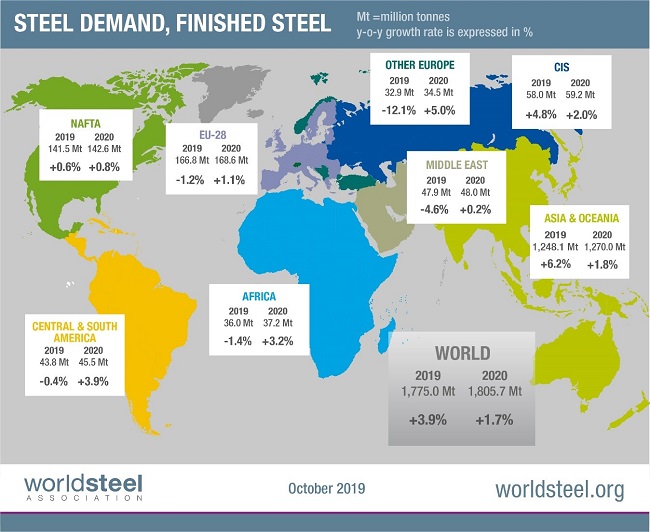

Ferrous – The World Steel Association released its revised short-term demand projections this week, with the association projecting steel demand in the NAFTA region will only increase 0.6% this year, followed by 0.8% growth next year.

In contrast, world steel demand is expected to grow 3.9% this year before slowing to 1.7% growth in 2020:

Worldsteel Economics Committee Chair Mr. Al Remeithi was quoted as saying, “The current SRO suggests that global steel demand will continue to grow in 2019, more than we expected in these challenging times, mainly due to China. In the rest of the world, steel demand slowed in 2019 as uncertainty, trade tensions and geopolitical issues weighed on investment and trade. Manufacturing, particularly the auto industry, has performed poorly, contracting in many countries, however in construction, despite some slowing, a positive momentum has been maintained.”

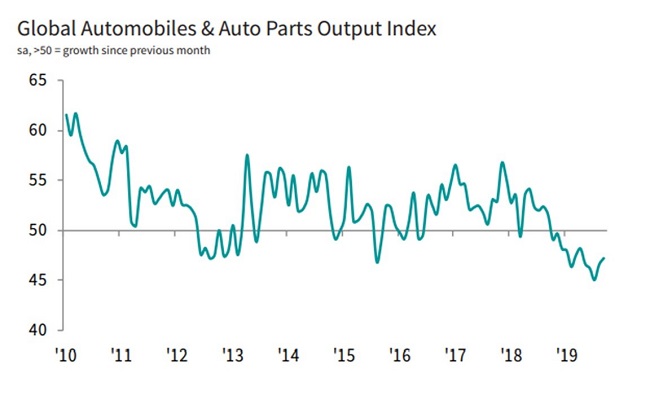

Regarding the automotive sector, worldsteel reports “Global automotive production decelerated in 2018 and is expected to contract in 2019 with the recession deepening and broadening across several major markets including Germany, Turkey, China and South Korea. The automotive market has been hit by more than global economic factors including, market saturation, reduction in purchasing and promotion incentives and most importantly customer hesitancy during the transition of the auto industry from combustion engine-powered via hybrid to fully electric vehicles.”

As for major ferrous scrap importer Turkey, worldsteel reports “Turkey has seen contracting construction activity in line with the overall economy. After a severe decline in 2019, Turkey will see only a moderate rebound in 2020.” This comes on top of President Trump’s announcement earlier in the week that “I will soon be issuing an Executive Order authorizing the imposition of sanctions against current and former officials of the Government of Turkey and any persons contributing to Turkey’s destabilizing actions in northeast Syria. Likewise, the steel tariffs will be increased back up to 50 percent, the level prior to reduction in May. The United States will also immediately stop negotiations, being led by the Department of Commerce, with respect to a $100 billion trade deal with Turkey.”

On a related note, Fastmarkets AMM reports that “Deep-sea scrap import prices in the Turkish market increased in the latest bookings heard for November shipments.... A steel mill in the Marmara region booked a Baltic Sea cargo on Monday, comprising 40,000 tonnes of HMS 1&2 (80:20) at $237 per tonne cfr. Another steel mill in the Izmir region also booked a Baltic Sea cargo, comprising 30,000 tonnes of HMS 1&2 (80:20) at $234.75 per tonne, late on Friday October 11. Those cargoes were the first Baltic Sea deals since September 30, when a steel producer in northern Turkey paid $222.75 per tonne cfr for HMS 1&2 (80:20). The latest deals also compared with the most recent deep-sea cargo sold from the United States at $233 per tonne cfr for similar material.”

