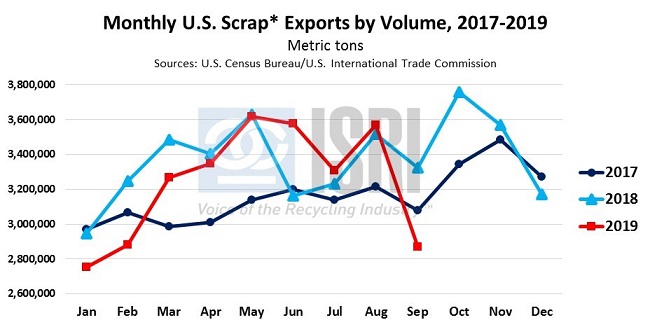

The latest trade figures from the Census Bureau show total U.S. scrap exports (including ferrous scrap, nonferrous scrap, plastic scrap, recovered paper and fiber, and other recycled commodities) during Jan-Sep 2019 totaled 29.2 million metric tons, down 2.5% as compared to the corresponding period in 2018.

By dollar value, year-to-date U.S. scrap exports are down 5% to $14.5 billion through September, a loss of nearly $785 million as compared to the first nine months of 2018. By major commodity group and dollar value, year-to-date:

- Plastic scrap exports are down 41% to $212 million;

- Ferrous scrap (ex- stainless and alloy steel scrap) exports are down 12% to $3.58 billion;

- Recovered paper and fiber exports are down 6% to $2.2 billion; and

- Nonferrous scrap (including precious metal scrap) exports are down less than 1% at $7.8 billion.

*Includes ferrous scrap, nonferrous scrap, plastic scrap, recovered paper and fiber, and other recycled commodities.

In terms of U.S. scrap export market gains and losses, it probably won’t come as a huge surprise that the largest net loss this year has been to mainland China, where export sales during Jan-Sep 2019 were down by nearly $1.3 billion year-on-year. On the positive side, the largest net market gains this year have been to Malaysia, Canada, Japan, Italy, Hong Kong, India, Saudi Arabia, the U.K., and Vietnam. With export sales of more than $1.9 billion, Canada has now become the largest export market for U.S. scrap.

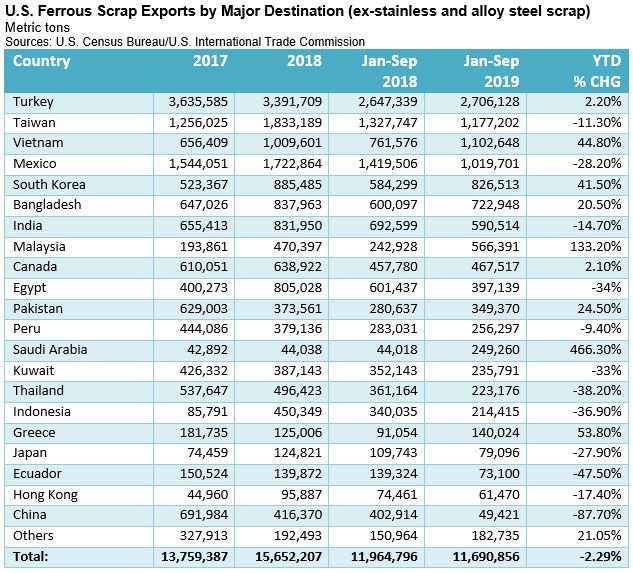

Ferrous – U.S. ferrous scrap exports (excluding stainless and alloy steel scrap) fell from 1.52 million metric tons in August to less than 1.12 million mt in September, according to the Census Bureau trade data, as improved demand from Bangladesh and Mexico was eclipsed by lighter loadings for Vietnam, Turkey, Taiwan, and Egypt, among others. That was for the month of September. For the year-to-date (Jan-Sep), U.S. ferrous scrap exports are reportedly down 2.3% to 11.69 million mt. The largest net market gains this year have been to Vietnam (+341 kt), Malaysia (+323 kt), South Korea (+242 kt), Saudi Arabia (+205 kt), and Bangladesh (+123 kt), while the biggest YTD market losses have been to Mexico, China, Egypt, Taiwan, and Thailand.

