somewhat better start in early 2020 according to the latest figures from the American Iron and Steel Institute. For the week ending January 4, 2020, AISI reports domestic raw steel production increased 2% year-on-year to 1.898 million net tons while the capacity utilization rate improved to 82% (up from 79.4% this time last year).

Amid improved steel output, on-going shipments to Turkey, and limited scrap availability, Fastmarkets AMM reports early trading in Detroit up around $30 per ton: “The January ferrous scrap trade in the United States has officially begun, with mills in Detroit entering the market and successfully securing prime scrap and secondary scrap at a $30-per-gross-ton increase from December levels. Prices for No1 busheling and shredded scrap in Detroit will increase to $290 per ton and $285 per ton respectively in January. It is still unclear where prices for steel turnings are headed.”

Jefferies research team was projecting higher scrap tags in January, with knock-on impacts for domestic steel pricing: “Should January US scrap prices move higher as market participants expect, this would translate to greater steel input cost support. This likely prompts steel producers to introduce further price hikes for both flat and long steel prices in January. Thus far the current steel price recovery has largely been characterized by a raw material input cost push rather than a more robust supply-demand driven market wherein metal spreads expand. Domestic HRC prices have improved ~$125/t (short ton) from $450-460 in October to $570-590 at year end. Since October, US mills have announced four price hikes equating to $150/t. Long product steel price hikes have been more mixed of late either ceding margins or only partly offsetting higher scrap costs. Looking into 1Q20 we see opportunity for domestic mills to raise steel prices further during a seasonally stronger demand period coupled with low import volumes that could equate to more meaningful metal spread expansion.”

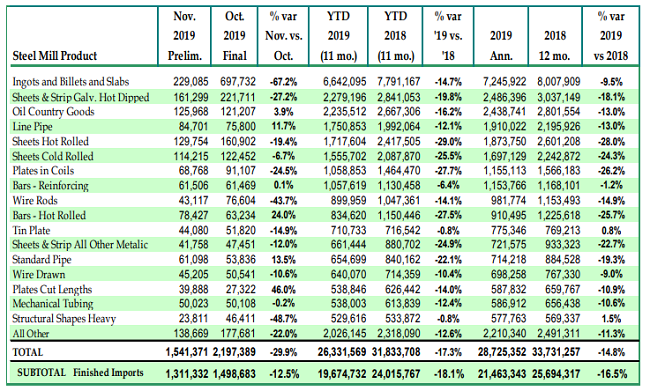

Total steel imports into the U.S. during the first 11 months were down 17.3% as compared to 2018 and finished steel imports were down 18.1% year-on-year according to preliminary figures from the Census Bureau and AISI:

Nonferrous

Nonferrous

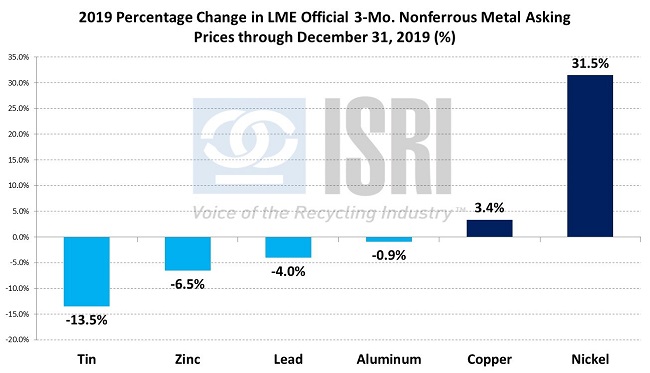

Over the course of 2019, tin (-13.5%), zinc (-6.5%), and lead (-4.0%) prices had the worst performances among the major base metals at the London Metal Exchange. Despite continued nickel price volatility which saw LME 3-mo. nickel trade from as low as $10,530 per ton in January to as high as $18,850 per ton in September, nickel prices outperformed the other base metals last year, ending the year 31.5% higher than at the end of 2018:

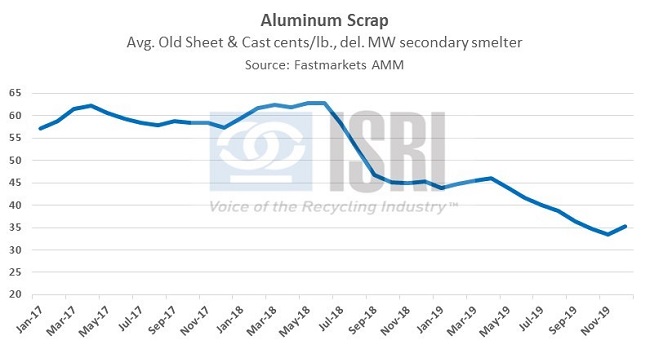

As has been the case, scrap prices for industrial metals have had a hard time keeping up with primary prices at the exchanges. For example, aluminum prices at the LME ended the year down less than one percent while old aluminum cast & sheet prices in the U.S. finished the year down more than 22%:

Diminished Chinese demand for base metal scrap imports has been one of the drivers for the disconnect between primary and secondary metal prices. As you may have seen since our last report, China announced the first batch of import quotas for 2020, which were actually better than many were expecting. Reuters reports, “The China Solid Waste and Chemicals Management Bureau, which is part of the ministry, published import allowances for 270,885 tonnes of high-grade copper scrap and 275,465 tonnes of aluminum scrap in the first batch of quotas for use next year. By the end of 2020, China aims to have a system in place to ensure there are no more imports of scrap metal classified as waste. The quotas are being closely tracked by traders amid concerns top metals consumer China, which tightened restrictions on scrap metal imports for environmental reasons from July, is leaving itself short of a key source of supplies. China now classes scrap metal as a solid waste. But changes will be introduced by the second quarter of 2020 at the latest, so high-grade copper and aluminum scrap meeting new standards will no longer be classed as waste and can be imported in unlimited amounts. But, for now, companies will need to secure quota allowances from the Ministry of Ecology and Environment to import scrap.”

Recovered Paper

According to Fastmarkets RISI, healthier demand from China and other Asian destinations helped to underpin OCC prices on the West Coast early in the new year. According to their latest report, RISI notes “After a year of volatile recovered paper prices in the USA, 2020 started this week with steady demand for bulk grades and some high deinking grades, helping to hold domestic pricing for most recovered paper prices, and pushing up pricing on export for old corrugated containers (OCC), new double-lined kraft cuttings (DLK), and sorted office paper (SOP), according to Fastmarkets RISI’s Jan. 6 pricing survey. OCC No. 11 increased $5/ton FOB on the West Coast, and held in every other US region as mills are running OK after several took downtime during the holidays, and have “healthy” inventories, as one mill contact in the East noted. This was a turn from yearend 2018, when mills had high inventories. Other mills marched through the holidays and suppliers secured orders for January, citing more movement than in recent months. Mills in the Pacific Northwest “are running low on material,” one trader said. Firm export demand from China, India, and Indonesia saw prices increase for No. 11 OCC – up $15/ton FAS to $67-70 out of the New York/New Jersey ports, $72-75 out of Los Angeles/Long Beach in California, and $67-70 out of the Oakland, CA, port. No. 12 double-sorted OCC increased $15/ton to $85-88 out of New York, $92-95 out of Los Angeles, and $87-90 out of Oakland. Steady demand for DLK to China increased pricing by $10/ton on export. Indonesia has resumed buying recovered fiber after putting a stop to pre-inspections, and was welcomed demand for US sellers as India has expressed its move to focus more on quality, therefore limiting its mixed paper imports.”