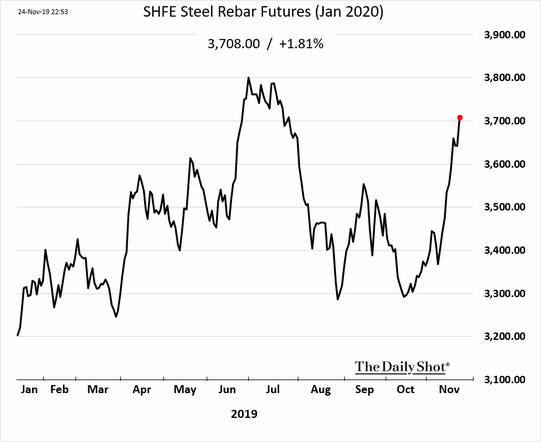

Ferrous – Steel rebar futures in Shanghai have rebounded significantly this month. Macquarie reports “China steel prices increased by 1%~4% last week, led by rebar.

Ferrous – Steel rebar futures in Shanghai have rebounded significantly this month:

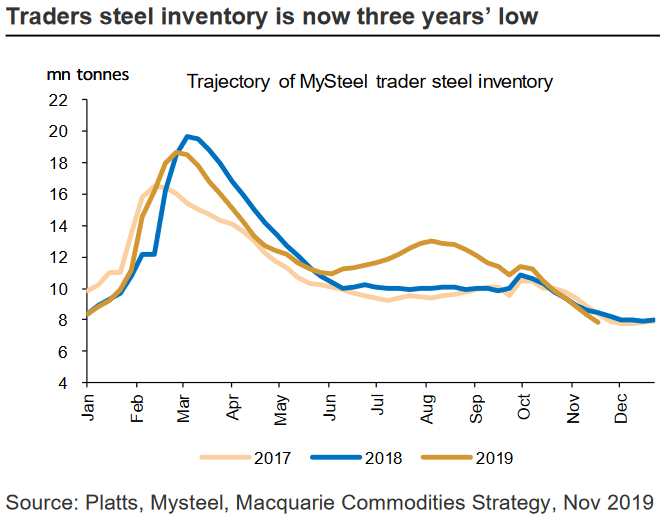

Macquarie reports “China steel prices increased by 1%~4% last week, led by rebar. As reported traders steel inventory fell to three years’ low and mills steel inventory dropped to be lower YoY, market realized that steel demand is better than they expected, thanks to resilient property investment and improving infrastructure FAI, and that construction sites have been ramping up construction after October disruption, ahead of the arrival of cold weather, which can also be shown by the estimated apparent rebar consumption. Calculated integrated steel mills margin has recovered to Rmb400~700/t, and EAF mills margin also grew from a loss to breakeven or small positive margin of Rmb100/t, thus we are seeing a recovery in EAF production while integrated mills production remains largely flat WoW. The momentum in demand is expected to continue over the next 3~4 weeks, but we expect inventory to gradually become stable after the recovery in steel supply.”

As for the U.S. steel market, UBS’ U.S. steel sector survey had some interesting takeaways, including:

- “Respondents expect HRC prices to rise in the near term (from US$482/st in October), possibly due to recent mill price hikes and the scrap price recovery.

- But 57% of US steel industry operators expect a decline in end-product demand over the next three months, while only 19% expect an increase.

- 70% of respondents expect US HRC prices to increase over the next three months, versus only 16% expecting a decline.

- However, buyers expect to receive a ~US$24/st discount for bulk orders of >1,000 st (vs. ~US$15/st previously).

- Moreover, 52% of respondents believe capacity cuts are needed to trigger a sustainable steel price recovery.

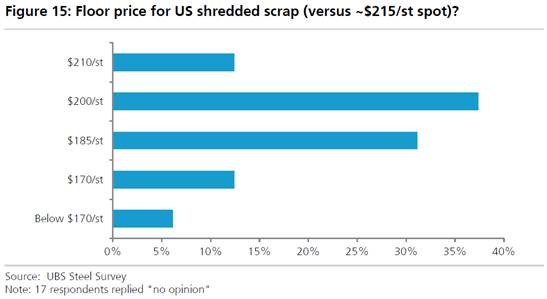

Looking forward, UBS reports “US$185-200/st is the perceived floor for shredded scrap prices versus US$215/st spot.”

Nonferrous –

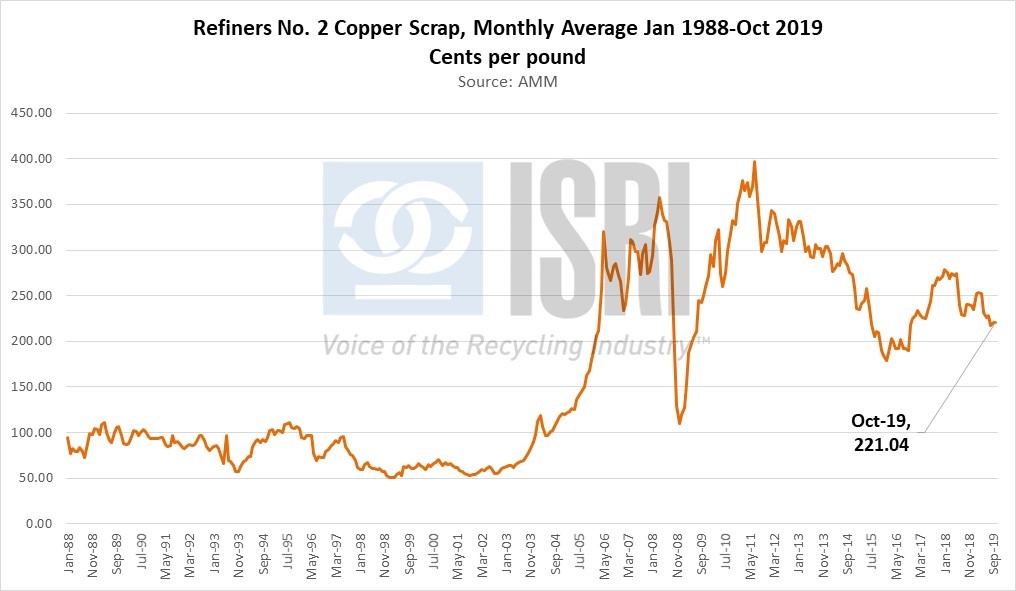

Refined copper prices in New York mostly bounced around between $2.616 and $2.666/lb. last week. As our good friend Ed Meir reported, “Metals finished mostly higher on Friday, but we are not seeing much follow-through today, as apart from copper and tin, the rest of the group is broadly lower, with lead doing the worst. In fact, our chart… shows that on a general index basis, the LME group is down so far this month, this despite all the positive trade talk we have been hearing about so far in November. Indeed, there have been additional pronouncements over the past 72 hours and although this has given global equity markets the usual boost, we are not seeing the buying spilling over into any other commodity complexes outside of metals either.” Copper scrap prices haven’t had much support lately either.

But as reported by FM Metal Bulletin today, there is some exciting news in the U.S. copper scrap market: “A new secondary copper smelter that will produce copper cathode and other elements from scrap raw material is in the works in the US state of Ohio.

Middletown, Ohio-based Cohen Recycling will be the main supplier of this "metal recovery facility," a source close to the project confirmed to Fastmarkets on Friday November 22.

Details such as the capacity of the smelter and the start date for production were not immediately available.

Fastmarkets also has learned that another scrap company in the United States intends to expand its operations and produce copper cathodes from secondary material.”