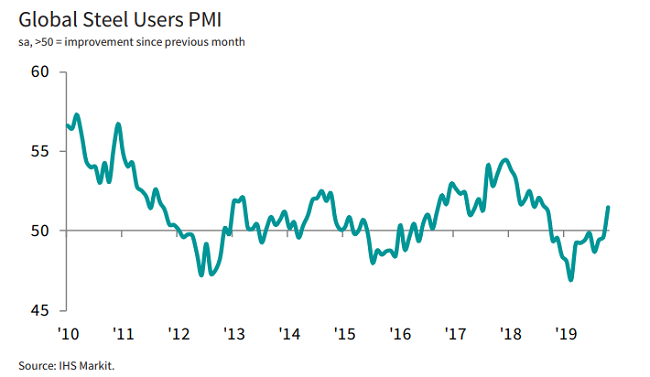

On a more positive note, IHS Markit reports that “For the first time in over a year in October, global steel users reported an improvement in operating conditions, driven by a solid increase in new orders that was mainly felt by Asian businesses. Output rose at an accelerated pace and input buying grew marginally, but job numbers continued to decline. Selling prices increased only slightly, as cost inflation cooled to its softest in over three-and-a-half years.”

But here in the U.S., the American Iron and Steel Institute reports weekly crude steel production for the week ending November 9, 2019 declined 2.2% year-on-year and was down 1.4% week-on-week to 1.862 million net tons as the capacity utilization rate came in at 80.5%, down from 81.6% the prior week.

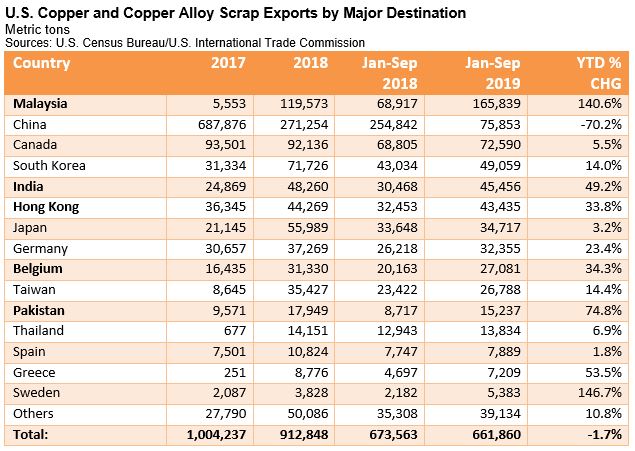

Nonferrous – For the year-to-date, U.S. copper and copper alloy scrap exports are down 1.7% by volume to less than 662,000 metric tons as the 70% drop in shipments to mainland China more than offset gains to Malaysia, India, Hong Kong, Belgium, Pakistan, and others. For the month of September, U.S. copper scrap exports dropped by 10,000 tons to 66,000 tons on weaker demand from most of the major destinations. Notable exceptions to the drop in September were South Korea and Belgium.

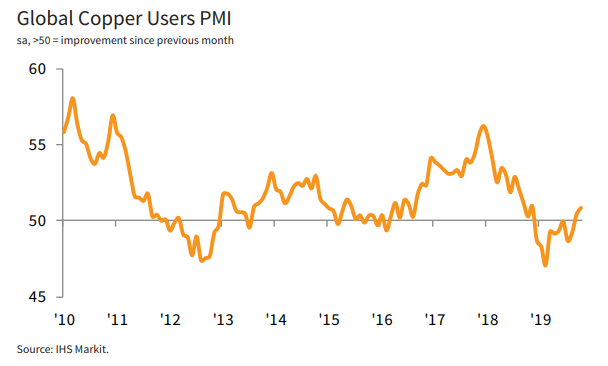

As with steel, IHS Markit also reports that global copper consumer sentiment has improved, although conditions in the U.S. and Europe continue to underperform: “Latest data at global copper users solidified the improvement in business conditions observed in September, as output and new orders both grew for the second consecutive month and at faster rates in October… On a regional basis, Asian users saw the quickest rise in production for 21 months, while output growth among US users slowed and European firms noted a further contraction.” Copper scrap prices at U.S. brass ingot makers were recently listed by Fastmarkets AMM at 252-254 cents for Bare Bright, 242-244 cents for No. 1 copper, 223-225 cents for No. 2 copper, 143-146 cents for radiators, and 154-155 cents per pound for yellow brass solids.

Plastic – U.S. plastic scrap exports during Jan-Sep 2019 declined 42% by volume to just over 505,000 metric tons according to Census Bureau trade data. By polymer and percentage change, shipments of PVC scrap were down 79% year-on-year, followed by weaker demand for PE scrap (-34%) and PET plastics (-32%).

By destination, U.S. plastic scrap exports to Malaysia and China are down 83% and 81%, respectively, through September, more than offsetting gains to Canada, Turkey, Indonesia, and others. In early 2017, monthly U.S. plastic scrap shipments to mainland China averaged around 75,000 tons per month but are averaging about 780 tons per month this year.