The Bloomberg Commodity Index was down around 0.3% this morning amid softer energy and precious metal prices. Reuters reports that “Oil slipped on Monday as China's economic outlook remained weak even as manufacturing data improved, with the continuing trade war with the United States weighing on demand growth for the world's largest crude importer.”

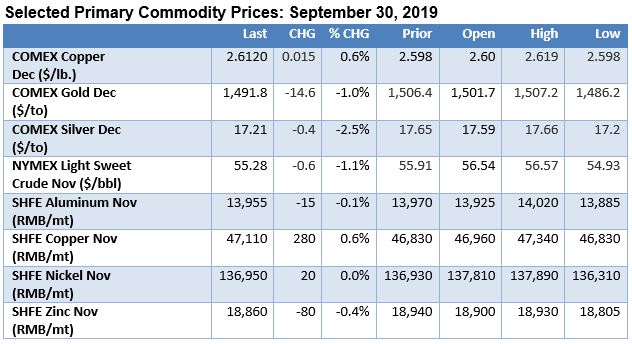

Regarding the Chinese manufacturing data, CNBC reports this morning that “Two widely watched indicators on China’s manufacturing activity came in above expectations on Monday. A private survey of China’s manufacturing activity, the Caixin/Markit factory Purchasing Managers’ Index (PMI), was 51.4 for September — the highest reading since February 2018. The latest data was much higher than the 50.2 that analysts polled by Reuters had expected and the 50.4 recorded in August.” In London, LME 3-mo. copper and aluminum were recently trading lower around $5,755/mt and $1,725/mt, respectively. In foreign exchange trade the dollar was firmer this morning as the euro slipped to $1.091 and the British pound was trading around $1.2323.