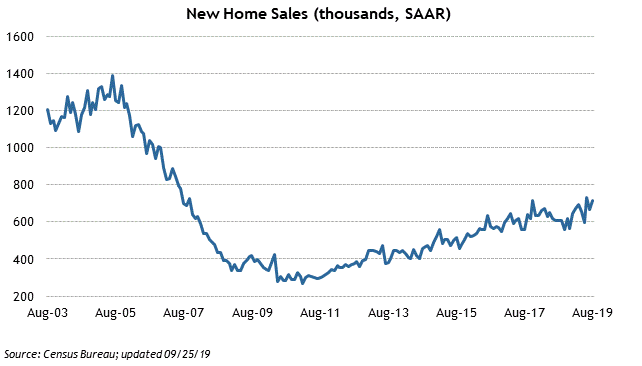

New U.S. home sales surprised to the upside in August, with the Census Bureau and Department of Housing and Urban Development reporting last week that sales of new single‐family houses were up 7.1% month-on-month and up 18% year-on-year to a seasonally adjusted annual rate of 713,000 units.

Declining mortgage rates have been widely cited as a source of support for the housing market. CNBC reports “The 30-year fixed mortgage rate has dropped about 120 basis points from last year’s highs to an average of 3.73%, according to data from mortgage finance agency Freddie Mac.”

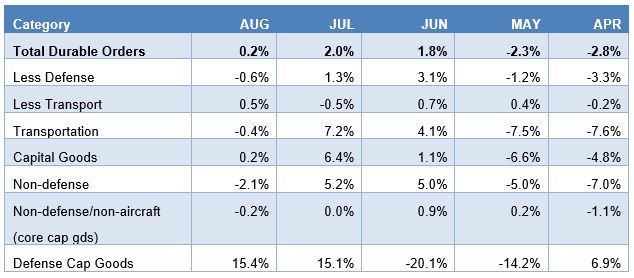

Durable goods orders also came in better than expected in August. Against the consensus forecast for a 1.0% drop, the Census Bureau reports new orders for manufactured durable goods advanced by $0.5 billion, or 0.2%, to $250.7 billion in August. Census reports that “Fabricated metal products, up four of the last five months, led the increase, $0.4 billion or 1.3 percent to $34.4 billion.”

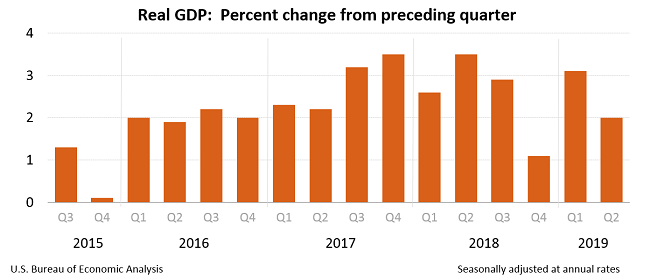

In line with expectations, the Bureau of Economic Analysis confirmed last week that real (adjusted for inflation) GDP increased 2% at a seasonally adjusted annual in the second quarter, although “Downward revisions to personal consumption expenditures (PCE) and nonresidential fixed investment were primarily offset by upward revisions to state and local government spending and exports.”

While U.S. personal income was up 0.4% last month, weaker than expected personal spending in August (+0.1%, vs. consensus forecast for 0.3% growth) tempered some expectations for 3rd quarter GDP growth. The Federal Reserve Bank of Atlanta’s GDPNow model now projects real GDP growth in the third quarter will be up 2.1 percent but, as the WSJ’s Daily Shot reports, “Morgan Stanley downgraded its Q3 forecast to 1.5%, while Oxford Economics is expecting 1.3%.”

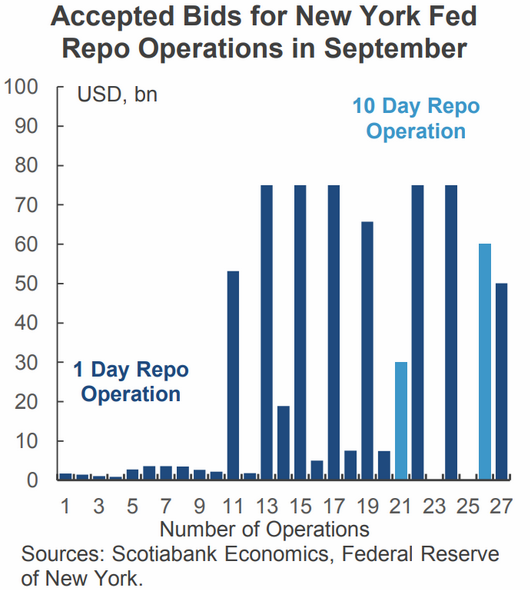

Last but not least, the WSJ reports that the Fed's repo financing remains in high demand, “…suggesting that a more permanent solution will be necessary. It will probably involve increasing bank reserves (via Treasury securities purchases) and a standby repo facility.”