U.S.-China trade negotiations remained in focus last week, with the Reuters reporting “U.S. President Donald Trump and Chinese counterpart Xi Jinping on Friday expressed a desire to sign an initial trade deal and defuse a 16-month tariff war that has lowered global growth.

However, concern remains that events in Hong Kong, riven by months of anti-government unrest, could undermine progress in trade talk.”

“All the uncertainty around U.S.-China (trade relationship) is putting a damper on investments. You don’t know where the world’s two largest economies are going and what the investment environment is going to be,” Paul Gruenwald, chief economist at S&P Global Ratings, told CNBC on Monday. “We’ve been arguing for some time that China slowing from a 7-8% back then to a 5.5% is a broadly healthy development,” Gruenwald told CNBC’s “Squawk Box,” adding that China’s labor force is currently “either flat or shrinking,” therefore the GDP per capita growth is still strong. In fact, the strained trade relationship is putting a greater dent on global growth than the direct impacts of tariffs he argued.”

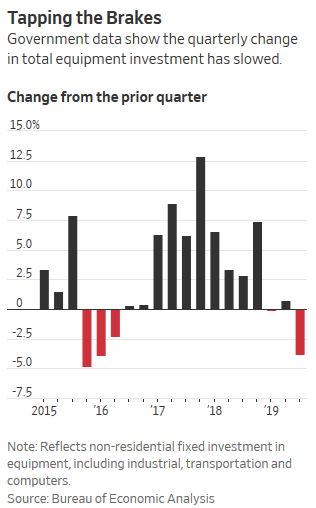

The Wall Street Journal reports that the escalation of the U.S.-China trade war coincided with a downturn in U.S. equipment investment: “Companies slow capital investment for a variety of reasons, and few have explicitly tied their cutbacks to trade, typically citing slowing demand or project delays instead. Still, economists and analysts point to timing: The pullback began in third-quarter 2018, just as the U.S. and China began threatening and then imposing significant tariffs on one another’s goods.”

The trade conflicts and signs of slower global economic growth have been cited by the Federal Reserve as major sources of concern going forward, hence the need to reduce rates. According to the minutes of the last FOMC meeting released last week: “Many participants continued to view the downside risks surrounding the economic outlook as elevated, further underscoring the case for a rate cut at this meeting. In particular, risks to the outlook associated with global economic growth and international trade were still seen as significant despite some encouraging geopolitical and trade-related developments over the intermeeting period.”

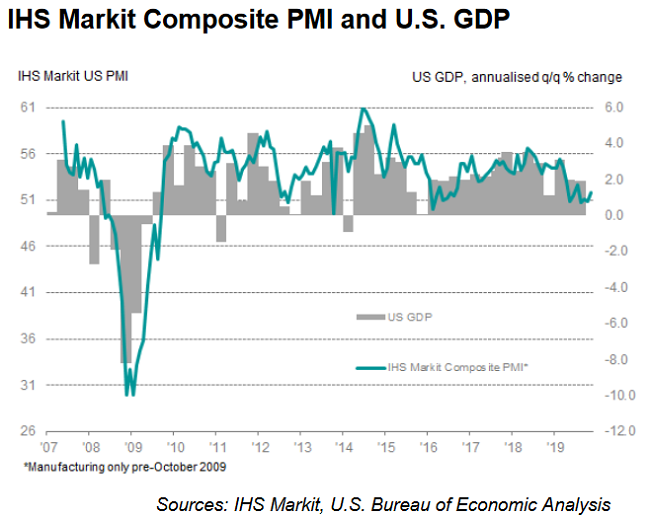

There have been some more encouraging indicators on the U.S. manufacturing and service sectors as well lately. IHS Markit reported on Friday that their flash U.S. composite output index rose to a 4-month high of 51.9 in November (up from 50.9 in October) while the flash U.S. Manufacturing PMI rose to a 7-month high of 52.2. According to the IHS Market press release, “At the same time, both manufacturers and service providers indicated a rise in workforce numbers. The overall increase in employment followed two successive months of payroll cuts.”

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at IHS Markit, said: “A welcome upturn in the headline index from the flash PMI adds to evidence that the worst of the economy’s recent soft patch may be behind us. Output of the combined manufacturing and service sectors rose in November at the fastest rate since July, spurred by improved inflows of new business. Encouragingly, firms took on staff again after two months of headcount reductions, primarily to help deal with rising backlogs of work.”

There were also positive readings on the U.S. housing market last week as the Census Bureau reported “Privately‐owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 1,461,000. This is 5.0 percent above the revised September rate of 1,391,000 and is 14.1 percent above the October 2018 rate of 1,281,000. Privately‐owned housing starts in October were at a seasonally adjusted annual rate of 1,314,000. This is 3.8 percent above the revised September estimate of 1,266,000 and is 8.5 percent above the October 2018 rate of 1,211,000. Briefing.com notes, “There was a sizable jump in starts (+8.6%) and permits (+8.2%) for multi-unit dwellings, yet the key takeaway from the report is that starts (+2.0%) and permits (+3.2%) increased for single-family units in an inventory-constrained environment for single-family homes.”

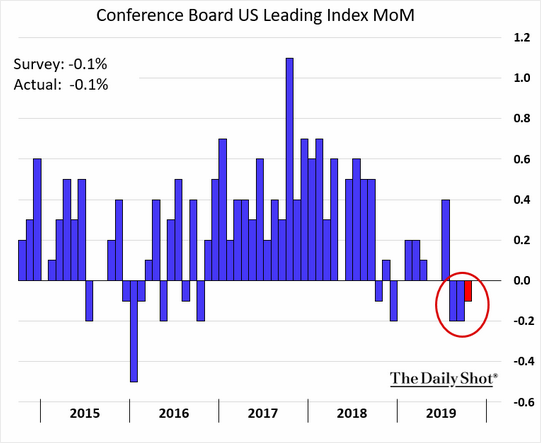

However, some leading economic indicators are still signaling sluggish U.S. economic growth in the near-term. The Conference Board’s Index of Leading Economic Indicators fell 0.1% in October 111.7, the third consecutive monthly decline.