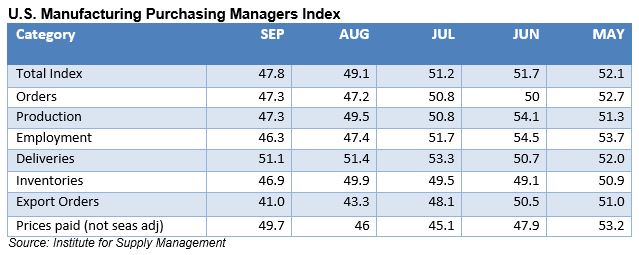

Signs of deteriorating U.S. manufacturing conditions are not helping scrap market sentiment. Last week, the Institute for Supply Management reported their U.S. manufacturing PMI dropped from 49.1 in August to 47.8 in September as the total index fell deeper into contraction territory and was the lowest reading since 2009.

Of note, while the ISM reports that prices for natural gas and precious metals were up in September, the following commodities experienced price declines: Aluminum; Base Oil; Corrugated Boxes; High-Density Polyethylene; Nylon; Pulp; Scrap; Steel; Steel – Hot Rolled; and Steel Products.

Here’s what some of the ISM’s survey respondents had to say:

- “Second month in a row in which shipments have outpaced new orders.” (Computer & Electronic Products)

- “Continued softening in the global automotive market. Trade-war impacts also have localized effects, particularly in select export markets. Seeing warehouses filling again after what appeared to be a short reduction of demand.” (Chemical Products)

- “Business outlook remains cautious. Orders seem to be decreasing, but luckily not as sharp of a decrease as we were expecting.” (Transportation Equipment)

- “General market is slowing even more than a normal fourth-quarter slowdown.” (Fabricated Metal Products)

- “Demand softening on some product lines, backlogs have reduced, and dealer inventories are growing.” (Machinery)

- “Business has been flat for us. Year-over-year growth has slowed dramatically.” (Miscellaneous Manufacturing)

- “We have seen a reduction in sales orders and, therefore, a lower demand for products we order. We have also reduced our workforce by 10 percent.” (Plastics & Rubber Products)

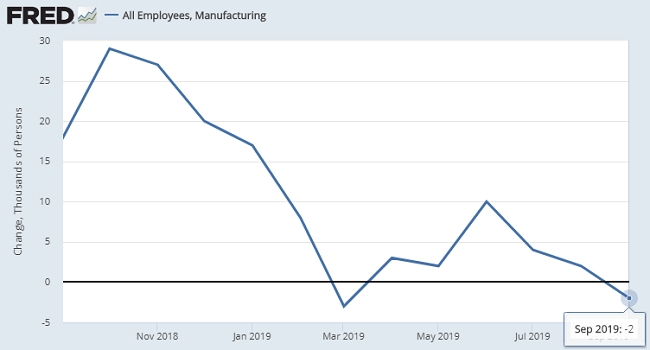

Take note of that last comment on workforce reduction in the plastics and rubber products sector, as the U.S. Labor Department reported last week that manufacturers cut their payrolls by 2,000 jobs last month:

Overall, the September jobs report was largely positive as total nonfarm payrolls increased by 136,000 and the unemployment rate declined to 3.5 percent (a 50-year low), although wage growth is slowing.

Deteriorating manufacturing conditions in Germany have also been widely cited as a source of concern. Earlier this week, the latest report in German industrial production came in slightly better than expected, although the year-on-year figures are still very much in negative territory. Bloomberg reports: “A jump in manufacturing fueled a surprise improvement in German industrial production following two months of decline. While good news, the development will do little to alleviate concerns about intensifying trade tensions and waning business confidence. Output rose 0.3% from July, despite a big drop in energy, compared with economist estimates for no change. Investment and basic goods production helped, while motor vehicle manufacturing also grew. But the outlook remains uncertain, with production down 4% on the year and shrinking factory orders signaling that no real turning point is in sight.”