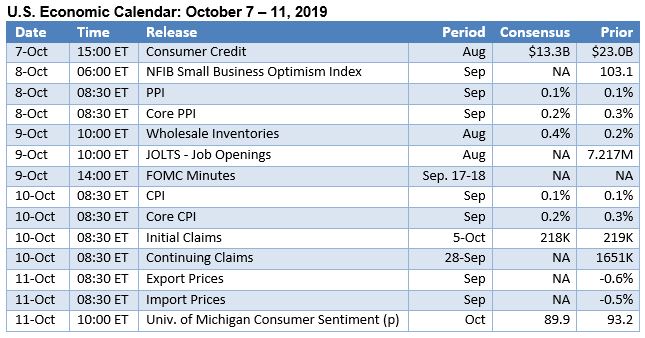

Investors will be paying close attention to the release of the minutes from the last Federal Open Market Committee meeting later today along with the minutes of the European Central Bank meeting due to be released tomorrow. On the U.S. economic calendar, new releases are still due out on consumer price inflation, initial unemployment claims, and consumer sentiment this week.

The consensus forecast is that consumer prices were up just 0.1% in September, although the producer price index for final demand that was released earlier in the week came in well below expectations (-0.3%). The U.S.-China trade talks are scheduled to re-start on Thursday, with the Financial Times reporting “Liu He, China’s vice-premier, is due in Washington this week for discussions with Steven Mnuchin, the US Treasury secretary, and Robert Lighthizer, the US trade representative, in an attempt to reach a truce after tariff escalations over recent months. If no agreement is reached, levies on $250bn of Chinese imports will rise from 25 per cent to 30 per cent on October 15, dealing a new jab to both economies.” The trade wars, global manufacturing slowdown, and Brexit concerns continue to weigh on the economic outlook. Earlier this week, the Wall Street Journal reported “the new leaders of the International Monetary Fund and World Bank warned in twin speeches of a deteriorating global economic outlook, just a week before they will lead the annual meetings of their institutions for the first time. ‘The global economy is now in a synchronized slowdown,’ said Kristalina Georgieva of Bulgaria, the former No. 2 official at the World Bank, who took the helm of the IMF a week ago.” We’ll have a look at the key economic, commodity, and scrap market developments and outlook in next week’s ReMA Market Report. Best wishes for a blessed holiday for all those observing Yom Kippur!