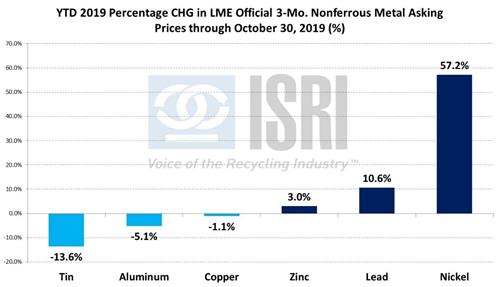

At the London Metal Exchange, nickel prices have outperformed the other base metals so far this year, rising 57 percent through late October, followed by rising lead (+10.6% YTD) and zinc (+3% YTD) prices.

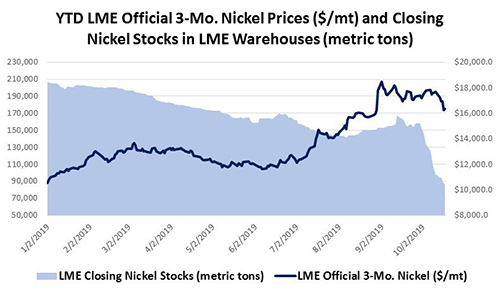

However, as compared to earlier in the year when nickel prices were up more than 70 percent, primary nickel prices have been pressured lower at the LME recently even as warehouse stocks continue to be drawn down. According to Andy Home at Reuters, “This LME stocks grab isn’t a reflection of current market dynamics but is rather about potential future market tightness resulting from the cut in the flow of Indonesian ore to China’s mainland stainless steel producers. It is no secret in the nickel market that a Chinese company has been snapping up LME stocks. Tsingshan Holding Group was the driver of falling stocks in July and is the name in the frame again this time. The stainless steel producer sits at the heart of the supply conundrum thrown up by Indonesia’s accelerated ban on ore exports.”

Regarding the rise in lead metal prices, INTL FC Stone reports that “the key driver behind this impressive performance comes as concerns over troubles at Nyrstar’s Port Pirie’s lead smelter in Australia remains in the markets mind. Following the two-month outage over June and July, in which 30,000 tonnes of lead production was lost (leading to a 20-25 million eur lost in earnings at Nyrstar), a further force majeure was announced at the end of August.”

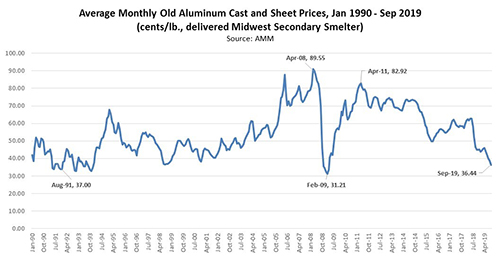

In contrast, LME 3-mo. aluminum and copper prices are down 5% and 1%, respectively, for the year-to-date. As primary aluminum prices have underperformed and as China’s import restrictions on aluminum scrap have created excess supply for a number of aluminum scrap grades, secondary aluminum prices in the United States remain under pressure.

Looking forward, the consensus forecast from analysts polled by Reuters shows “Analysts expect cash LME aluminum to average $1,814 a tonne in 2020, up 6% from the current price” while “the LME cash copper price is expected to average $6,050 a tonne in 2020… a 3% increase from the price on the afternoon of Oct. 25.” In comparison, Macquarie Research is extremely cautious on their base metals outlook for the near term: “The fundamental outlook for Base Metals is subdued: sufficient supply + stable trade. Our survey of China's copper industry revealed active fabricators/traders, while the big trade shift has been rising conc. imports to offset scrap import bans. Zinc's price is capped at lows by a persistent surplus (improving supply vs. moderating demand, buoying TCs). China's aluminium output rate's up again (+4% to 35Mtpa, Jan-Sep), on an input cost-collapse (power/alumina), with exports rising again. Nickel's price tracked the general plight of the other base metals until July, when the first news of a possible ban on Indonesia's Ni-bearing ore exports emerged.”