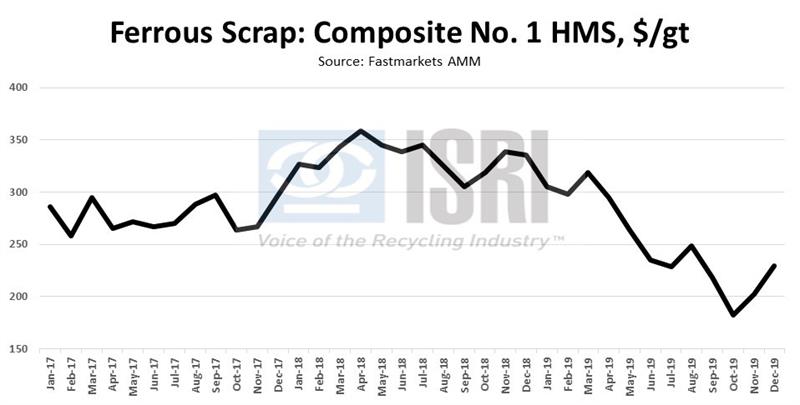

Ferrous scrap prices in the United States rebounded in the fourth quarter of 2019 but benchmark grades like No. 1 HMS were still down around $100 per gross ton as compared to the end of 2018. While shredded scrap prices also declined over the course of 2019, the premium paid for No. 1 busheling over shredded narrowed from nearly $60 per ton in January 2019 to less than $5 per ton by the end of the year as shredded scrap supplies tightened.

As iron ore and scrap prices advanced late in the year, U.S. steelmakers have continued to push for sheet price hikes: “Nucor intends to raise flat-rolled steel prices by at least $40 per ton ($2 per hundredweight) effective immediately. The move applies equally to hot-rolled, cold-rolled and galvanized products, the steelmaker said in a letter to customers dated Monday December 16 … The announcement means that North America’s largest electric-arc furnace steelmaker has joined ArcelorMittal, the world's largest steelmaker, in a fourth round of US flat-rolled price increases. U.S. mills are now officially seeking prices that are $150 per ton higher than they were in late October,” Fastmarkets AMM reports.

Late in the year, the American Iron and Steel Institute reported that for the week ending December 7, 2019, raw steel production in the United States was down 0.8% from the preceding week and down 2.1% from the corresponding week in 2018 to 1.821 million net tons as the capacity utilization rate came in at 78.7 percent. For the year-to-date, AISI estimates U.S. steel production increased 1.9 percent to 90.74 million tons through December 7th with an average capacity utilization rate of 80.1 percent.

Global Steel Trends

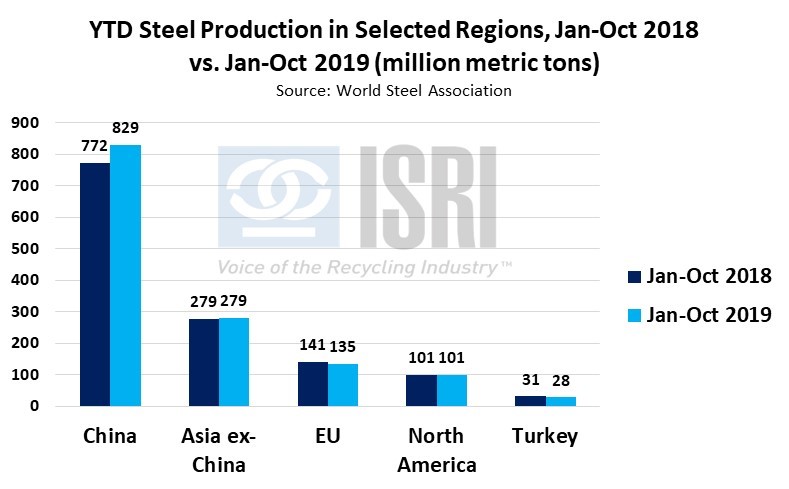

According to figures from the World Steel Association, global crude steel production during Jan-Oct 2019 increased 3.2% year-on-year to more than 1.53 billion tons as Chinese steel production increased 7.4% to nearly 830 million tons through October.

In North America, declining steel output in Canada and Mexico was offset by rising production in the United States, leaving overall production practically unchanged at 100.7 million tons during Jan-Oct 2019. Over the same period, steel production in the European Union fell 3.6% year-on-year due largely to reduced production in Germany (-4.6%), Italy (-3.8%), France (-3.9%), and Spain (-2.6%). Among the major overseas consumers of ferrous scrap, steel production is down this year in Turkey (-10.6%), Taiwan (-2.5%), Mexico (-7.8%), and South Korea (-0.4%), while Vietnamese steel production surged nearly 50% higher during the first 10 months of the year, according to worldsteel data.