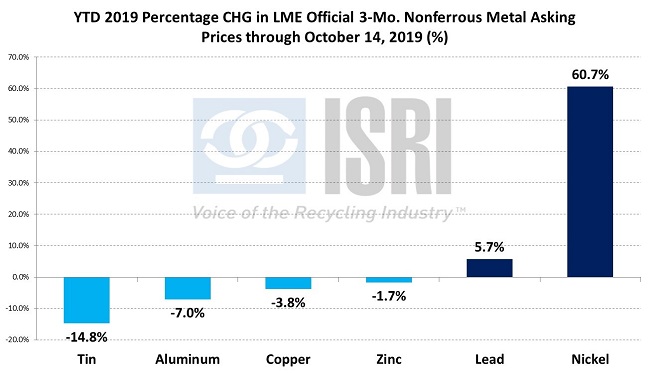

Nonferrous – Aluminum prices at the London Metal Exchange continue to underperform (down 7% year-to-date) amid on-going concerns about slower global auto demand and excess Chinese aluminum production.

Reuters and Macquarie report this week that major Chinese aluminum producer “…Hongqiao (6.5Mpa; 18% of China’s 36Mtpa), has engaged the provincial government of Yunnan, seeking to build a smelter there – presumably to benefit from the province’s hydropower capacity, reducing the company’s on-going environment risk. Industry feedback suggests 2Mtpa capacity is being considered (>30% hike for company), representing its first expansion since it was forced to close almost 3Mtpa of unauthorized capacity in 2017…. The recent collapse in aluminium smelting’s key input cost of alumina, together with an apparent easing of constraints on China’s industrial activity as a growth offset, may be prompting another round of capacity growth.”

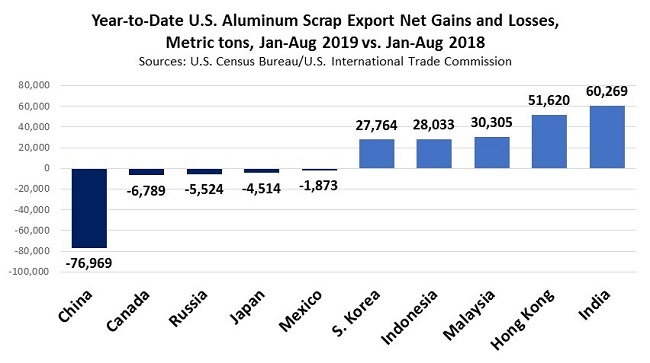

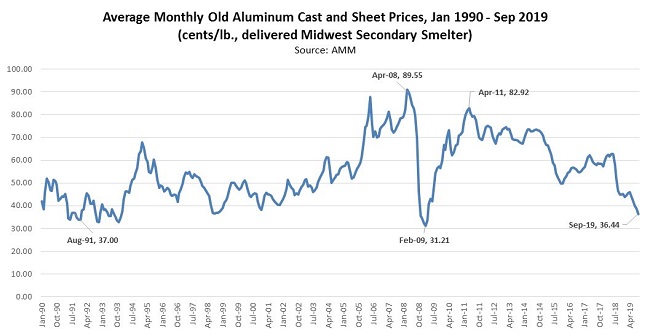

As has been reported, aluminum scrap prices have fared even worse than primary prices this year as the market adjusts to restricted Chinese aluminum scrap imports and restructuring of the U.S. market. Although market growth in India, S. Korea, Malaysia, Indonesia, and other markets have more than offset the drop in Chinese aluminum scrap demand, the scrap market remains under significant pressure.

Here’s the updated chart of U.S. average aluminum old cast & sheet prices going back to 1990:

Plastics – According to the latest Census Bureau trade data, U.S. plastic scrap exports during Jan-Aug 2019 were down nearly 44 percent as compared to the first 8 months of 2018 to just under 458,000 metric tons. As compared to the nearly 558,000 tons of plastic scrap exported to China in 2017, U.S. plastic scrap shipments to China have totaled less than 6,000 tons so far this year. Other major market declines include Malaysia (-85.6%), Thailand (-81.2%), Vietnam (-81.3%), and India (-13.5%) that have only partially been offset by gains to Canada, S. Korea, Indonesia, Turkey, Senegal, and the Philippines.