Ferrous – Fastmarkets AMM reports their “…daily steel hot-rolled coil price, fob US mills, ended Friday August 16 at $29.30 per hundredweight ($586 per ton), down 1.8% from $29.85 per cwt on Thursday and down 2.7% from $30.11 per cwt a week earlier.”

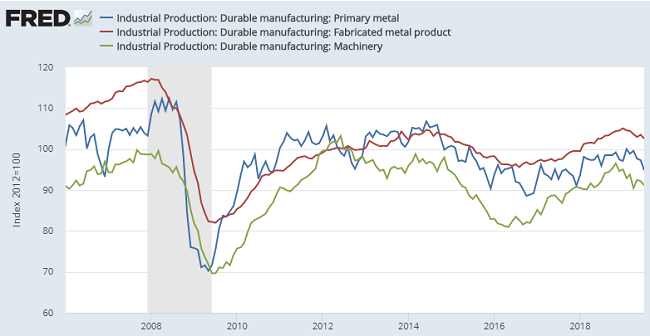

The recent softness in steel prices comes amid weakening output in key U.S. metals-related sectors including primary metals, fabricated metal products, and machinery:

As for U.S. crude steel production, the American Iron and Steel Institute reported last week that for the week ending on August 10, 2019, domestic raw steel production was up 0.3% week-on-week but down 1.6% year-on-year to 1.861 million net tons as the capacity utilization rate came in at 80.2 percent. Year-to-date U.S. steel production (through August 10) was still up 4.7% as compared to the corresponding period last year at 59.8 million net tons, according to AISI.

Of note for the U.S. steel market, the Wall Street Journal reports today that “An Australian steelmaker said it will spend roughly US$700 million to expand its U.S. business, joining American rivals that have outlined plans to add capacity locally in the wake of President Trump’s import tariffs. BlueScope Steel Ltd. said it will be able to produce 850,000 more metric tons of steel each year at its North Star business in Delta, Ohio, once the expansion is completed. That represents a 40% increase on current capacity. The North Star plant sells nearly all its steel to customers in the U.S. Midwest, especially automotive and construction companies. It sells around 95% of its steel within a 300-mile radius of the mill.”

Recent iron ore price volatility has made for more complicated global steel market conditions, with Macquarie reporting the benchmark iron ore index was down 12.6 percent last week to US$89.55/dmt, the lowest level since April.

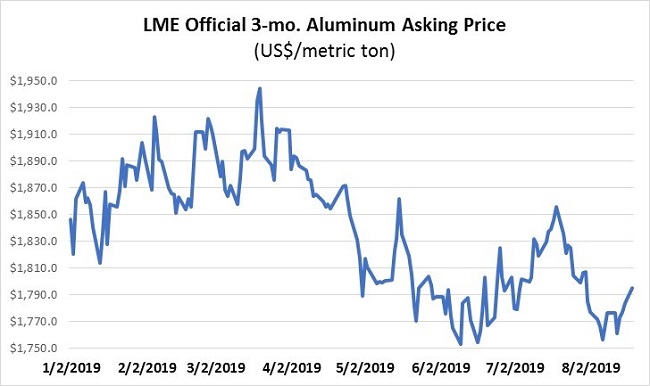

Nonferrous – Aluminum prices at the London Metal Exchange have come under pressure this year as expectations for capacity expansions, declining global auto production, and the on-going impacts of the U.S.-China trade have contributed to the drop in aluminum prices from around $1,950 per mt in March to less than $1,780 per ton recently.

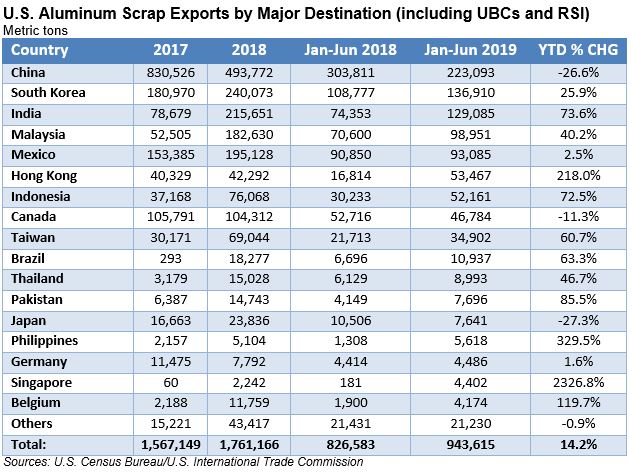

Secondary aluminum prices in the United States have come under even more severe pressure, with Fastmarkets AMM recently list old sheet at 38-40 cents, old cast at 37-40 cents, painted siding at 38-41 cents, and MLC at 44-47 cents per pound. In stark contrast, the U.S. aluminum scrap export data paints a much more encouraging picture, with the latest Census Bureau data showing aluminum scrap exports (including UBCs and RSI) during the first half of 2019 were up 14% year-on-year to nearly 944,000 metric tons. While year-to-date aluminum scrap exports to mainland China have declined 27% this year, that drop has been more than offset by gains to S. Korea (+26%), India (+74%), Malaysia (+40%), Indonesia (+73%), Taiwan (+61%), Brazil (+63%), and other markets.

With so much uncertainty weighing on the domestic and global primary & secondary aluminum industries, you are not going to want to miss our upcoming Aluminum Roundtable to be held on August 13, 2019 from 9:00-10:30 a.m. in Chicago where moderator extraordinaire John Woehlke from JW Consulting will be joined by a fantastic group of speakers including Becky Proler from Southern Core Recycling. Karsten Faak from Trimet Aluminium, and Doug Hilderhoff from the CRU Group. We hope to see you at our fast-approaching ISRI 2019 Commodity Roundtables Forum next month!

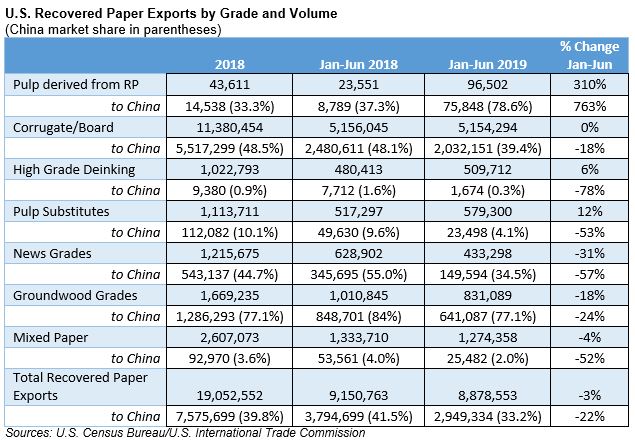

Recovered Paper – Paper markets have been dealing with declining OCC pricing which doesn’t necessarily track with a severe decline in Chinese demand for OCC. Even with a decline in alternative markets, which doesn’t bear out in the export data, there have been several board mill investments coming online to increase domestic demand for brown grades. The Paper Stock Report’s August 1 price sheet has OCC holding steady and DLK seeing a slight increase in average price mostly driven with increasing upper range prices outside of the West Coast and Pacific Northwest.