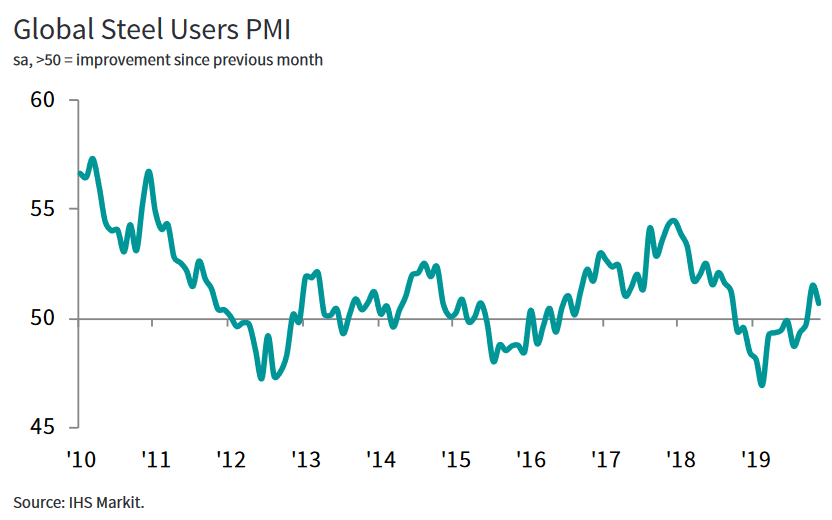

According to IHS Markit, “The seasonally adjusted Global Steel Users Purchasing Managers Index™ (PMI) fell from 51.5 in October to 50.7 in November, signaling an uplift in business conditions for the second consecutive month. However, the rate of growth slowed to a marginal pace. Notably, U.S. steel users reported the first improvement in operating conditions since June. On the negative side, Asian users saw an easing in growth from October's recent high, while European firms indicated declining business conditions for the twelfth month in a row.”

Ferrous Scrap Trade Flows

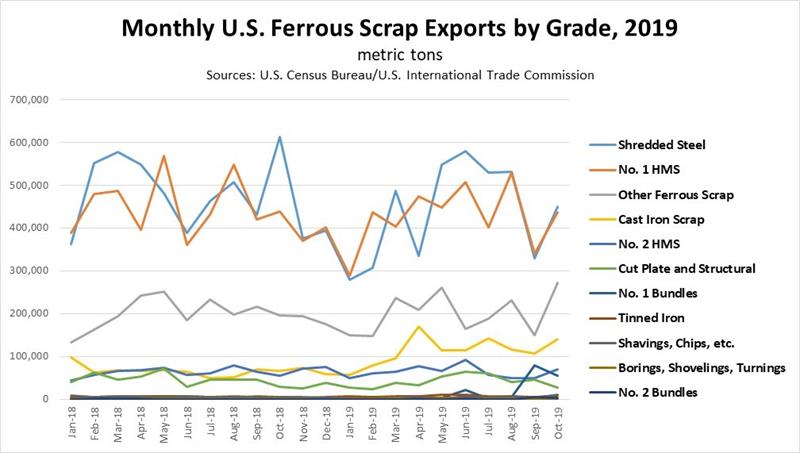

Ferrous scrap exports from the United States (excluding stainless steel and alloy steel scrap) rose from 1.17 million metric tons in September to nearly 1.48 million tons in October thanks to improved overseas demand for shredded, No. 1 heavy melt, cast iron scrap, and other ferrous grades according to the latest figures from the U.S. Census Bureau.

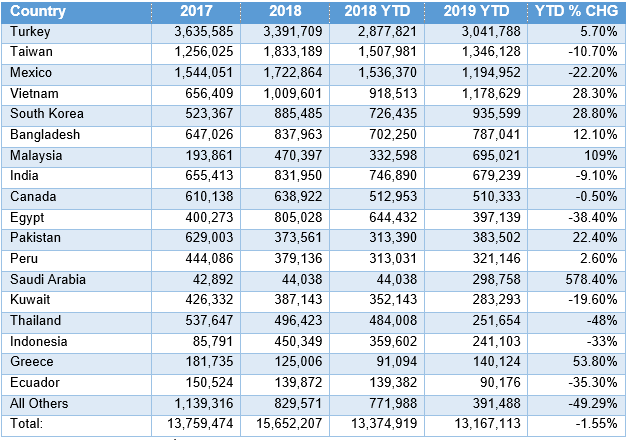

However, year-to-date U.S. ferrous scrap exports are still down nearly 1.6% as compared to the first 10 months of 2018 as weaker demand from Taiwan, Mexico, India, Egypt and other markets have more than offset improved trade flows with Turkey (+5.7%), Vietnam (+28.3%), South Korea (+28.8%), Bangladesh (+12.1%), Malaysia (+109%), and others.

