Following the Labor Day holiday in the U.S., stocks on Wall Street started the morning in negative territory amid the imposition of new U.S. tariffs on Chinese imports and a disappointing reading on U.S. manufacturing PMI. As reported by Investor’s Business Daily, “Dow Jones futures fell sharply Tuesday morning, along with S&P 500 futures and Nasdaq futures.

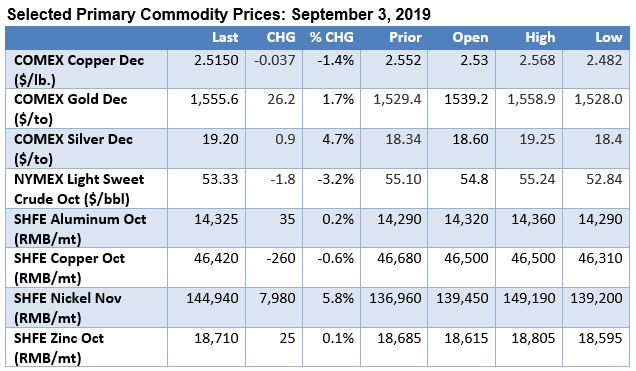

On Sunday, President Donald Trump went ahead with new China tariffs on $110 billion worth of imports, including some Apple products for the first time. Beijing retaliated, further escalating the China trade war. China vowed to support growth and liquidity, boosting the Shanghai composite on Monday. However, the U.S. and China reportedly haven't agreed on a date or agenda for new trade talks.” In commodity trading, precious metal prices continue to benefit from the risk-off environment with COMEX silver and gold futures surging past $1,555/to and $19/to, respectively in New York. In London, nickel prices remain in focus with LME 3-mo. nickel trading as high as $18,710/mt early in the session before retreating below $18,000/mt. Base metal prices were generally lower today with LME 3-mo. copper and aluminum little changed around $5,607/mt and $1,750/mt, respectively. In foreign exchange trading the British pound continues to get hammered by Brexit worries, with the pound sterling trading as low as $1.1958 earlier today.