Markets and the financial press were fixated on the inverted U.S. yield curve last week as the 30-year Treasury yield dipped below 2 percent and the Dow Industrials plunged 800 points lower on Wednesday.

Recent economic reports from Germany and China have done little the calm investor jitters, either. Eurostat reported last week that German GDP in the second quarter declined 0.1% as compared to the preceding quarter. Manufacturing data from Germany have been even more troubling, with German industrial production reportedly down 6.2% year-on-year and off 1.8% month-on-month in June. Official economic reports from China also came in below expectations last week as Chinese industrial production growth slowed to 4.8% in July (from 6.3% in June) while Chinese retail sales growth slowed to 7.6% last month, down from 9.8% growth previously.

U.S. industrial production also came in below expectations in July according to the latest report from the Federal Reserve. Against the consensus forecast for 0.1% growth, the Fed reports that U.S. industrial production declined 0.2% last month, including a 0.4% drop in manufacturing output.

According to the Fed’s press release, “Manufacturing output declined 0.4 percent in July, with durables, nondurables, and other manufacturing (publishing and logging) all posting decreases. Production fell for most major durable goods categories. The largest declines were recorded by wood products, machinery, and nonmetallic mineral products, while the only sizable gain was registered by aerospace and miscellaneous transportation equipment. Paper products posted the only increase among nondurables; the indexes for textile and product mills, for printing and support, and for plastics and rubber products each fell 1.0 percent or more.”

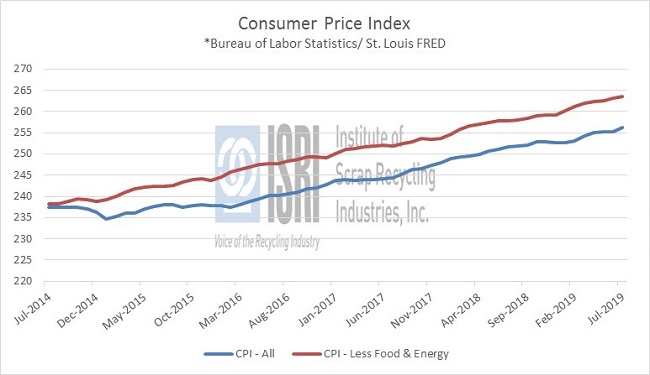

U.S. housing market data were mixed last week as building permits posted an 8.4% monthly gain to a seasonally adjusted annual rate of 1,336,000 in July, while housing starts came in well below expectations at 1,191,000 SAAR, down 4.0 percent from June. Of note, consumer price inflation ticked up in July due in part to rising prices in the housing and medical sectors. The BLS reports that “the Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in July on a seasonally adjusted basis after rising 0.1 percent in June, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.8 percent before seasonal adjustment.” That 1.8% increase over the last 12 months remains below the Fed’s 2 percent target, leaving room for further cuts.

With so much focus on monetary policy and bond yields, the U.S. inflation readings have taken on even greater significance than usual. But as Bloomberg and other news outlets have been reporting, the Treasury Department’s possible issuance of ultra-long dated 50-year and 100-year Treasuries could have a more immediate impact on bond yields: “With interest rates on 30-year U.S. debt hitting all-time lows this week, the government is once again considering whether to start borrowing for even longer. The U.S. Treasury Department said Friday that it wants to know what investors think about the government potentially issuing 50-year or 100-year bonds, going way beyond the current three-decade maximum.” Following that announcement, the WSJ’s Daily Shot reported “The US curve steepened because the issuance of 50- and 100-year Treasuries will create competition (reduce demand) for the long bond,” which in turn could potentially take some of the pressure off of falling global long-term bond yields.