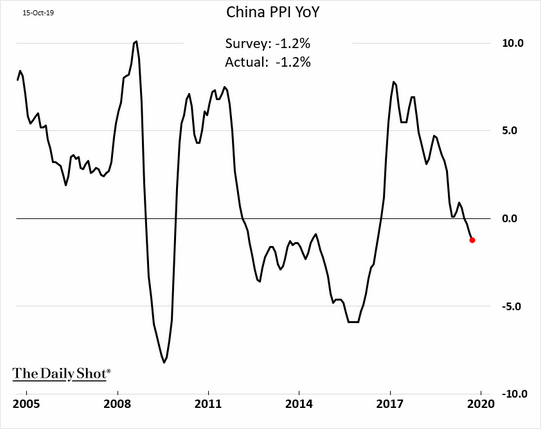

Reuters reports that “China’s factory gate prices declined at their fastest pace in more than three years in September, reinforcing the case for Beijing to unveil further stimulus as manufacturing cools on weak demand and U.S. trade pressures.

The producer price index (PPI), considered a key barometer of corporate profitability, dropped 1.2% year-on-year in September, National Bureau of Statistics (NBS) data showed on Tuesday. That marked the steepest decline since July 2016 but matched forecasts in a Reuters survey of analysts.

“In contrast, China’s consumer prices rose at their fastest pace in almost six years, driven mostly by the surge in pork prices as African swine fever ravaged the country’s hog herds. However, core retail inflation pressures remain modest, giving policymakers room to introduce measures to prop up demand. The grim outlook is unlikely to change even as tensions in the year-long trade war between Beijing and Washington have eased somewhat. U.S. President Donald Trump said on Friday the two sides had reached agreement on the first phase of a deal and suspended a tariff hike, but officials said much work still needed to be done.”

As for the latest Chinese trade data, the CME Group reports “{Chinese} exports fell 3.2 percent on the year in September after falling 1.0 percent in August, close to the consensus forecast for a fall of 3.0 percent, while imports fell 8.5 percent on the year, after falling 5.6 percent previously, bigger than the consensus forecast for a fall of 5.0 percent.” As imports dropped faster than exports, China's trade surplus widened from $34.83 billion in August to $39.65 billion in September. Concerns about the impact of the trade war have prompted some analysts to cut their third quarter Chinese GDP growth forecasts below 6 percent.

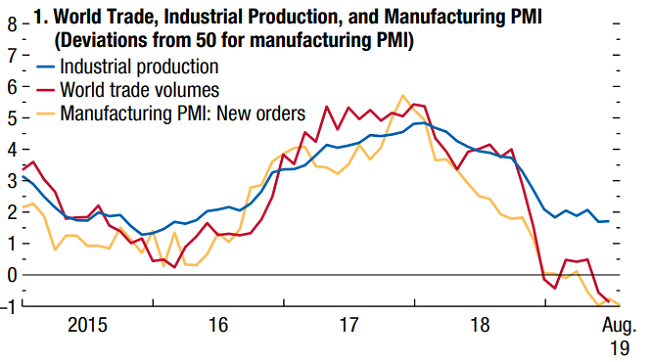

In its latest World Economic Outlook released today, the International Monetary Fund is now projecting that slower global manufacturing output and international trade flows are weighing on economic growth: “Over the past year, global growth has fallen sharply. Among advanced economies, the weakening has been broad based, affecting major economies (the United States and especially the euro area) and smaller Asian advanced economies. The slowdown in activity has been even more pronounced across emerging market and developing economies, including Brazil, China, India, Mexico, and Russia, as well as a few economies suffering macroeconomic and financial stress.”

Source: International Monetary Fund, WEO, October 2019.

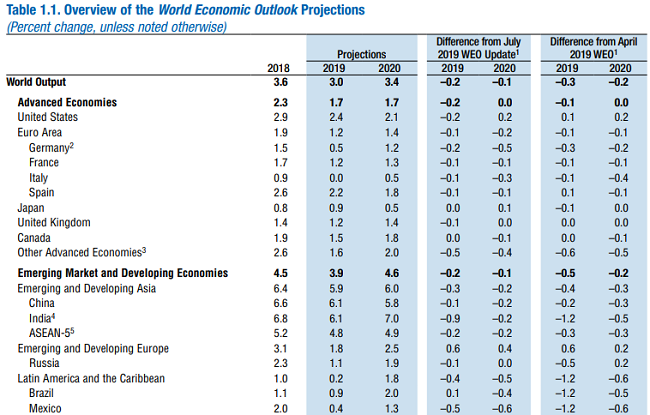

As a result, the IMF has lowered its 2019 projections for economic growth for the euro area (1.2%), the U.S. (1.7%), China (6.1%), and the world (3.0%) – marking the lowest expected level of global growth since 2008/2009. And while global economic output is expected to modestly rebound to 3.4% growth in 2020, that’s still down from the IMF’s April forecast for 3.6% growth next year.

Source: International Monetary Fund, WEO, October 2019.