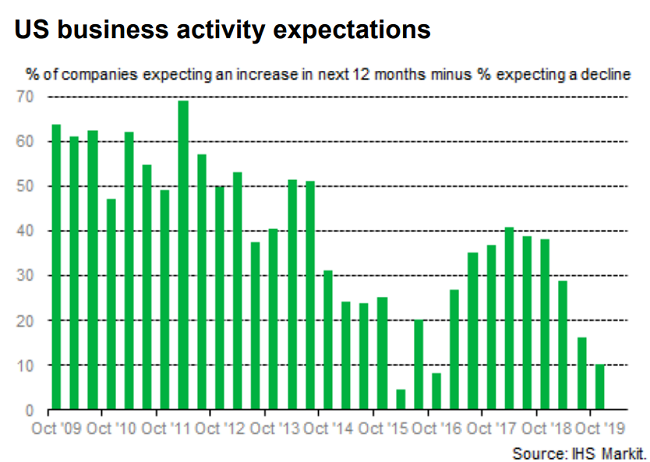

IHS Markit reports that U.S. business optimism has hit a 3-year low: “The latest IHS Markit Business Outlook survey signals that U.S. private sector firms are less optimistic towards the outlook for business activity over the coming 12 months than in June.

The net balance of firms expecting a rise in output has dropped from +16% in June to +10% in October and is the lowest for three years. The net balance of firms forecasting growth is also below the global (+14%) and developed market (+12%) averages. Both manufacturing and service sector firms expressed a lower level of positive sentiment towards future output than earlier in the year.”

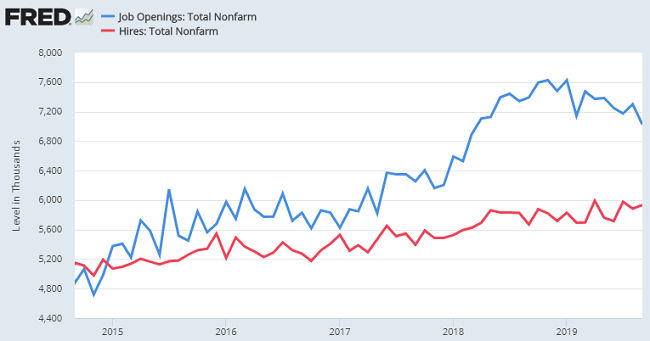

Tight labor markets remain a key source of concern for U.S. manufacturers (and scrap processors) as attracting and retaining new employees remains extremely difficult. The latest Job Openings and Labor Turnover Survey from the Labor Department shows total nonfarm job openings (7.02 million) still exceeded new hires (5.9 million) by a wide margin in September, although that gap has narrowed somewhat since the beginning of the year:

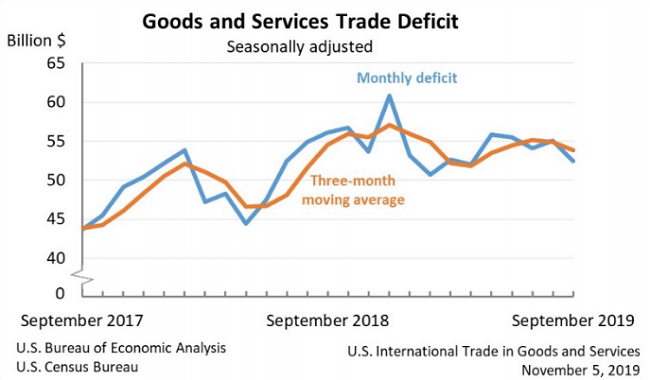

Concerns about the trade landscape is another major concern for U.S. businesses. Last week, the Census Bureau reported “…the goods and services deficit was $52.5 billion in September, down $2.6 billion from $55.0 billion in August” as both imports and exports declined in September. “September exports were $206.0 billion, $1.8 billion less than August exports. September imports were $258.4 billion, $4.4 billion less than August imports.” But for the year-to-date, the trade deficit increased $24.8 billion, or 5.4 percent, as compared to the first 9 months of 2019 as U.S. exports decreased by $7.0 billion and imports increased by $17.8 billion, according to the Census Bureau press release. We take detailed look at the year-to-date trend in U.S. scrap exports below.