Indicators of U.S. manufacturing and industrial production continue to disappoint amid signs of slowing U.S. economic growth and heightened trade impacts. Last week, the Federal Reserve’s Beige Book reported “Manufacturing activity continued to edge lower.

Contacts in some Districts suggested that persistent trade tensions and slower global growth weighed on activity… A number of Districts reported that manufacturers reduced their headcounts because orders were soft. However, some firms were more concerned about the longer-term availability of workers and subsequently chose to reduce hours rather than staff levels.”

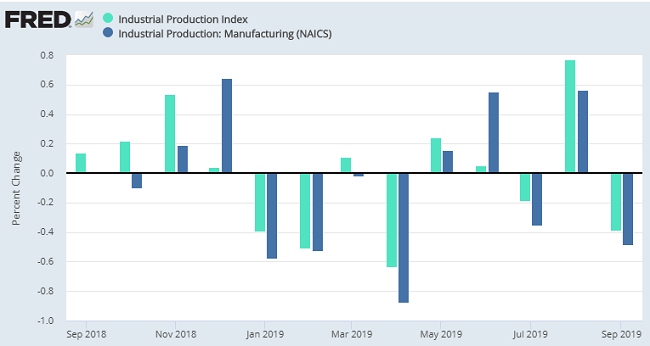

So-called “hard” economic reports are confirming the trend in the survey data. The Fed also reported last week that U.S. industrial production decreased 0.4% in September, including a 0.5% drop in manufacturing output and 1.3% contraction in mining as crude oil production and mine drilling slowed: “The cutback in motor vehicle output in September contributed to a drop of nearly 2 percent for consumer durables and to declines of around 1 percent for transit equipment and for durable goods materials. The indexes for many of the other market groups were relatively little changed.”

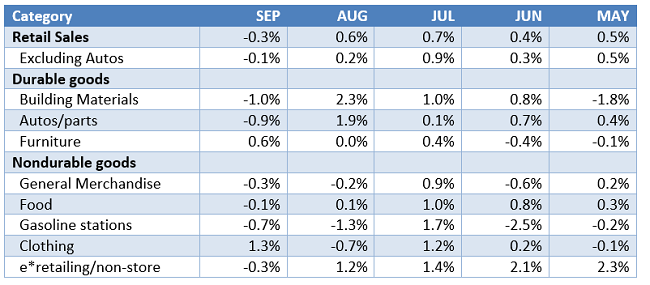

U.S. retail sales also came in below expectations last month, declining 0.3% as compared to August 2019 as sales of autos and auto parts were down 0.9%, although retail sales are still up over 4% as compared to this time last year.

Similarly, the headline numbers on U.S. housing starts and building permits appeared to be quite negative, with the Census Bureau reporting building permits were down 2.7% in September as housing starts declined 9.4% as compared to August. But when the volatile figures on multi-unit buildings are factored out, the trend in single-family units is looking better:

So what do all these mixed economic reports mean for the U.S. economy and manufacturing going forward? According to the Conference Board’s index of leading economic indicators (-0.1% in Sep), we’re still looking at slower growth ahead, but not outright contraction: “The US LEI declined in September because of weaknesses in the manufacturing sector and the interest rate spread which were only partially offset by rising stock prices and a positive contribution from the Leading Credit Index," said Ataman Ozyildirim, Senior Director of Economic Research at The Conference Board. "The LEI reflects uncertainty in the outlook and falling business expectations, brought on by the downturn in the industrial sector and trade disputes. Looking ahead, the LEI is consistent with an economy that is still growing, albeit more slowly, through the end of the year and into 2020."