YTD U.S. Ferrous Scrap Exports (ex-stainless & alloy steel) by Major Destination

Metric tons

Sources: U.S. Census Bureau/U.S. International Trade Commission

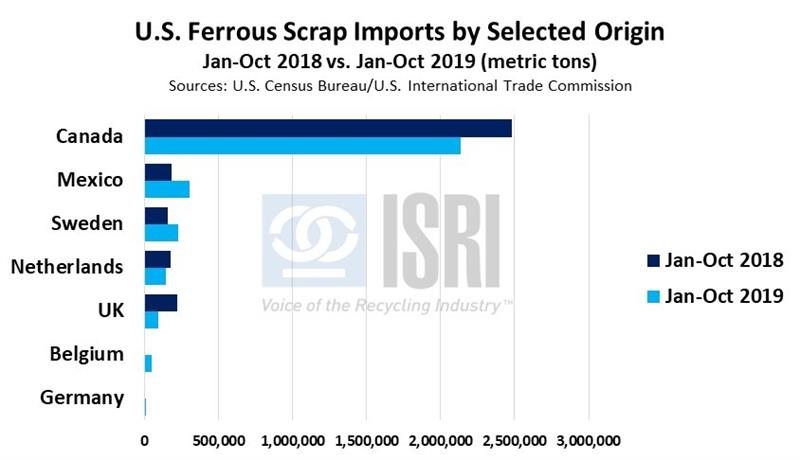

Ferrous scrap imports into the United States have declined more rapidly than ferrous exports as falling imports from Canada (-14%) eclipsed increased imports from Mexico (+68%) and Sweden (+44%). As a result, U.S. Census Bureau data show total U.S. ferrous scrap imports during Jan-Oct 2019 were down 10.5% year-on-year to just over 3 million metric tons.

Mixed Manufacturing Indicators

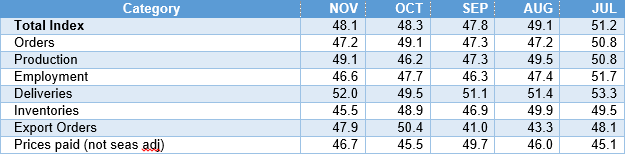

U.S. and global manufacturing reports have been sending mixed messages lately as concerns about slowing global economic growth and the on-going trade disputes have weighed on market sentiment, despite reports of job gains in the U.S. manufacturing sector and a reported 1.1% rebound in U.S. industrial output in November. According to the Institute for Supply Management, their Manufacturing PMI declined from 48.3 in October to 48.1 in November, the 4th consecutive month of readings in contraction territory (below 50) as both new orders and new export orders fell sharply.

U.S. Manufacturing Purchasing Managers Index

Source: Institute for Supply Management

- Here’s what some of their survey respondents from the major manufacturing sectors had to say:

- “Business level is similar to October.” (Computer & Electronic Products)

- “Chemical industry has been slow globally, but the curve seems to be flattening.” (Chemical Products)

- “Economic uncertainty continues. Our outlook on future business is cautious, yet positive.” (Transportation Equipment)

- “Economy is holding up. Business is staying constant. The same challenges persist — foreign exchange, trade uncertainty and trend changes [for example, sugar reduction].” (Food, Beverage & Tobacco Products)

- “Slowdown in business has us revising our 2020-21 capital spend.” (Petroleum & Coal Products)

- “The order book continues to shrink below our forecast levels. We’re unsure at this point how much of the slowdown is tied to certain events [like the General Motors strike], year-end inventory reductions by customers, or a worsening economy. We don't expect clarity on this until early 2020, when we expect to either see restocking orders [a good sign] or not [a bad sign].” (Fabricated Metal Products)

- “Demand has stabilized for the last half of [the fourth quarter], and production will be stable for the rest of this year.” (Machinery)

- “Heading into the holiday season, we are seeing the backlog decrease as new orders for 2020 seem lighter than in past years.” (Plastics & Rubber Products)

- “Markets have downshifted further. The continued confusion surrounding China trade has kept export markets on edge. Profits are elusive. Cash-flow planning is paramount. The general economy is slowing down.” (Wood Products)

- “Incoming orders and production have ticked back up. Tariffs are still a question.” (Furniture & Related Products)

World Bank Commodity Price Forecasts

Heading into 2020, the World Bank is forecasting that the average global iron ore price will decline from $92.2 per dry metric ton in 2019 to $81.3 per ton in 2020 and $80.1 per ton in 2021. Energy prices are largely expected to moderate next year as well, with the average price of crude oil forecast to dip from $60 per barrel in 2019 to $58 per barrel in 2020. Here are the most recent metals and minerals, precious metals, and energy price forecasts from the World Bank (updated October 29, 2019):