Last week’s better than expected jobs reports (nonfarm payrolls +266,000 in November, unemployment rate down to 3.5%) gave a boost to equity and commodity markets, pushing the Dow Industrials back over 28,000 as COMEX copper prices jumped from $2.666/lb. to as high as $2.7535 on Friday.

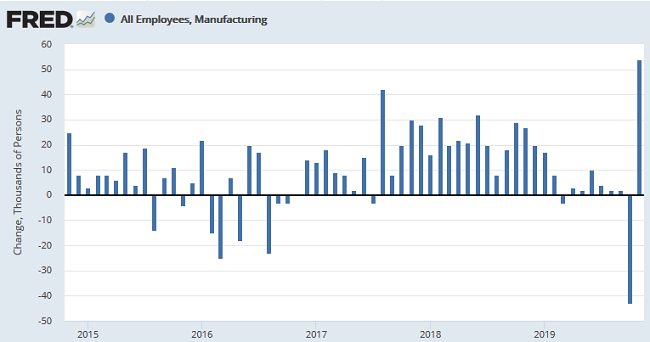

The positive jobs numbers included gains in health care (+45,000), professional and technical services (+31,000), and manufacturing (+54,000), while “…employment in motor vehicles and parts was up by 41,000 in November, reflecting the return of workers who were on strike in October.”

The jump in manufacturing jobs in November stands in contrast to recent reading on the manufacturing front. According to the Institute for Supply Management, their U.S. manufacturing PMI number dropped from 48.3 in October to 48.1 in November, the fourth consecutive month where PMI staying in contraction territory. According to the ISM press release, “Overall, inputs indicate (1) supply chains are meeting demand and (2) companies are less confident that materials received will be consumed in a reasonable time period. Prices decreased for the sixth consecutive month, at a slower rate.”

Here’s what some of their survey respondents had to say:

- “Business level is similar to October.” (Computer & Electronic Products)

- “Chemical industry has been slow globally, but the curve seems to be flattening.” (Chemical Products)

- “Economic uncertainty continues. Our outlook on future business is cautious, yet positive.” (Transportation Equipment)

- “Economy is holding up. Business is staying constant. The same challenges persist — foreign exchange, trade uncertainty and trend changes [for example, sugar reduction].” (Food, Beverage & Tobacco Products)

- “Slowdown in business has us revising our 2020-21 capital spend.” (Petroleum & Coal Products)

- “The order book continues to shrink below our forecast levels. We’re unsure at this point how much of the slowdown is tied to certain events [like the General Motors strike], year-end inventory reductions by customers, or a worsening economy. We don't expect clarity on this until early 2020, when we expect to either see restocking orders [a good sign] or not [a bad sign].” (Fabricated Metal Products)

- “Demand has stabilized for the last half of [the fourth quarter], and production will be stable for the rest of this year.” (Machinery)

- “Heading into the holiday season, we are seeing the backlog decrease as new orders for 2020 seem lighter than in past years.” (Plastics & Rubber Products)

- “Markets have downshifted further. The continued confusion surrounding China trade has kept export markets on edge. Profits are elusive. Cash-flow planning is paramount. The general economy is slowing down.” (Wood Products)

- “Incoming orders and production have ticked back up. Tariffs are still a question.” (Furniture & Related Products)

Uncertainty on the trade front has been a recurring theme for U.S. manufacturers, and last week the Commerce Department reported the U.S. trade deficit narrowed from $51.1 billion in September to $47.2 billion in October as imports slowed more than exports. Trade issues have been a major concern for scrap recyclers as well. Below we take a look at the recent trend in U.S. scrap exports.