Competitive monetary policy easing, rising debt levels, the escalating U.S.-China trade dispute, and uneven manufacturing data continue to be major sources of concern for future global economic growth.

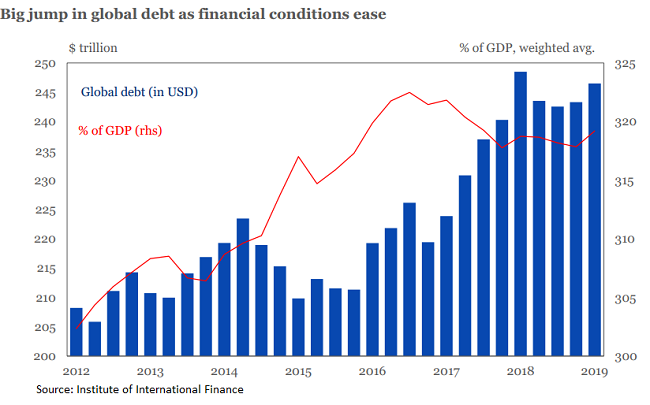

Here’s the recent trend in global debt levels from the Institute of International Finance:

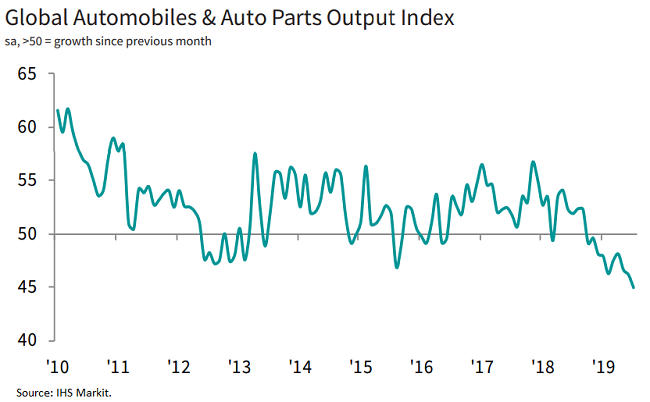

On the global manufacturing front, the slowdown in automobile and auto parts production has deteriorated significantly in recent months. According to IHS Markit, the “latest PMI data signaled a deepening downturn in the global automobiles & auto parts sector at the start of the second half of 2019. Output, new orders and employment all contracted at the fastest rates since the global series began in late-2009. Moreover, indices for new export orders and purchasing activity also hit record lows in July.”

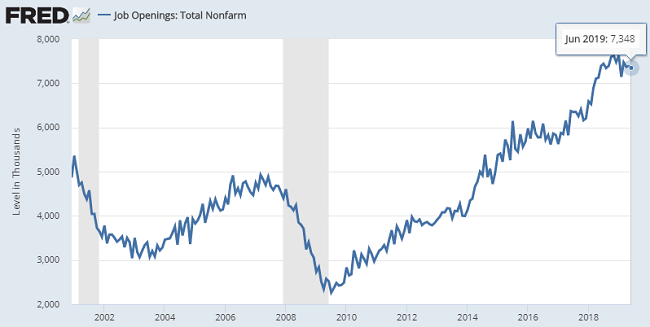

More positively for the U.S. economy, the labor market continues to exhibit strength while inflation levels remain largely in check. Last week, the Bureau of Labor Statistics reported that U.S. job opening remain elevated at more than 7.3 million in June, while initial unemployment claims remained extremely low at 209,000 for the week ending August 3, and the increase in the U.S. producer price index was in-line with expectations at 0.2% in July.

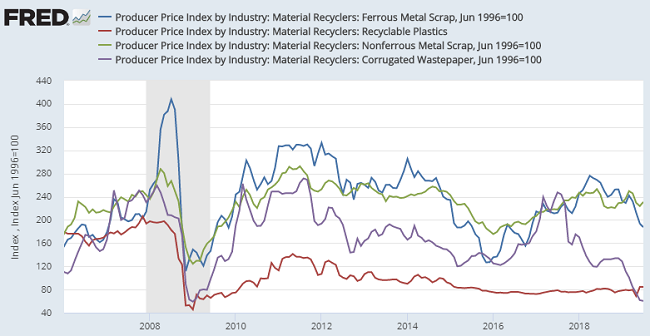

But for scrap recyclers, producer prices for the major scrap commodities have for the most part remained under pressure this year. Here are the producer prices for U.S. ferrous scrap, nonferrous scrap, recyclable plastics, and corrugated (purple line) from Jan 2006 through Jul 2019: