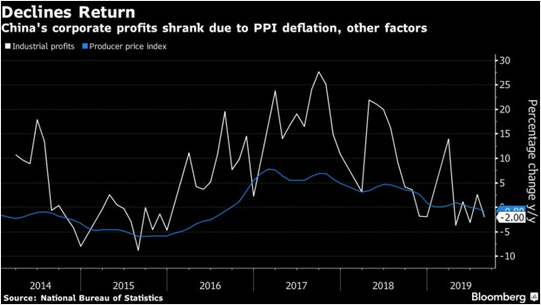

Ferrous – China’s National Bureau of Statistics reported last week that total Chinese industrial profits declined 1.7% during the first 8 months of 2019 while total profits at Chinese manufacturers of ferrous metals declined 31.3% over the corresponding period.

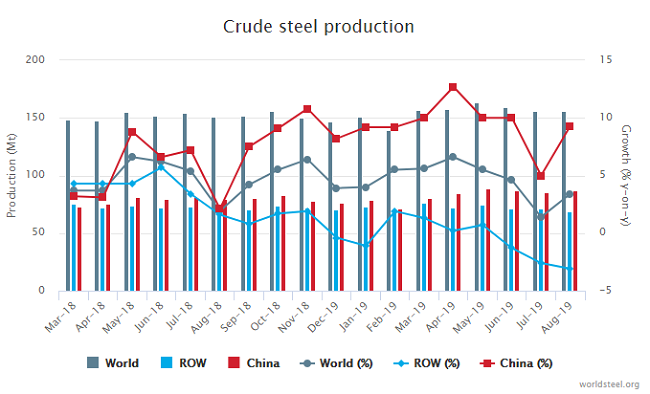

And yet at the same time, the World Steel Association reports Chinese steel production was up 9.3% year-on-year in August to 87.25 million metric tons while Chinese steel production during Jan-Aug 2019 was up 9.1% to nearly 665 million metric tons.

Not surprisingly, record output and decreased profitability have been accompanied by falling producer prices in China. According to the NBS, China’s producer price index for ferrous metals declined 0.8% month-on-month in August.

But Macquarie reports that environmental protection cuts ahead of the National Day/Golden Week holidays helped to underpin steel prices in China last week: “China steel prices climbed by 0.4%~1.4% last week. Mysteel national blast furnace capacity utilization rate dropped by nearly 10% over the past week, reducing daily hot metal production by 105ktpa, and steel inventory drawdown accelerated from previous week, of which traders steel inventory fell by 5.2% WoW and mills steel inventory fell by 1.5% WoW. However, reported rebar production continued to increase WoW thanks to the improvement in long steel product profit margin and recovery in EAF production, and we saw an increase in apparent rebar consumption again. Environmental protection policy also had impact on construction sites, but the impact seems to be less than that on steel production, and if steel production recovery after holiday is more than demand resumption, steel inventory drawdown may slow down by then.”

Here in the United States, worldsteel reports steel production was up just 0.3% year-on-year in August to around 7.5 million metric tons as steel prices in the U.S. have come under pressure. Fastmarkets AMM reports “US hot-rolled coil prices are holding steady around $27 per hundredweight ($540 per ton) as market participants look for a catalyst to lift them higher amid fears that they could be knocked lower in the fourth quarter. Fastmarkets AMM's daily steel hot-rolled coil index, fob mill US ended Thursday September 26 at $27.14 per hundredweight ($542.80 per ton), little changed from $27.08 per cwt on Wednesday but down 1.3% from $27.51 per cwt a week earlier.” But some industry sources indicate hot-rolled coil prices have dropped considerably lower.

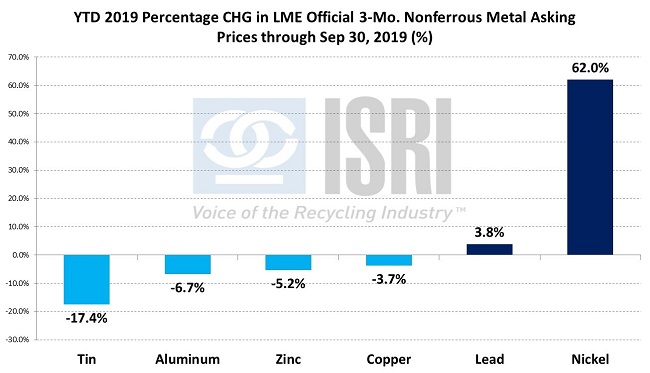

Nonferrous – Copper prices in New York mostly bounced around between $2.57-$2.62 per pound last week, while AMM was recently listing brass ingot maker scrap prices at 246-248 cents for Bare Bright, 238-240 cents for No. 1 copper, 217-219 cents for No. 2 copper, and 212-214 cents for light copper. In London, the LME official 3-mo. copper asking price was down 3.7% for the year-to-date as of this morning despite reported global copper market supply deficits.

According to figures released by the International Copper Study Group last week, global demand for refined copper exceeded copper supply by 220,000 metric tons during the first half of 2019, up from the 177,000 mt supply deficit in the first half of last year. According to ICSG’s press release, “…world refined production declined by about 1% in the 1st half of 2019 with primary production (electrolytic and electrowinning) declining by 1.5% and secondary production (from scrap) increasing by 1%. The fall in world refined production was mainly due to:

- A 38% decrease in Chilean electrolytic refined output due to temporary smelter shutdowns whilst undergoing upgrades to comply with new environmental regulations. Total Chilean refined production (including Electrowinning) declined by 15%.

- A decline of 33% in India’s production which was negatively impacted by the shutdown of Vedanta’s Tuticorin smelter in April 2018.

- A 28% decrease in Zambian refined output due to power supply interruptions, smelter outages and the introduction on 1st January 2019 of a 5% custom duty on copper concentrate imports constraining smelter feed.

- Reduced output in Japan, Peru, the United States and a few European countries due to smelter maintenance shutdowns.”

Recovered Paper –

PPI Pulp & Paper Week reported last week that “US recovered paper consumption decreased 2% last month compared with August 2018, and was down 3% when compared with the same eight months of 2018, the American Forest & Products Association (AF&PA) reported. Mill inventories in August were down 3% from the previous month and were down 11% when compared with August 2018, according to AF&PA data. Total OCC consumption decreased 2% in August compared with August 2018, and was down 4% when compared with the first eight months. OCC mill inventories in August fell 5% from July and were down 19% compared with August 2018. Total mixed paper consumption in August increased 3% compared with August 2018, and was up 3% when compared to the same eight months of 2018. Two additional recycled containerboard machines are to be running next month. One already is producing in Wisconsin and the second in Ohio is to be next month. Both run on mixed paper.”

RISI also reported on the latest batch of Chinese import quotas as follows: “China issued 101,500 tonnes of recovered paper import permits to seven mills owned by six companies on Sept. 23, taking the total quotas for this year to 10.3 million tonnes globally -- off more than 4 million tonnes from the same nine months of 2018. It marked the 12th batch released by China's Ministry of Ecology and Environment (MEE) for 2019. This time last year, the MEE had issued 20 batches by the end of September; 362,980 tonnes had been released on Sept. 20, 2018, pushing the total approved at that time to 14.92 million tonnes. In the latest round, Nine Dragons Paper topped the list at 56,560 tonnes.”