Ferrous – The World Steel Association reported last week that steel production in China increased 5.0% year-on-year in July to 85.2 million tons amid reports of firmer demand. For the year-to-date, Chinese steel production is up 9% to more than 577 million tons, worldsteel report.

According to Macquarie Research, “Major Chinese ports iron ore inventory increased by 1.2% last week, returning to above 120mt (121.3mt) after staying below since mid-June. However, sentiment on iron ore becomes more mixed as some people believe steel mills are restocking iron ore based on the strong daily iron ore offtake at ports, which rose by another 0.6% WoW last week to the highest level since mid-February, though reported steel mills iron ore inventory fell by over 2 days (6% in volume) over the past two weeks. Steel production restriction in Tangshan for September is estimated to be looser than the restriction in August, and we learned that so far margin-driven production cut among BF/BOF producers are mainly done through the reduction of scrap usage instead of iron ore.”

As for the major U.S. ferrous scrap export markets, the latest worldsteel figures show sharp year-to-date declines in both Turkey (-10.2%) and Mexico (-10.3%), modest changes in steel production in Taiwan (-0.7%) and Turkey (+0.6%), and a sharp spike in Vietnamese steel production (+57.1% so far this year).

As for the United States, worldsteel reports that YTD steel production was up 4.8% during Jan-Jul 2019 to 51.8 million metric tons, although the pace of growth slowed to 1.8% year-on-year growth for the month of July. Of note, Fastmarkets AMM reported on Friday that their U.S. hot rolled coil index ended last week “…at $29.17 per hundredweight ($583.40 per short ton), down by 0.4% from $29.29 per cwt the day before but up by 0.6% from $29 per cwt one week earlier.”

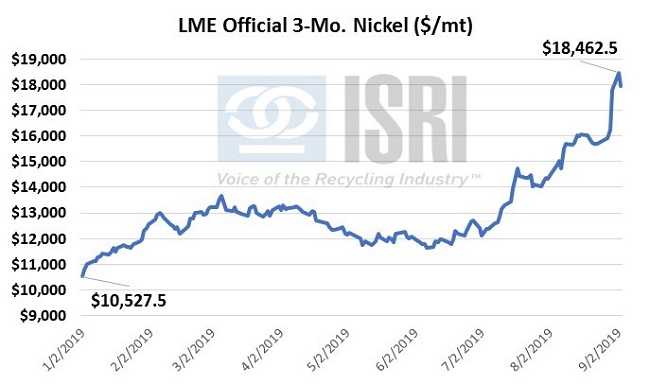

Nonferrous – Nickel remains firmly in the spotlight thanks to the reported total ban on Indonesian nickel ore exports starting in January 2020 and accompanying ramp up in nickel prices. In London, LME 3-mo. nickel futures surged past $18,000 per metric ton, trading as high as $18,850/mt (=$8.55/lb.) on Monday.

Macquarie reported last week that “SHFE nickel price jumped by 6.4% WoW while LME price rallied by 14.5%. Market is excited about the news that government have confirmed to ban on nickel ore export from January 2020. In our analysis we see a full ban of Indonesia nickel ore export could add ~200kt to our global nickel market deficit, which will eat into exchange stocks and lead to sever tightness in the nickel market for the next two years, while earliest tightness could ease is in 2021 assuming a rapid acceleration in building nickel processing capacity in Indonesia. Following the strong rise in nickel price, NPI price is now in a bigger discount against nickel cathode, and stainless mills are seeing lower margin due to lagged price increase in stainless steel products, and stainless-steel inventory in major cities further jumped last week to a new record high.”

On a related note, Fastmarkets reports that starting on September 25th, stainless steel futures will begin trading at the Shanghai Futures Exchange for the first time: “According to a draft of stainless futures contract issued by SHFE early in August, the standard product to be traded will be stainless steel cold-rolled coil 304/2B 2.0mm x 1,219mm with trimmed edges. Sources foresee nickel futures - which are actively traded on the SHFE and the London Metal Exchange - having a considerable impact on stainless steel futures, which in turn will affect the spot market.”

With so much excitement in the nickel and stainless markets, you won’t want to miss ISRI’s Nickel/Stainless Roundtable to be held on September 11, 2019 as part of next week’s 2019 Commodity Roundtables Forum where our panel of experts will include Michael Friedman from Sustainable Management Corp., Barry Hunter from Hunter Alloys, Fred Penha from INTL FC Stone, and ISRI’s own Joe Pickard. We hope to see you there!

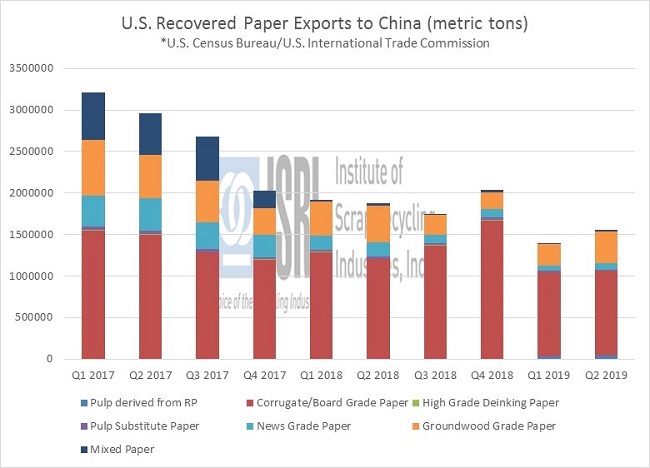

Paper and Plastic – Despite considerable shifts in trade policy that would have suppliers scrambling, Chinese demand for imported recovered paper remains robust within the license quota limitations. An additional tariff of 5% is likely to put pressure on sellers as Chinese mill buyers will need to negotiate harder to maintain their margins.

When you compare Q1 or Q2 2018 to the corresponding periods in 2019, the lower exports can easily be attributed to weaker retail sales. What may difficult to see on the chart is a near exponential increase in exports of pulp derived from recovered paper. Resource Recycling has recently published a map showing the new capacity in the U.S. for consuming recovered paper that has come online or been announced since 2017. The recent Nine Dragons acquisitions have primarily been to consume recyclable paper for pulp to feed their mill infrastructure in China. With 1.3 million metric tons of pulp making capacity set to come online in the coming years, we may see some life breathing back into the mixed paper market.